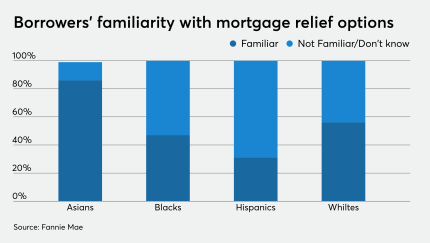

A survey conducted throughout the second quarter found knowledge gaps based on race and income.

-

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

Both Moody's and DBRS Morningstar project elevated credit-loss levels for the auto lender, compared to prior deals, due to COVID-19 uncertainties

September 8 -

Fintech lenders that reported a surge in missed payments at the start of the pandemic have seen credit quality rebound substantially since. But credit performance could still deteriorate if high unemployment persists and Congress fails to enact more relief measures.

September 8 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

Global trade is sinking while the pandemic interrupts international port and shipping activity. But securities backed by marine-cargo container fleets and leases have bombarded the securitization market this summer.

September 8

-

Deals, trends and research in structured finance and asset-backed securities for the week of Aug. 28-Sept.3

September 4 -

The captive-finance arm of General Motors is the first automotive lender this year to launch a securitization to finance inventories as dealerships rebound from COVID-19-related economic stresses.

September 3 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

The share of 78-month loans is at 14.9%, compared to approximately 10% in World Omni's previous issuance from its subprime/nonprime shelf.

September 2 -

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

The transaction would affect about 54% of the government's outstanding bond debt.

September 1 -

The Dallas-based chain was forced to advance additional principal payments on its asset-backed notes after trailing 12-month sales fell below $1.5B.

September 1