News of the omicron variant’s spread could drive mortgage rates lower at a time when buyers were bracing for

"Much remains unclear about the impact of the omicron variant, but at the moment, there's no cause to expect a substantial impact on the housing market," said Jeff Tucker, senior economist at Zillow. "Depending on the course of the virus, there may be a temporary impact on mortgage rates, as there was when

But another surge in COVID-19 cases could cloud the outlook for economic growth, which in turn would likely slow the recent rise of mortgage rates, Tucker continued.

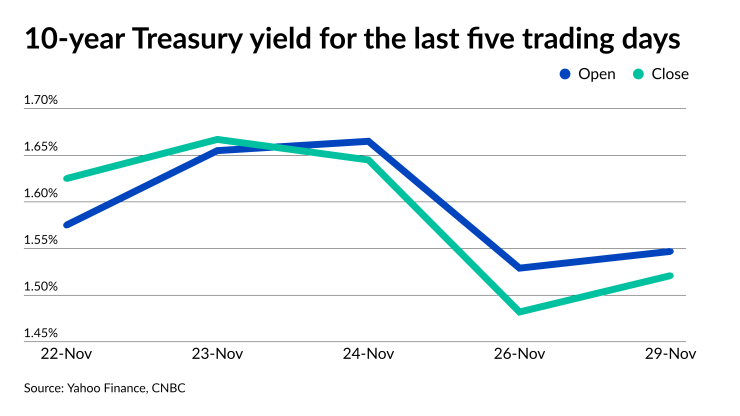

As the news of the variant's spread caused the U.S., among others, to restrict travel from countries in southern Africa, investors made an initial "flight to quality" by putting money into the bond market, which sent yields spiraling down on the 10-year Treasury, a benchmark for the 30-year fixed mortgage. It closed at 1.645% on Nov. 24 but opened the next trading day, Nov. 26, at 1.528%. It fell further on Nov. 26 to 1.482% when trading ended.

On Nov. 29, at 9:30 a.m., the 10-year yield zoomed back up to 1.564%, but turned again, hitting a low of 1.510% around noon. By 4 p.m., it was at 1.521%.

Last Friday's drop in the 10-year yield had an immediate impact on "at the money" mortgage servicing rights values of almost 5 basis points, said Tom Piercy, managing director of Incenter Mortgage Advisors. Today's rebound in the yield as fears are easing, has regained some of that lost value.

"We anticipate continued recovery with a sell-off on Friday as employment numbers will be released and expectations are that number will be strong," Piercy continued. "That being said, any news of the omicron variant that comes out as negative will cause the markets to react again as they did this past Friday."

Omicron's public emergence comes at a time when housing remains hot. Pending home sales in October

At the same time, competition, possibly driven by worries over inflation, drove home prices up 15% year-over-year for the four week period ended Nov. 21 to $359,975, according to Redfin.

"Demand for homes remains high as millennials continue to age into homeownership during a time when the new normal includes more work-from-home options, giving potential home buyers more geographic flexibility, which results in further demand for homes," said Odeta Kushi, the deputy chief economist for First American Financial. "Unless the omicron variant results in further lockdowns and quarantines, a decline in mortgage rates stemming from a flock to treasuries would just add fuel to the housing demand fire."

If anything, the market is probably overreacting, said Louis Navellier, chief investment officer of money management firm Navellier and Co., in a report to investors. "I don't think this is a big deal. Hopefully, we recover and we over-acted."

People around the world are putting their money into the U.S., because the economies of other nations face their own problems.

"It's as simple as that," Navellier said. "And Treasury bond yields are remarkably well-behaved."

In comparison, back in March 2020, when COVID-19 related shutdowns began to affect the U.S. economy, the nonconforming secondary market all but shut down. That forced Impac Mortgage Holdings

However, since then, not only has the non-qualified mortgage/private label securitization market recovered, activity is now back at 2019 levels. “Investors have seen how these loans have continued to perform for the past year and a half,” said Allen Meigide, executive director at LoanScorecard. “This time around we expect the investor community will be ready and will continue to support non-QM production.”

Although home sales in April 2020 were affected by the shutdown, they were not

Today, it's a different story for the market.

"We're obviously watching how this develops, it's still pretty early to speculate on how this might play out," said Kevin Parra, CEO and co-president of Plaza Home Mortgage. "One thing that's different this time around is that investors and warehouse lenders have seen this before and will likely react more calmly."

Potential buyers have not yet shied away.

"We aren't seeing any unusual slowdowns due to the emergence of the omicron variant, other than the normal slowdown that occurs annually in the real estate market around the holiday season," said vice president and general manager Michael Lane of ShowingTime, a company now owned by Zillow which tracks the average number of