-

Sales of previously owned homes unexpectedly increased to a one-year high as buyers rushed in ahead of a surge in mortgage rates, further depleting tight inventories to a record low.

February 18 -

Democrats cited the increasing share of home purchases by Wall Street firms while Republicans pointed to rising conforming loan limits and other measures by Fannie Mae and Freddie Mac during the Senate Banking, Housing and Urban Affairs committee hearing.

February 10 -

Compounding factors of low inventory and high costs also helped lead to another decline in Fannie Mae’s Home Purchase Sentiment Index.

February 7 -

An increase in the number of completed homes over the last two months and prospects of higher interest rates this year as the Federal Reserve tightens monetary policy may have encouraged a pickup in contract signings.

January 26 -

A measure of home prices in 20 U.S. cities jumped 18.3%, down from 18.5% in October, the S&P CoreLogic Case-Shiller index showed Tuesday. It marked the fourth straight month that home-price appreciation has cooled off ever so slightly.

January 25 -

The debt facility from Barings is likely the largest to a Black-owned investor in the market.

January 24 -

December's average balance for a mortgage to purchase a newly constructed property set an all-time high, the Mortgage Bankers Association's Builder Application Survey found.

January 20 -

The Reserve Bank of Dallas data in housing prices hints at a so-called ‘episode of exuberance,’ but the central bank is a long way from sounding the alarm.

January 5 -

Recent existing home sales have been stronger than expected, but next year could see a market held back by the inventory shortage and higher rates.

December 20 -

Canada’s national pension fund struck its first partnership to build and rent out single-family homes in the U.S., joining a rush to capitalize on a housing shortage.

December 8 -

The U.S. Treasury Department will begin developing regulations that could expand reporting requirements for all-cash real estate purchases as part of the Biden administration’s efforts to cut down on global corruption, according to two senior administration officials.

December 6 -

Similarities between the current rate of appreciation and what took place between 2004 and 2006 are mitigated by changes in the housing market.

December 3 -

Besides making the deduction permanent, the bill doubles the income threshold for those eligible to claim it.

December 2 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

Though unlikely to derail a hot housing market, another surge in COVID-19 cases could cloud the outlook for economic growth, analysts said.

November 29 -

However, the median monthly expense associated with financing is still lower than that for a lease.

November 24 -

But in November, home buyer demand reached its highest level since RedFin began compiling the data in 2017.

November 23 -

The number of plans is less than one-fourth of what it was at its pandemic peak, and many are expiring, so the group will replace the weekly measure with a monthly one.

November 8 -

Average incomes for this age group increased by 24% since 2012, but housing prices jumped 86%.

October 25 -

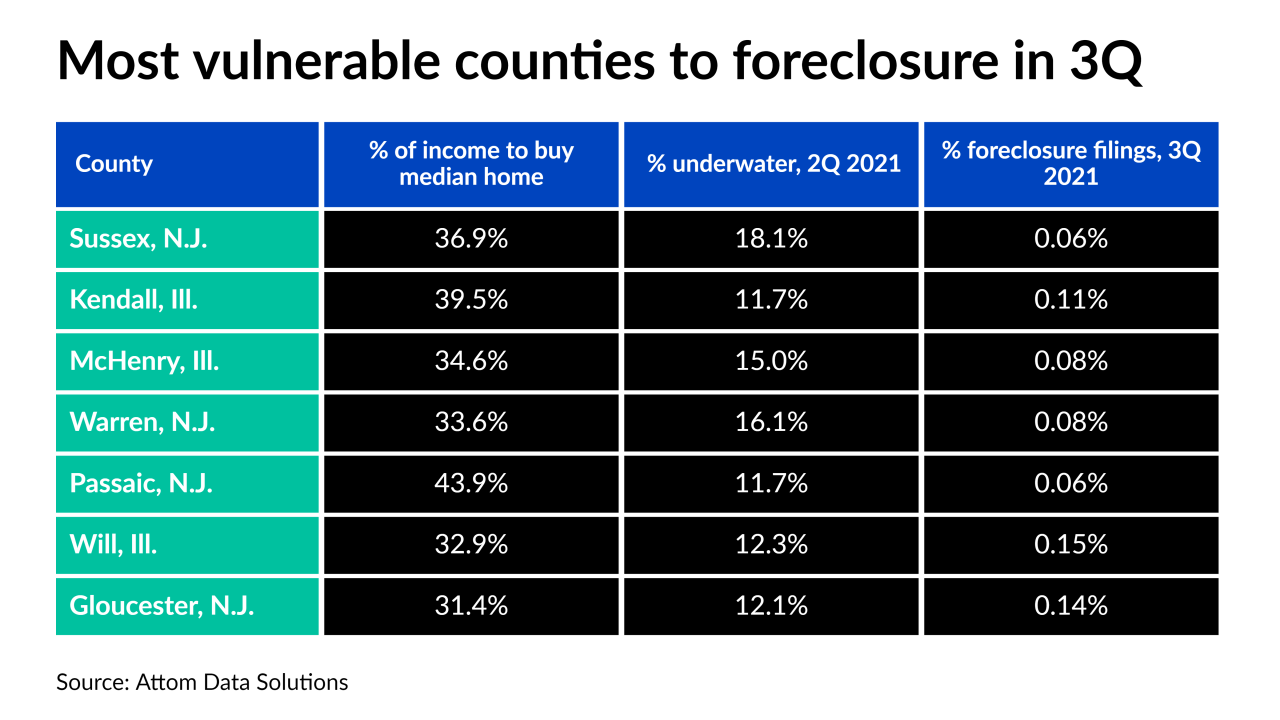

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21