-

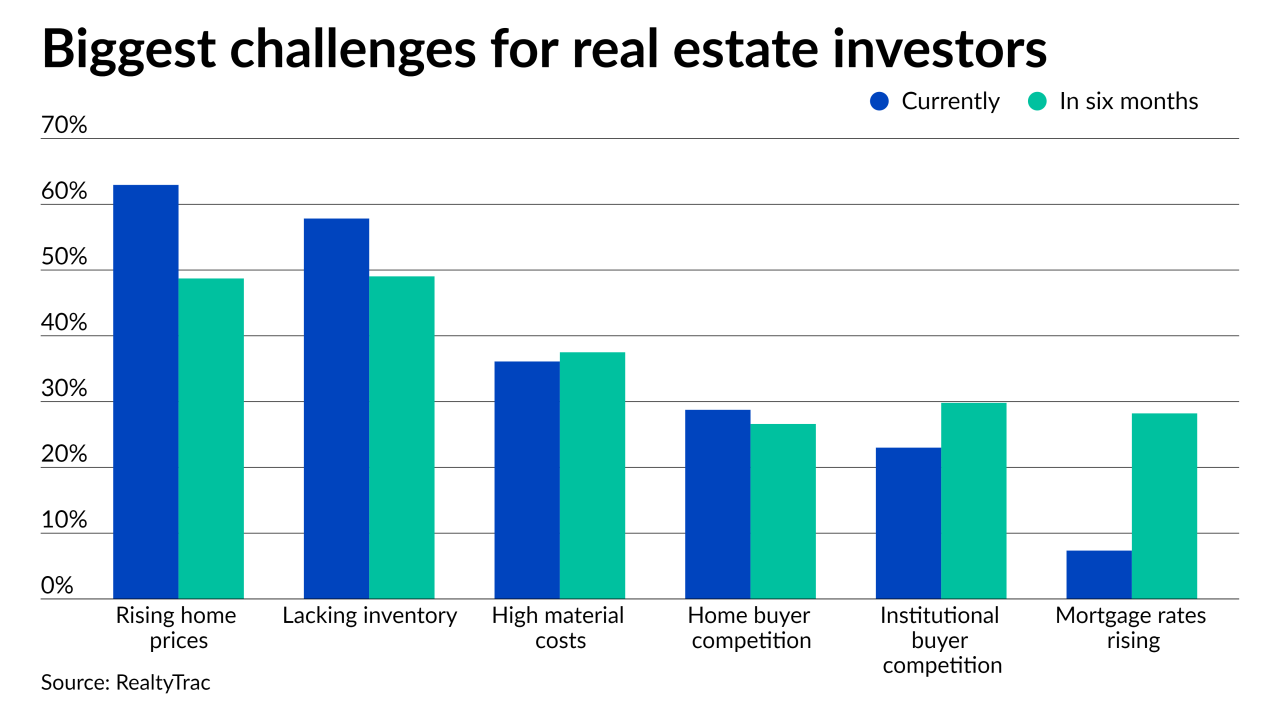

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

The decline from 4.4% in July and 6.88% a year ago brings the number much closer to pre-pandemic norms, but foreclosure starts are a different story.

September 22 -

U.S. homebuilder sentiment rose in September amid lower lumber prices and strong housing demand.

September 20 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10 -

Single-family home construction also increased across communities of all sizes, but notably in outlying metro areas.

September 7 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

None of the leading areas ranked by investor share of sales were in the Golden State during 2020, in contrast to the state’s dominance on the list in the wake of the Great Recession.

August 30 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18