-

U.S. homebuilder sentiment rose in September amid lower lumber prices and strong housing demand.

September 20 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10 -

Single-family home construction also increased across communities of all sizes, but notably in outlying metro areas.

September 7 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

None of the leading areas ranked by investor share of sales were in the Golden State during 2020, in contrast to the state’s dominance on the list in the wake of the Great Recession.

August 30 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

A ClimateCheck score measures the risk of disaster at the zip-code level over the period of a 30-year mortgage.

August 4 -

While the numbers were higher than they were a year earlier, the decline comes at a time of year that usually produces some of the best returns for sellers.

August 2 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

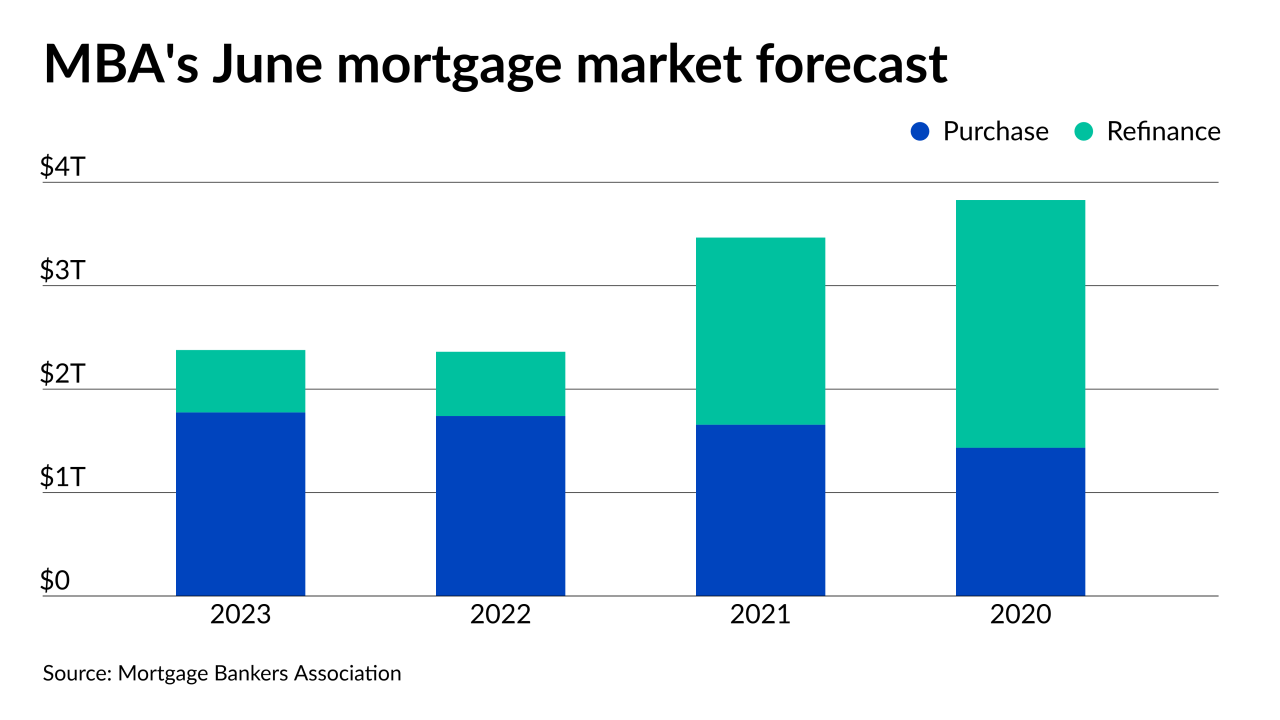

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

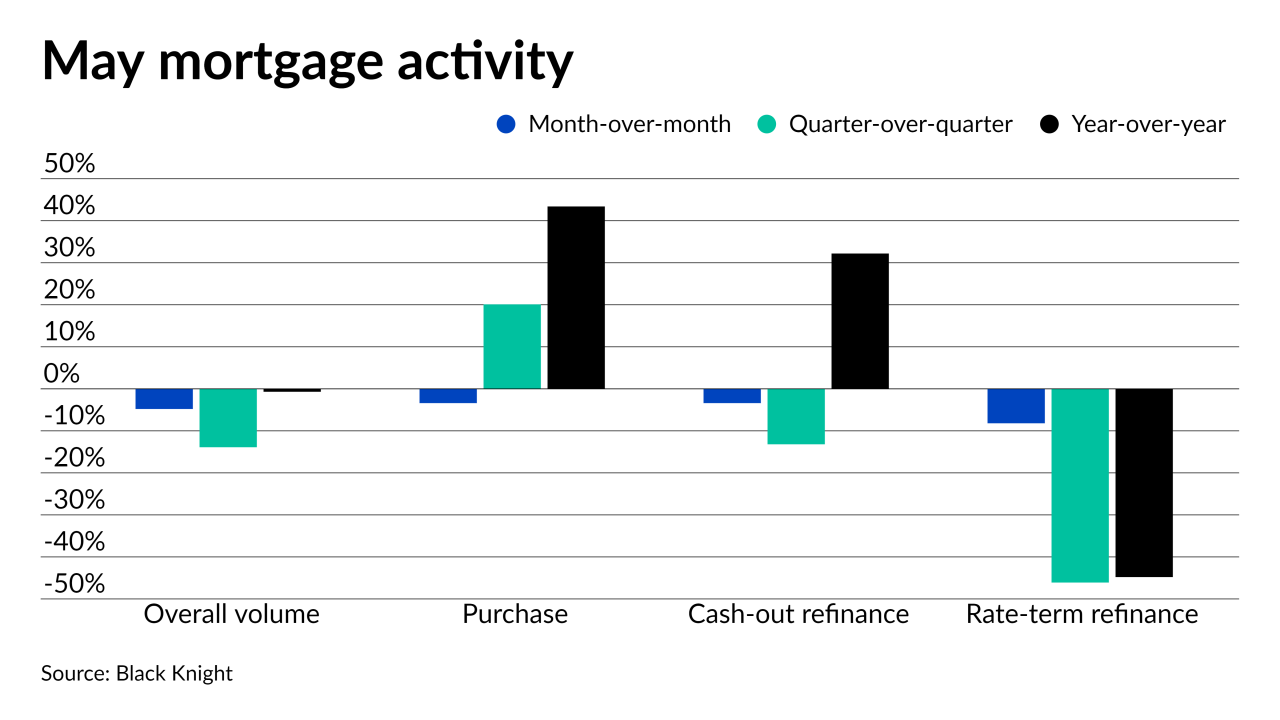

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7