-

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6 -

In its initial message to the new head of the Consumer Financial Protection Bureau, the Community Home Lenders Association reiterated its call to require depository loan officers to be licensed.

October 4 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

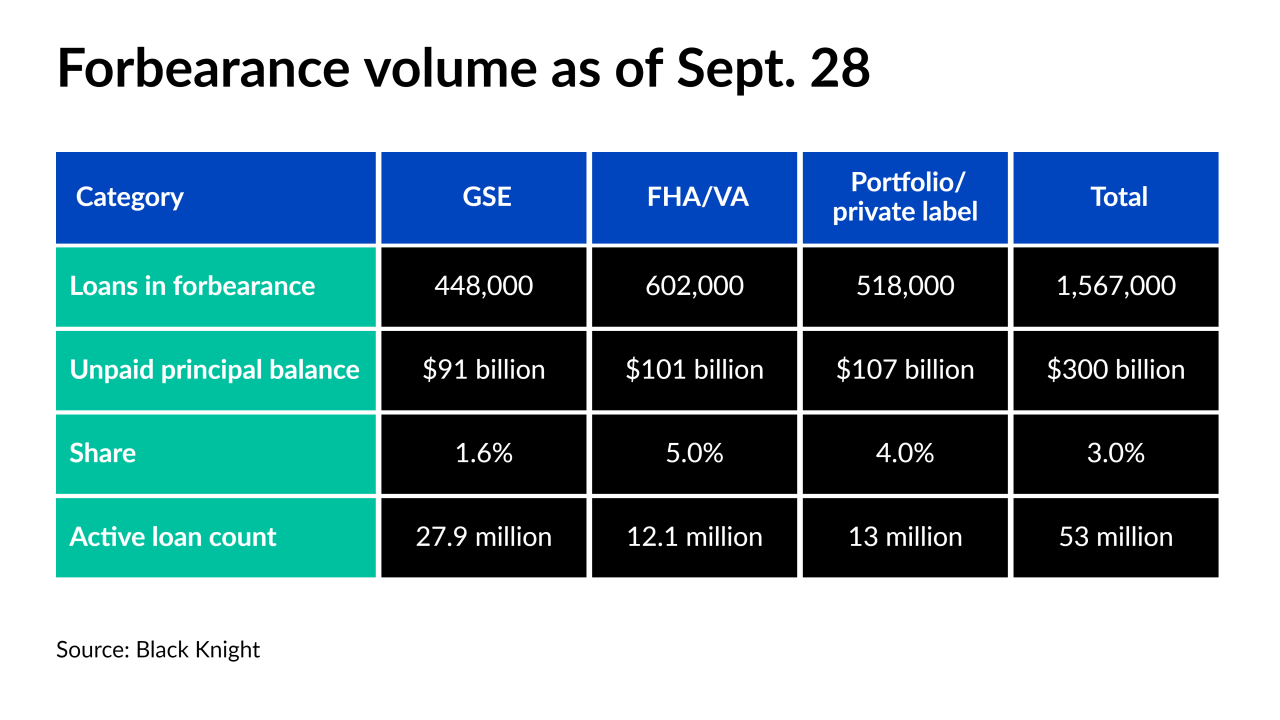

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

While PLS loans still represent a sliver of the overall mortgage market and are nowhere near the $1 trillion level seen before the Great Recession, issuance jumped markedly this year.

September 30 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

Taper announcement, slowing COVID cases help remove downward pressure, leading to increases across all loan-term types.

September 30 -

While the collateral is high quality, analysts raised concerns about a number of key parties that they feel lack robust securitization experience and financial strength.

September 30 -

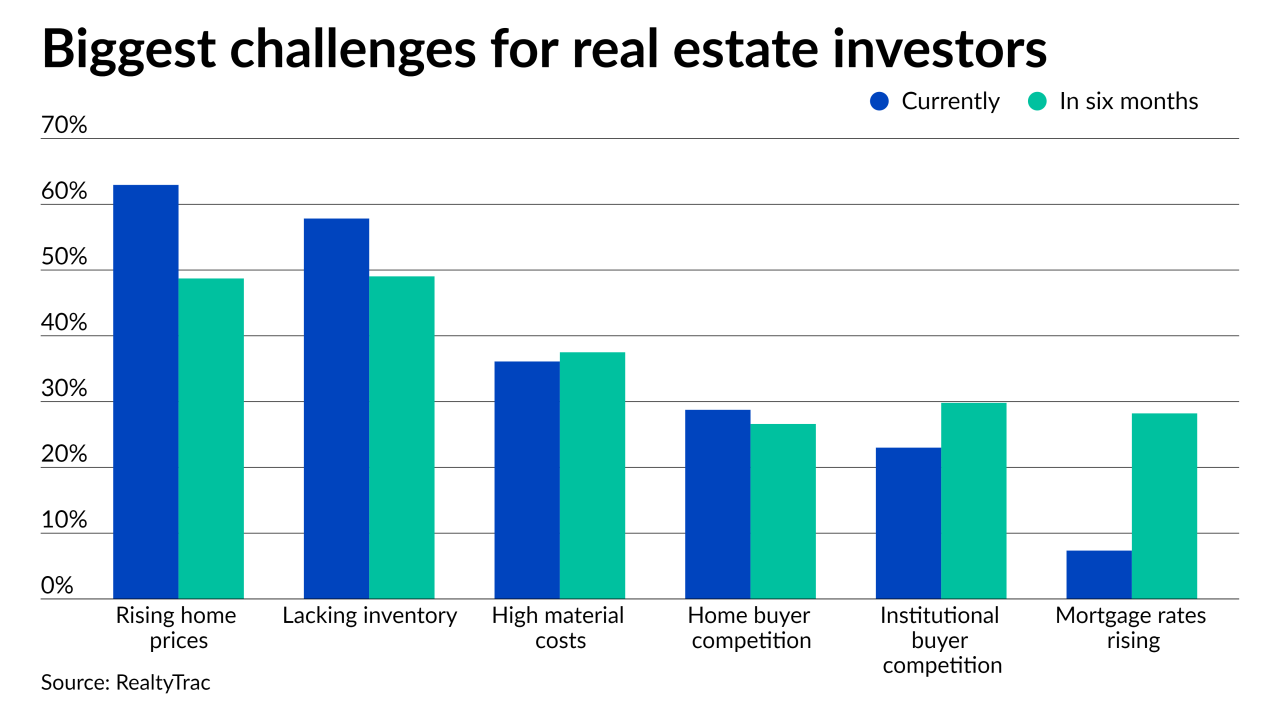

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29 -

The proposal calls for a 20-year mortgage with Ginnie Mae and Treasury participation, but critics suggest that other measures would be more effective in bridging the gap in home equity.

September 28 -

The transaction is also the first securitization for ACREC. The entity is also taking on multiple roles, acting as sponsor, issuer and collateral manager.

September 27 -

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The filing by Tamara Richards also accused the founder and other execs of encouraging a "frat house" environment that mistreated women.

September 24 -

The need to size up the impact of hurricanes and pollution is increasing and current measures aren’t as precise as credit or rate models, according to the Research Institute for Housing America.

September 23 -

Foreign investment helped offset a slowing domestic recovery, causing few ripples for the week, but economists expect future taper of bond purchases to lead to upward movement.

September 23 -

The decline from 4.4% in July and 6.88% a year ago brings the number much closer to pre-pandemic norms, but foreclosure starts are a different story.

September 22 -

Applications were up 9% compared to July’s total, while the average price for newly built houses hit a record.

September 21 -

Sandra Thompson, who has been acting director of the Federal Housing Finance Agency since June, has won backing from the mortgage industry and community groups for the experience she brings to the role. The push comes as the administration is said to be considering Mike Calhoun of the Center for Responsible Lending.

September 20 -

U.S. homebuilder sentiment rose in September amid lower lumber prices and strong housing demand.

September 20