-

Changes in the Fed, including the replacement of Jay Powell as chairman, might shift the board back to a dovish economic position.

October 18 -

The drop over the 30-day period was in line with a large number of plan expiration dates, and occurred despite the extension of an initial filing deadline for government loans.

October 15 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

Increased purchase activity countered a slowdown in refinance applications, which were impacted by rising rates.

October 13 -

Two Wall Street firms and a single-family rental investor have purchased portions of the government-sponsored enterprise's latest nonperforming loan package.

October 12 -

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12 -

The entire pool is comprised of fixed-rate, fully amortizing mortgages, with an average balance of $901,373. They are also first-lien loans.

October 8 -

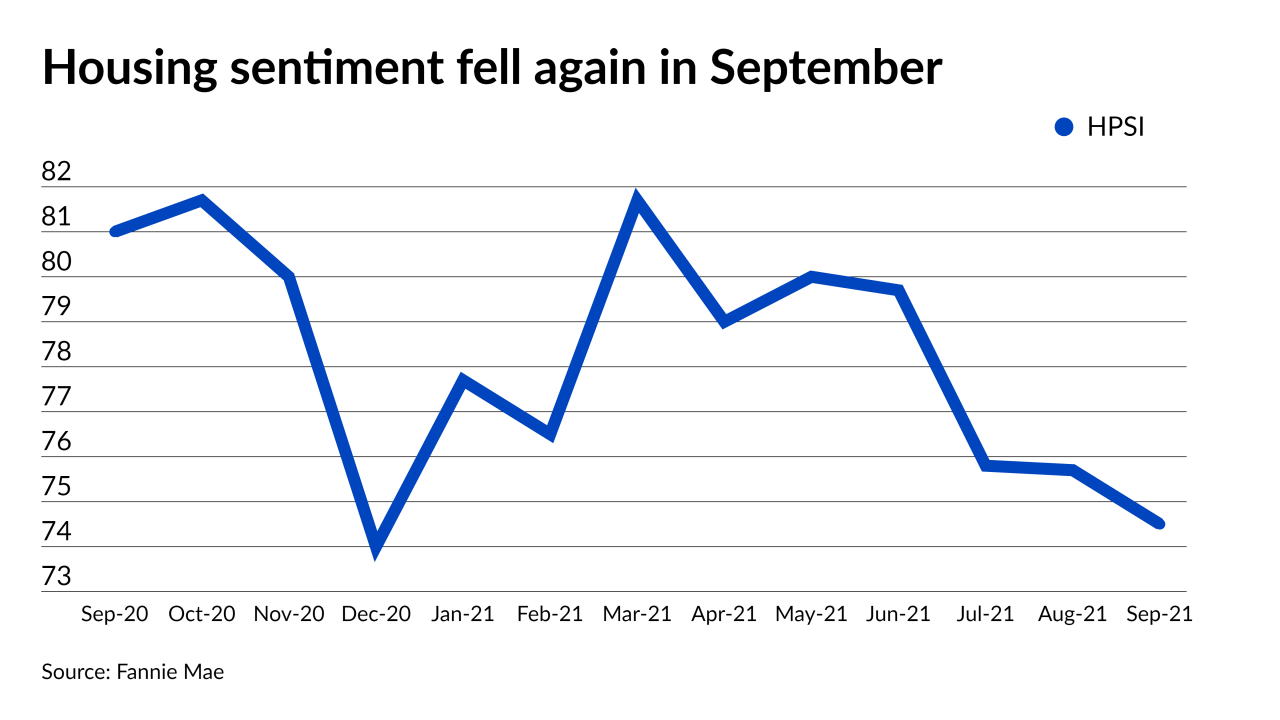

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

Those leaving forbearance or other relief plans generally had higher credit utilization rates, were more likely to have mortgages, and experienced lower levels of bank card delinquencies, according to TransUnion.

October 7 -

However, economic data points to likely future increases, with investors awaiting numbers from upcoming jobs report.

October 7 -

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6 -

In its initial message to the new head of the Consumer Financial Protection Bureau, the Community Home Lenders Association reiterated its call to require depository loan officers to be licensed.

October 4 -

Both third-party lenders will purchase conforming loans with balances of $625,000 — 14% higher than the current limit — in anticipation of regulators' action.

October 1 -

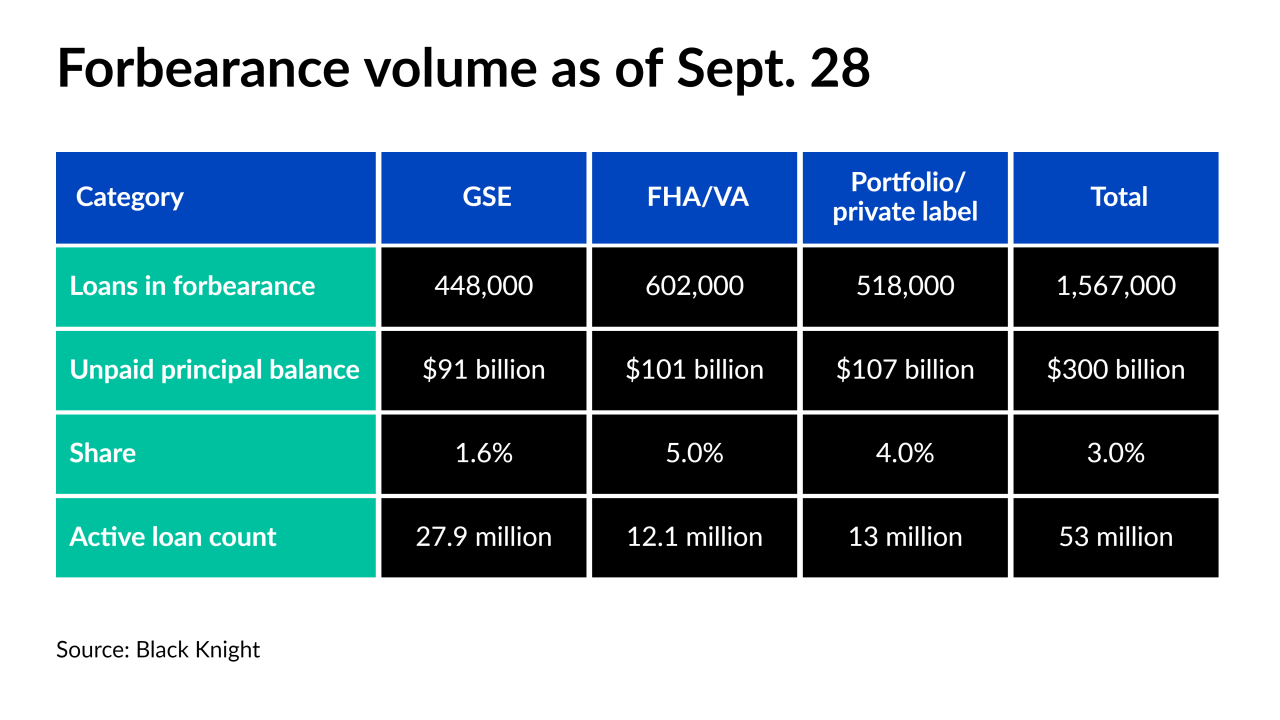

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

While PLS loans still represent a sliver of the overall mortgage market and are nowhere near the $1 trillion level seen before the Great Recession, issuance jumped markedly this year.

September 30 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

Taper announcement, slowing COVID cases help remove downward pressure, leading to increases across all loan-term types.

September 30 -

While the collateral is high quality, analysts raised concerns about a number of key parties that they feel lack robust securitization experience and financial strength.

September 30 -

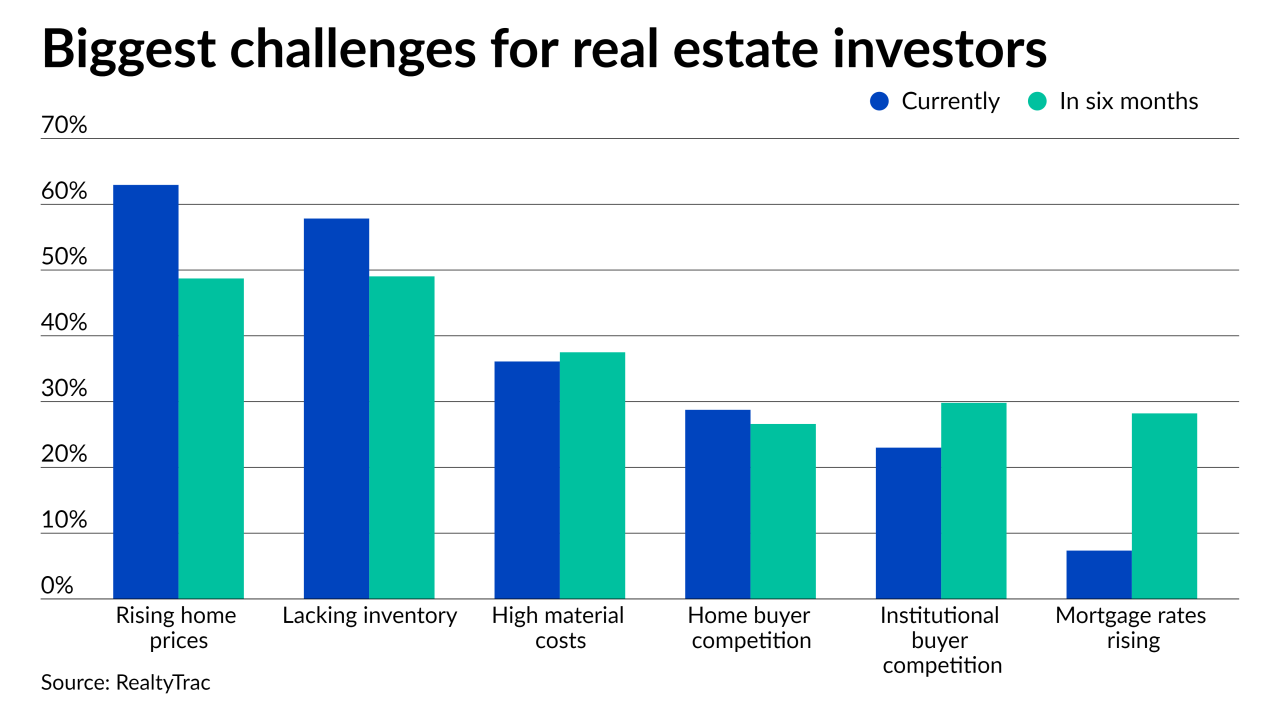

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29