The Mortgage Bankers Association raised its originations forecast for 2021, but its economists' outlook remains more conservative than those at Fannie Mae and Freddie Mac.

It now predicts the industry will produce $3.85 trillion in lending volume this year, which compares with its September forecast of $3.74 trillion. Both Fannie Mae and Freddie Mac now expect industry loan originations

Compounding the MBA's forecast is uncertainty around what is happening in Washington, D.C., including finalizing the infrastructure and social spending packages that could impact the broader economy, Mike Fratantoni, the group's chief economist, said at its annual convention on Sunday.

"On the monetary policy side, we've changed our forecast now with this October release to match what the

He expects the Federal Open Market Committee at its November meeting to announce they’ll stop adding to their balance sheet over the course of seven or eight months but are still going to reinvest principal payments back into their mortgage-backed securities holdings.

However, uncertainty abounds around what the Fed actually will do because its composition is up in the air, including questions regarding whether

"A number of voters on this FOMC...have set us on a path, giving us signals of a taper and a faster lift off in terms of short term rates than we had seen previously," Fratantoni said. "Now that's cast into question — are we going to get a much more dovish cast of characters here in the next five, six months or are we going to get a continuation of this plan for normalization of monetary policy?"

That could be influenced by

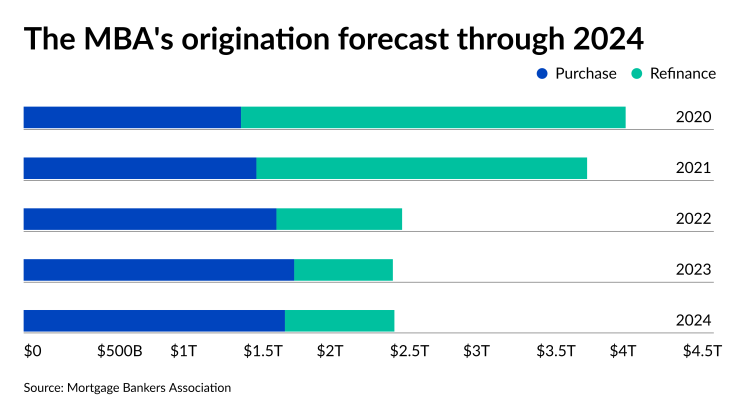

Still, the MBA also raised its forecasts for the next two years, maintaining its prior view of record-levels of purchase volume. The new forecast also includes slightly higher than previously expected, but still significantly diminished, refinance originations.

It raised its 2022 forecast to $2.59 trillion, up from $2.38 trillion, but its purchase outlook held flat at $1.73 trillion. The following year, total volume is now expected to reach nearly $2.53 trillion, up from $2.47 trillion. Purchase volume is predicted to grow to $1.85 trillion, a slight increase from its September forecast of $1.83 trillion.

The MBA made its first projections for 2024, with volume essentially even compared with 2022 at $2.53 trillion, but purchases slipping to $1.78 trillion.

Inventory remains an overhang on purchases throughout the forecast period. Joel Kan, the associate vice president of economic and industry forecasting, presented two alternative scenarios on the purchase side, where housing starts are 15% better than expected and 15% lower.

In the optimistic forecast, driven by a stronger U.S. economy than currently predicted which would then drive more housing starts, Kan said, 2022 purchase volume would rise to $1.98 trillion, then $2.1 trillion in 2023 and $2.04 trillion in 2024.

But even in the downside miss, purchases would still be slightly lower than what is expected for this year. In this scenario 2022, would have $1.51 trillion of purchase volume, moving up to $1.61 trillion in 2023 before dropping back to $1.57 trillion in 2024.