-

The overall pace of both entries and exits slowed, even as the private-label securities and portfolio loan segment saw a spike in its numbers.

August 23 -

Late payments on office loans have trended upward recently, but longer lease periods may mitigate the potential for distress in that sector, the Mortgage Bankers Association said.

August 5 -

The number of people exiting pandemic-related payment suspensions starting in September will be daunting to process, according to a Black Knight report published Monday.

August 2 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

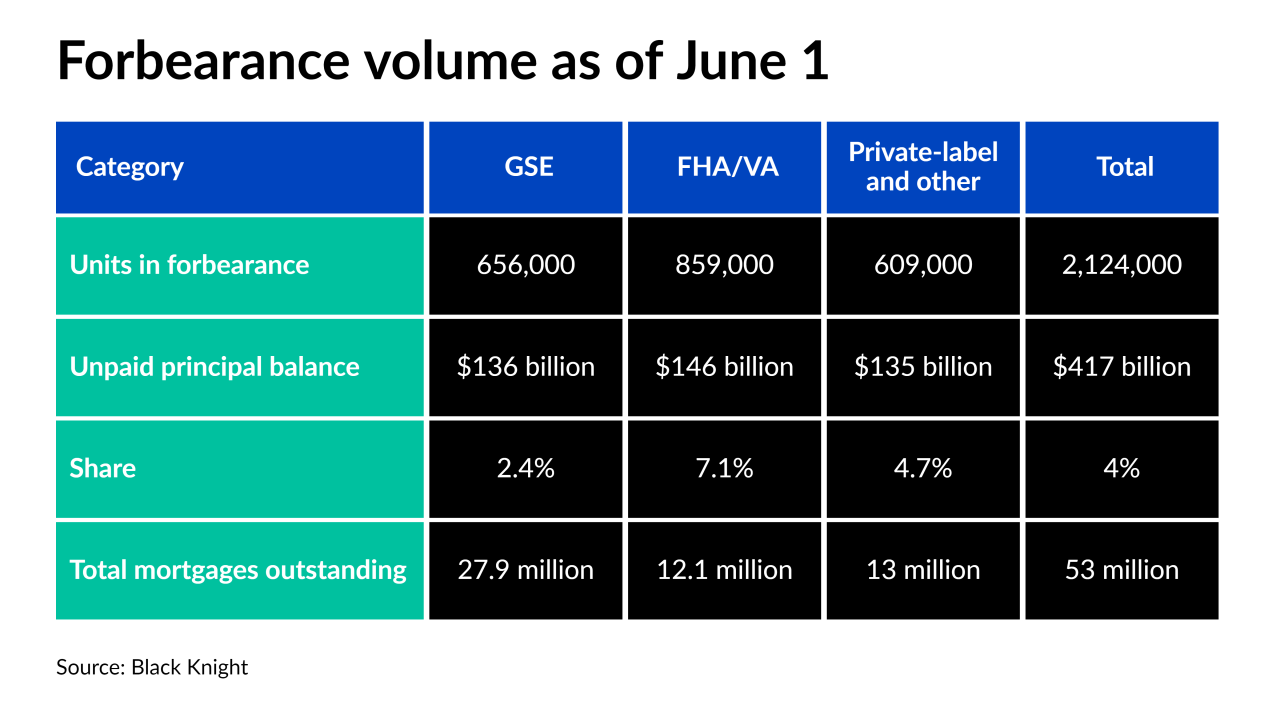

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Short-term late payment rates rose again and later stage delinquencies remain at elevated levels compared to those prior to the pandemic, the Mortgage Bankers Association said.

May 3