-

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

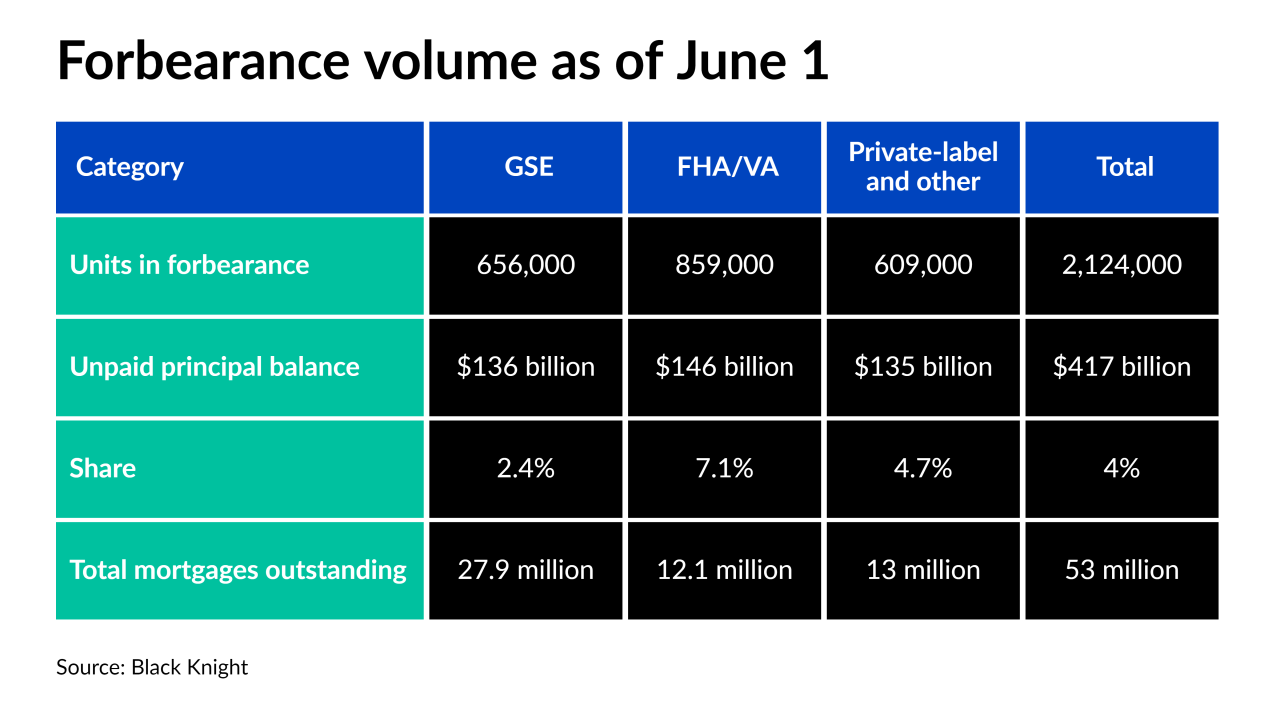

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Short-term late payment rates rose again and later stage delinquencies remain at elevated levels compared to those prior to the pandemic, the Mortgage Bankers Association said.

May 3 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

Thanks to a series of government measures, the pandemic did not cause the massive wave of distressed debt flooding the market that many expected, but certain property types remain vulnerable.

April 23 -

Though the government-sponsored enterprises have some of the lowest forbearance rates in the market, they expect to contend with a significant population of borrowers who face steep financial setbacks after the pandemic ends.

April 22 -

Also, even with bans in place, the total number of filings keeps inching up due to actions taken on vacant properties.

April 15 -

However, the decline in Black Knight’s numbers may stem from a previous deadline that policymakers have since extended.

April 9 -

However, the number of borrowers who failed to remit payment but were not yet 30 days overdue increased.

April 1 -

About 3.4 million renters believe themselves to be at risk of eviction, but when the moratorium ends, the actual number may be between 130,000 and 660,000, according to a Zillow report published Monday.

March 29 -

The Consumer Financial Protection Bureau’s acting director has said he could rethink the pending Fair Debt Collection Practices Act rules, but a report released Monday indicated they’re moving ahead for the time being.

March 22 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

The agency will allow an additional three months of forbearance for multifamily property loans backed by Fannie Mae and Freddie Mac, as long as tenant protections are offered.

March 4