Credit risk transfers used by Freddie Mac to manage distressed mortgage risk staged

Although capital markets disruption from the pandemic, refinancing and

Freddie Mac’s results suggest that if Fannie Mae were also to come back, the whole market could rebuild the CRT protection on its total unpaid principal balance of single-family loans reference pools relatively quickly.

CRTs represent portions of potential losses on loans that can be sold to private investors, which help to limit risk if a mortgage does not perform.

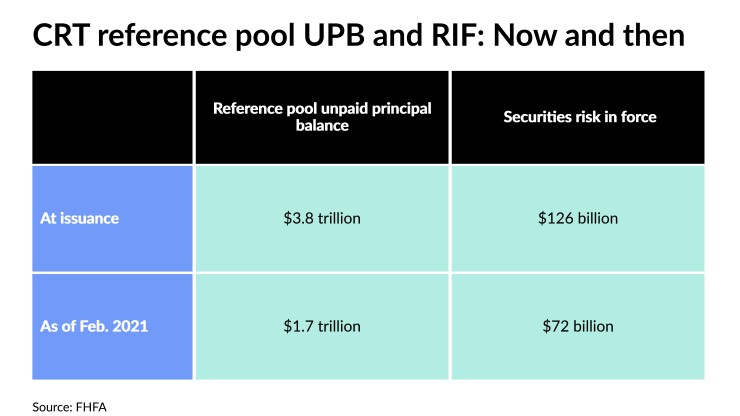

The overall reference pool UPB of active CRTs as of February 2021 had declined from $3.8 trillion to $1.7 trillion and risk in force had fallen from $126 billion to $72 billion due to

“Fannie could take this risk that they’ve been stockpiling on their balance sheet and lay it off using CRT,” said Ed DeMarco, president of the Housing Policy Council and acting director of the FHFA from 2009 to 2014, when CRTs were first introduced at Fannie Mae and Freddie Mac.

Fannie at deadline still had issuance of CRTs on hold to evaluate their costs and benefits, including what reduction in capital relief they provide under FHFA’s enterprise regulatory capital framework. It may engage in credit risk transfer transactions in the future.

To be sure, the FHFA — in line with its treatment of CRT in the capital rule — did raise some concerns related to their performance, including the toll prepayments took on the financial instruments and their associated costs. The net cost for CRT between 2013 and 2021 was $15 billion.