-

The Federal Reserve has already agreed to shut down emergency credit programs funded by the Coronavirus Aid, Relief and Economic Security Act, but Sen. Pat Toomey, R-Pa., and others want Congress to ensure the central bank cannot revive them.

December 17 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

But existing deals are likely to experience issues resulting from higher defaults, faster prepayment speeds.

December 9 -

The new revolving platform will allow the credit-card issuer to periodically assign new accounts into the existing collateral pool without having to establish a new trust for each issuance.

December 9 -

U.S. consumer borrowing rose in October by less than forecast, reflecting a decline in credit card balances as the pandemic continued to limit some purchases.

December 7 -

Risk premiums for new transactions, which package and sell leveraged loans into tranches of varying risk and potential return, have tightened to pre-pandemic levels and Wall Street predicts a rise in sales in 2021.

December 7 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

The third-quarter forbearance rate of the refinanced private student loans fell to 2.58% from the 8.36% average during the second quarter of the year – which is an approximate 70% decline.

December 4 -

Deals, trends and research in structured finance and asset-backed securities for the week of Nov. 28-Dec. 3

December 4 -

The incoming administration chose a battle-tested policymaker who can draw on her nearly two decades at the Fed to help rebuild an economy still struggling from the coronavirus pandemic.

November 30 -

The central bank will prolong the life of the Commercial Paper Funding Facility and three other programs while returning congressionally approved funds for five separate facilities that will shut down Dec. 31.

November 30 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

Yellen, the former head of the Federal Reserve, would become the first woman to hold the nation’s top economic policy job just as the coronavirus pandemic threatens another downturn.

November 23 -

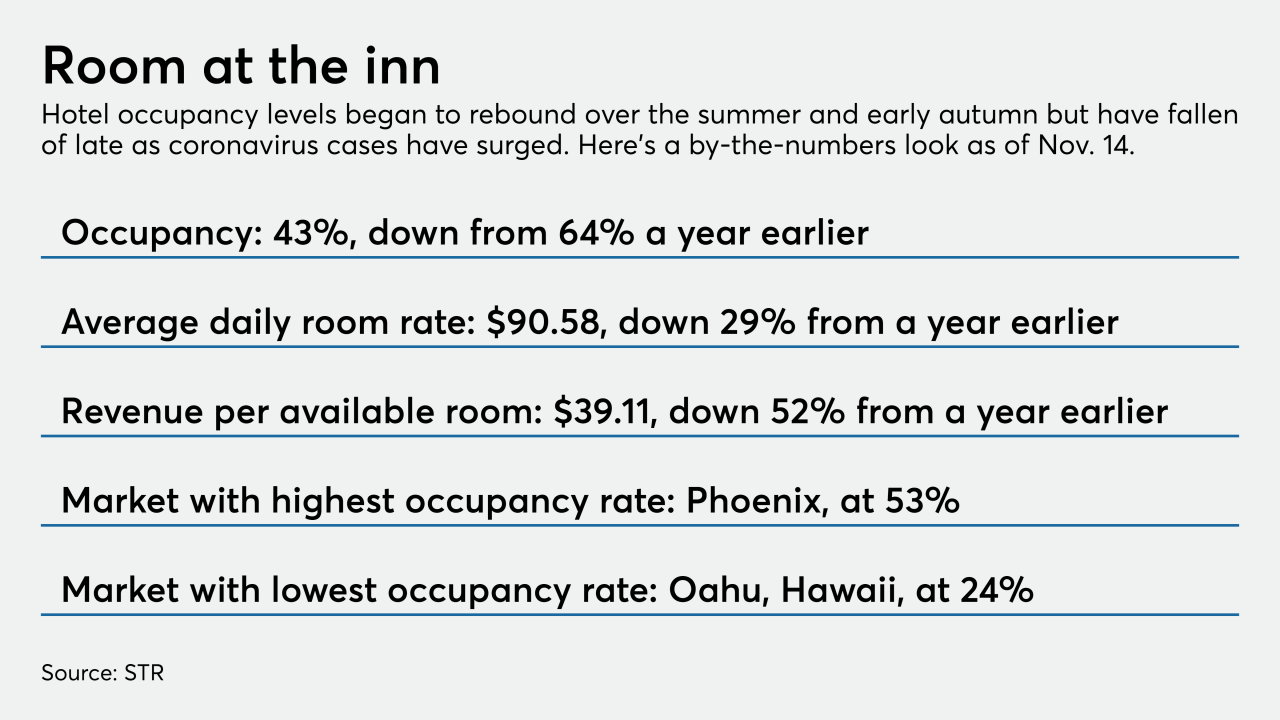

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Weaker consumer spending data coming into the holiday season, as well as a resurgence of the COVID-19 spread, pushed mortgage rates to a new low, Freddie Mac said.

November 19 -

A Freddie Mac study of loans in forbearance from 2017 and 2020 found that, over both periods, borrowers had low credit scores and high debt-to-income ratios.

November 18 -

JPMorgan Chase CEO Jamie Dimon says the partisan bickering over coronavirus relief aid is harming households and businesses and jeopardizing the chances of an economic recovery.

November 18 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17