-

Deals, trends and research in structured finance and asset-backed securities for the week of Nov. 28-Dec. 3

December 4 -

The incoming administration chose a battle-tested policymaker who can draw on her nearly two decades at the Fed to help rebuild an economy still struggling from the coronavirus pandemic.

November 30 -

The central bank will prolong the life of the Commercial Paper Funding Facility and three other programs while returning congressionally approved funds for five separate facilities that will shut down Dec. 31.

November 30 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

Yellen, the former head of the Federal Reserve, would become the first woman to hold the nation’s top economic policy job just as the coronavirus pandemic threatens another downturn.

November 23 -

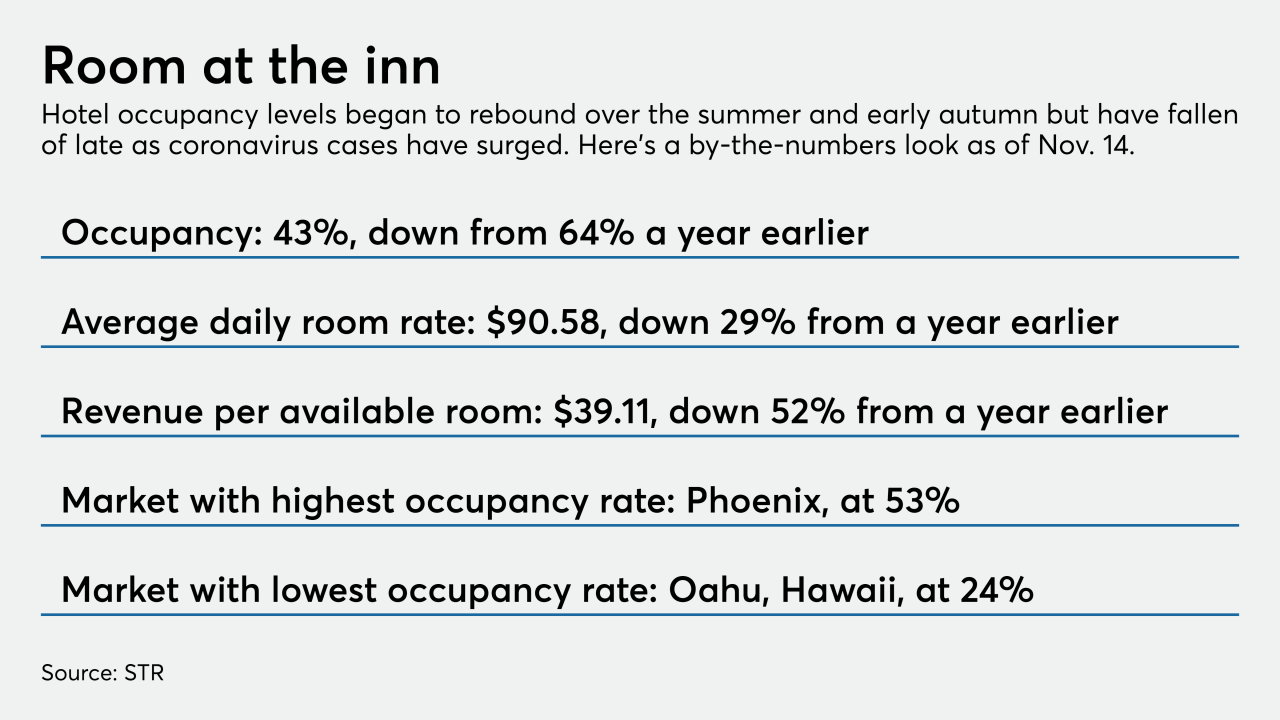

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Weaker consumer spending data coming into the holiday season, as well as a resurgence of the COVID-19 spread, pushed mortgage rates to a new low, Freddie Mac said.

November 19 -

A Freddie Mac study of loans in forbearance from 2017 and 2020 found that, over both periods, borrowers had low credit scores and high debt-to-income ratios.

November 18 -

JPMorgan Chase CEO Jamie Dimon says the partisan bickering over coronavirus relief aid is harming households and businesses and jeopardizing the chances of an economic recovery.

November 18 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Mortgage rates moved off of their all-time low this week as a result of reports that Pfizer's coronavirus vaccine was potentially 90% effective, according to Freddie Mac.

November 12 -

Brookfield's Capital Automotive is marketing a new series of bonds secured by revenues from property sale-leaseback agreements with large auto dealer groups.

November 10 -

Signs of weakness are showing in commercial real estate where property values have begun falling. The report also said that hedge fund leverage has remained elevated and that life insurers are reaching debt levels not seen since the 2008 financial crisis

November 10 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

While the overall rate fell in October, S&P noted a sharp rise in the proportion of loans overdue 60 days as many roll out of COVID-19 forbearance.

November 9 -

With a Democrat set to take the White House in January, the agenda for agencies like the CFPB could undergo a rapid transformation, housing finance reform could be turned on its head and progressive banking ideas that were unthinkable over the past four years could gain traction.

November 7 -

Executives from a half-dozen major financial institutions avoided detailed commercial lending forecasts and gave a mixed outlook on consumer credit at an industry conference. And they called on Washington to pass an aid package targeted at the most troubled business sectors as soon as it can.

November 5 -

The deal, backed by loans and leases on 55 corporate jets, is the first transaction to price since the coronavirus outbreak cratered the global air travel industry.

November 4 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

November 2