-

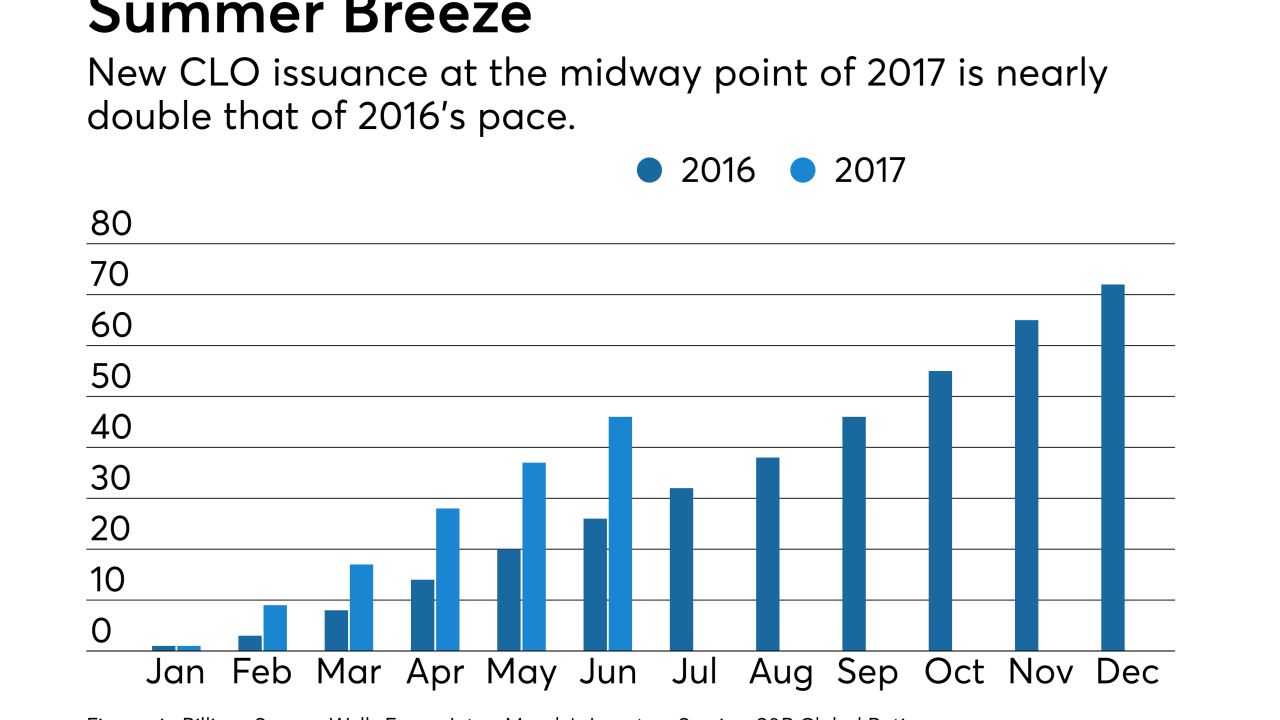

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1 -

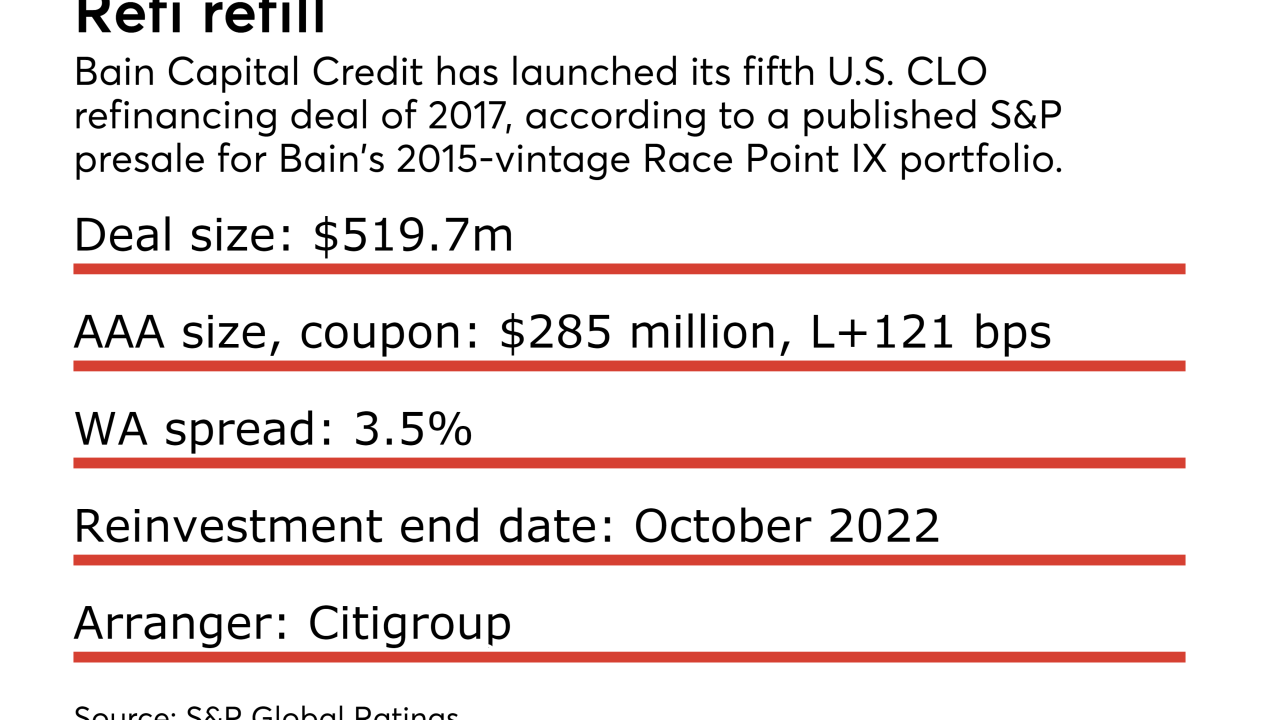

Race Point IX CLO, a 2015 vintage deal, follows four other refinancings that Bain has completed for its Race Point, Avery Point and former Cavalry issuance platforms; Bain has also refinanced a Euro CLO.

August 30 -

The family-owned real estate group affiliate has committed a significant amount of capital to growing the finance and investment side of the organization, which includes balance sheet lending.

August 27 -

The pricing of BlueMountain Fuji's second-ever transaction pushed the monthly new issuance total to $10.1 billion - only the third time since last November the market has eclipsed the $10 billion barrier.

August 27 -

It’s not clear whether syndicated credit agreements require 100% investor consent before adopting a new benchmark. The industry trade group suggests giving new loans the flexibility to change indexes without unanimous approval, but investor advocates are balking.

August 23 -

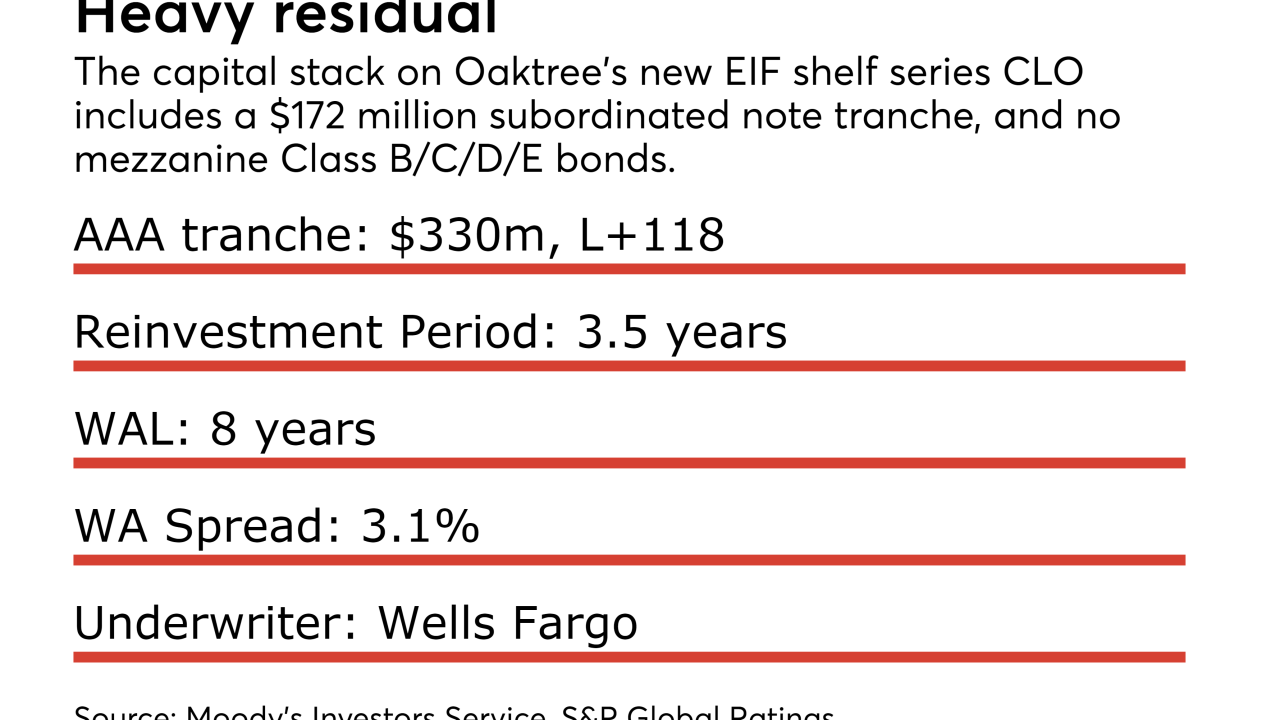

The $533.1 million collateralized loan obligation portfolio has an unusual capital structure; just two senior tranches will be issued, along with a single subordinated tranche comprising more than one-third of the notional value.

August 22 -

The three new deals totaling $1 billion that priced in August, bringing issuance for the year-to-date to $8.3 billion., That matches 2016's full-year total.

August 22 -

Although challenges have accelerated for certain segments of the U.S. retail industry, the exposure to troubled retail in U.S. structured finance sectors is limited, posing small-to-modest risks for some asset classes.

August 16 -

In Europe, €1.6 billion of new collateralized loan obligations priced during the month July, taking issuance volume for the year to date to €10 billion across 25 deals. That's in line with the €9.7 billion issued during same period last year.

August 7 -

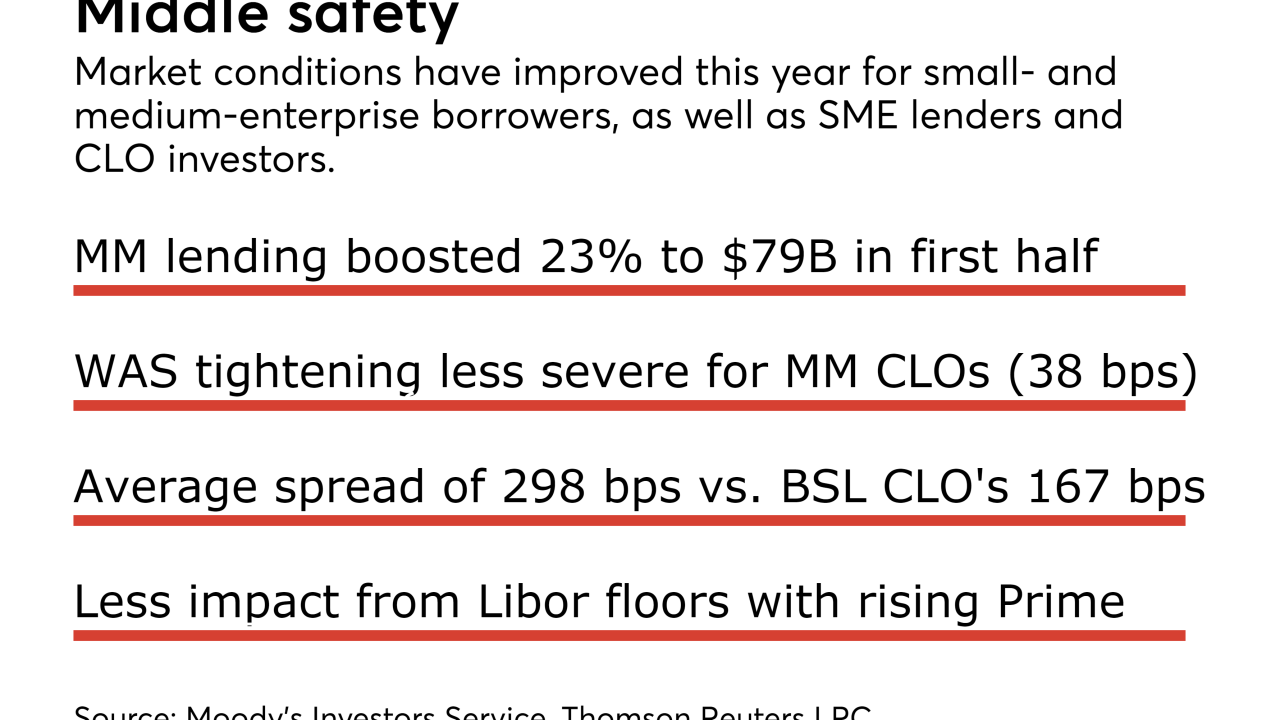

Tennenbaum is offering up its third middle-market CLO as market conditions ripen for SME loan portfolios

August 2 -

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

An affiliate managing the loan for the reinsurance giant's investment advisory arm will keep a horizontal equity strip of the deal for dual EU/US risk retention compliance.

August 1 -

While leveraged loans may use prime as a fallback, getting unanimous consent from collateralized loan obligation investors to use an alternative benchmark could be a challenge.

July 30 -

The alliance should help the asset registry and communications platform, accelerate its expansion beyond leveraged loans and structured finance and into more overseas markets.

July 20 -

Chinese banks and insurance companies represent a new and potentially large source of capital that could crowd out U.S. banks as investors in collateralized loan obligations.

July 11 -

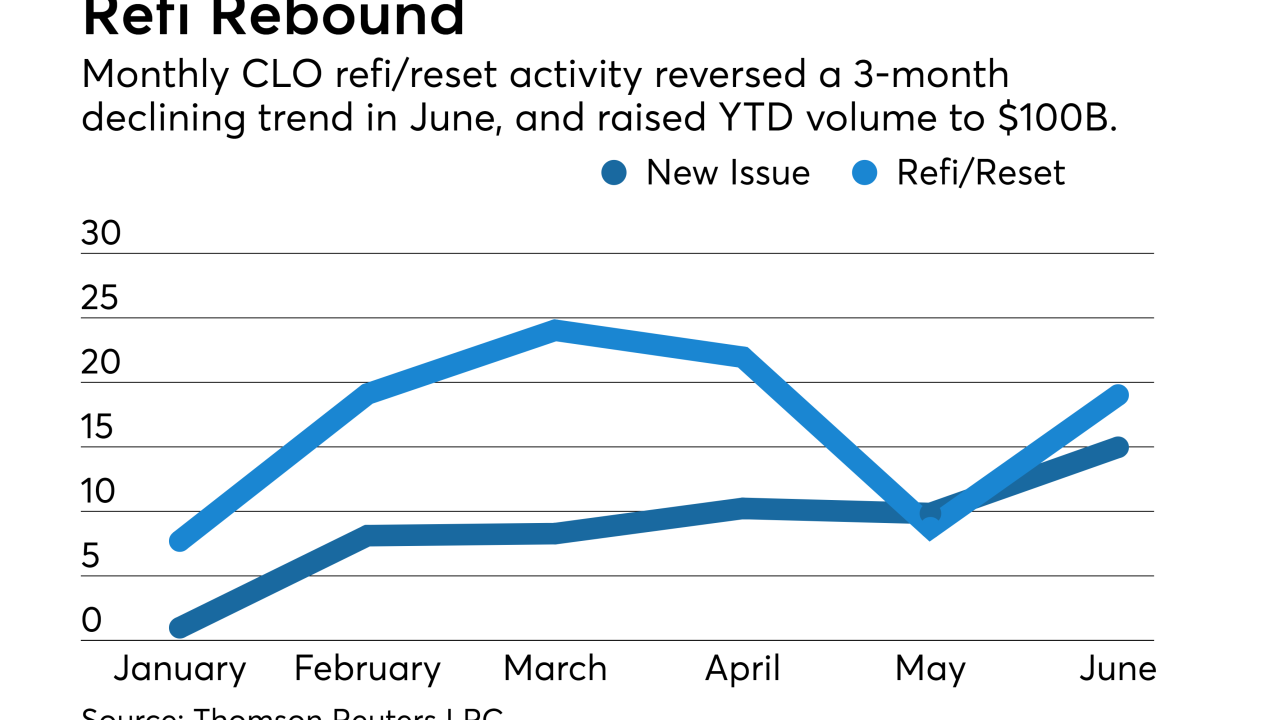

That was an increase of more than $5 billion, or 30%, from May's total, according to Thomson Reuters LPC, though it fell short of refinancing/reset activity, which rebounded to more than $19 billion.

July 10 -

Triumph Capital Advisors doubled its business with a risk-retention driven acquisition of Doral Bank's CLO assets in 2015; the same regs spurred its spin-off as a separately capitalized vehicle to Pine Brook under CEO Gibran Mahmud.

July 10 -

With risk premiums on collateralized loan obligations at or near their tightest levels since the financial crisis, there may be nowhere to go but out, according to Wells Fargo Securities.

July 3 -

The $15 billion upward revision puts the bank's projection in line with that of JPMorgan; four new CLOs were printed last week, and another six were refinanced or repriced.

June 25