August was the second busiest month of the year for the CLO market, as managers took advantage of an ample supply of new leveraged loans to print deals.

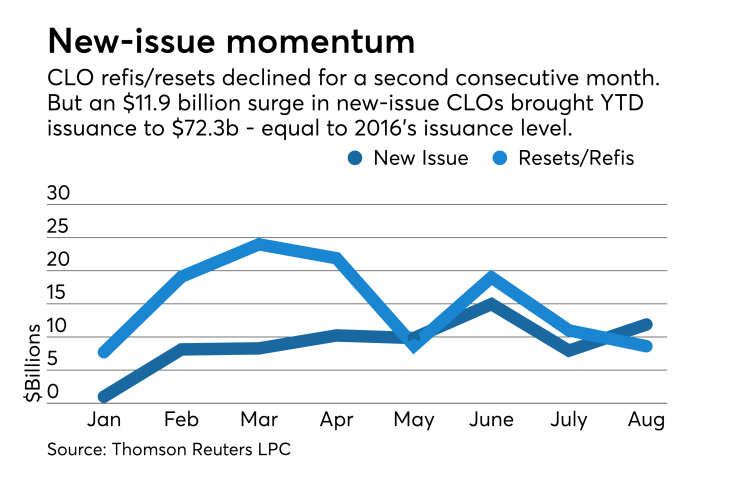

New-issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

The only busier period this year was the $14.9 billion in CLO offerings that priced in June covering 26 deals; prior to that, the market hadn't seen as much issuance since March 2015, when volume totaled $15.24 billion across 28 deals.

Those numbers don’t include the refi/reset activity in CLOs last month, which involved $8.6 billion over 18 deals, building refinancing volume levels to $120 billion on the year.

In the new-issue deals, the average portfolio size was $495.3 million, ranging from the $189.6 million JFIN Revolver 2017-2 deal managed and arranged by Jefferies, to CIFC’s $814.4 million CIFC Funding 2017-IV transaction via Bank of America Merrill Lynch.

The CLO market was driven by a continuing blitz of speculative-grade leveraged loan activity for a market in which CLO managers and loan mutual/ETF funds are the primary shoppers. More than $104 billion in new-issue and refinancing loans (including institutional and pro rata) came online in August, boosting year-to-date loan volume to $900 billion, LPC reports. Only $508 billion had been issued in the comparable period in 2016.

Within CLOs, a majority of loans are pricing at par-plus rates: 64% as of the end of August, compared to just 36% a year ago (but down slightly from 68% in July).

Discount margins for new broadly syndicated CLOs ticked down to 124 basis points over Libor, the tightest spread over the past 20 months. Three deals priced inside of 120 basis points, including the $512.5 million Neuberger Berman Loan Advisors 25 through BAML (118 basis points) and Oaktree EIF III Series II, a $553.2 million portfolio that also prices wide of Libor at 118 basis points.

[A tighter spread of 74 basis points was attached to the AAA paper of a $302.9 million transaction priced from Palmer Square Management, but that outlier deal involved a non-reinvestable, static CLO with a limited shelf-life callable in October 2018. Palmer Square Loan Funding 2017-1 had an “immense” demand, said Palmer Square president Christopher Long, “because people really like that profile: high quality, short- duration floating rate debt.”]

Loan holdings in U.S. CLOs grew more concentrated among larger borrowers in August, with the top 25 CLO holdings totaling $48.18 billion, compared to the $46.82 billion that comprised July’s top 25 holdings.

Technology (13% of all loan holdings) and healthcare (10%) remain the sectors with the highest levels among CLO assets. The top 3 firms in terms of loan exposure are Moody’s Ba1-rated Dell Inc. ($3.1 billion), mobile device insurance provider Asurion (rated B1, $2.85 billion) and aerospace component manufacturer Transdigm (rated B1, $2.83 billion).

Some individual borrowers drew wider interest from CLO managers. Both Scientific Games (B2, Moody’s Investors Service) and CenturyLink (Ba2) saw CLO holding concentrations grow nearly 20% month-over-month.

Scientific Games, a gaming equipment provider to the casino industry, surged 18.99% to $1.88 billion from $1.58 billion, likely aided by the launch of a $3.28 billion term loan B-4 proposal in July.

Telecom firm CenturyLink’s CLO holdings grew 17.69% to $1.73 billion from $1.47 billion. No new loan plans were announced, but the firm recently received Colorado state regulatory approval of its $24 billion merger with Level 3 Communications announced last November. Nearly 40% of that deal is to be debt-funded.

Community Health Systems (B3), meanwhile, had CLO holdings fall to $1.46 billion from $1.57 billion, a 7% decline, as it divests assets to reduce its $15 billion debt loan, according to Moody’s.

Citi remains atop the CLO primary issue league tables with 17 deals in 2017, for a total volume of $11 billion, or a 15% market share, followed by Bank of America Merrill Lynch (12 deals, $8.4 billion, 12%) and Morgan Stanley ($8 billion, 14 deals, 11%).

Citi is also the leading arranger for resets with $9.2 billion of volume across 18 deals for a 28% market share, followed by JPMorgan ($5.9 billion, 12 deals, 18% market share) and Jefferies ($4.4 billion, 10 deals, 14% market share).

For straight refinancings, Citi is second to Morgan Stanley’s 32 deals totaling $14.6 billion for a 17% market share; Citi follows with a 16% market share from 30 deals totaling $13.5 billion.

As for Europe, CLO activity picked up with two new issues totaling €778 million priced in August: Och Ziff Capital Management’s $415.25 million OZLME 2017-2, and Bain Capital Euro CLO 2017-1.

That brings European YTD volume to €10.4 billion over 27 deals. That is in line with the €10 billion in deals recorded last year. European managers have conducted €1.3 billion of combined refi/reset activity, with YTD volume at €18 billion.

Barclays is the top new-issue arranger in Europe with six deals totaling €2.47 billion, followed by Citi with €1.94 billion across five deals and Credit Suisse with three deals totaling €1.28 billion. Morgan Stanley leads among arrangers for resets (7 deals, €2.51 billion) while BAML has arranged €1.82 billion in refinancings among six deals.

CLO assets under management now stand at $464 billion for U.S. CLOs (1,154 deals) and €70 billion for European CLOs.