-

The company allegedly made more than $200 million in "improper payments" before filing Chapter 11 earlier this week, lenders claimed, citing dividends and bonuses to corporate insiders.

January 29 -

Sponsored by American Water, the deal funds service contracts on HVAC, plumbing and external water lines.

January 9 -

The portfolio consists of first-lien, fixed-rate and interest-only balloon RTLs. They were originated with original terms of six to 24 months to maturity.

July 23 -

Non-residential customers accounted for about 56.4% of Kentucky Power's revenue, a potential credit risk because it is closely tied to business cycles.

June 4 -

ACHM 2025-HE1 will repay notes using a pro-rata, sequential pay structure that must satisfy an overcollateralization test, and cumulative loss and delinquency triggers.

March 29 -

All the notes, which are fixed rate, have an Aug. 18, 2031 final maturity date, DBRS said. The transaction will repay investors sequentially.

October 9 -

The transaction structure benefits from several forms of credit enhancement to the deal, including advance rates of 55.0%, 66.5% and 76.5% on the classes A, B and C notes, and a rapid amortization trigger event.

November 6 -

The loans were aggregated by JUPS, the deal’s sponsor and an affiliate of Jefferies and Jefferies Asset Funding.

February 27 -

Jefferies is housing the initial round of $300 million in loans under a repurchase agreement with four lenders, as well as with the trust established for the transaction in Jefferies’ standing as the repo seller.

July 22 -

Stonyrock Partners will focus on buying stakes in asset managers focused on middle-market strategies.

April 23 -

The Renaissance and Grand Hyatt Seattle, both sponsored by R.C. Hedreen, account for 14.2% of the assets in the $774.1 million JPMCC 2018-COR4.

February 11 -

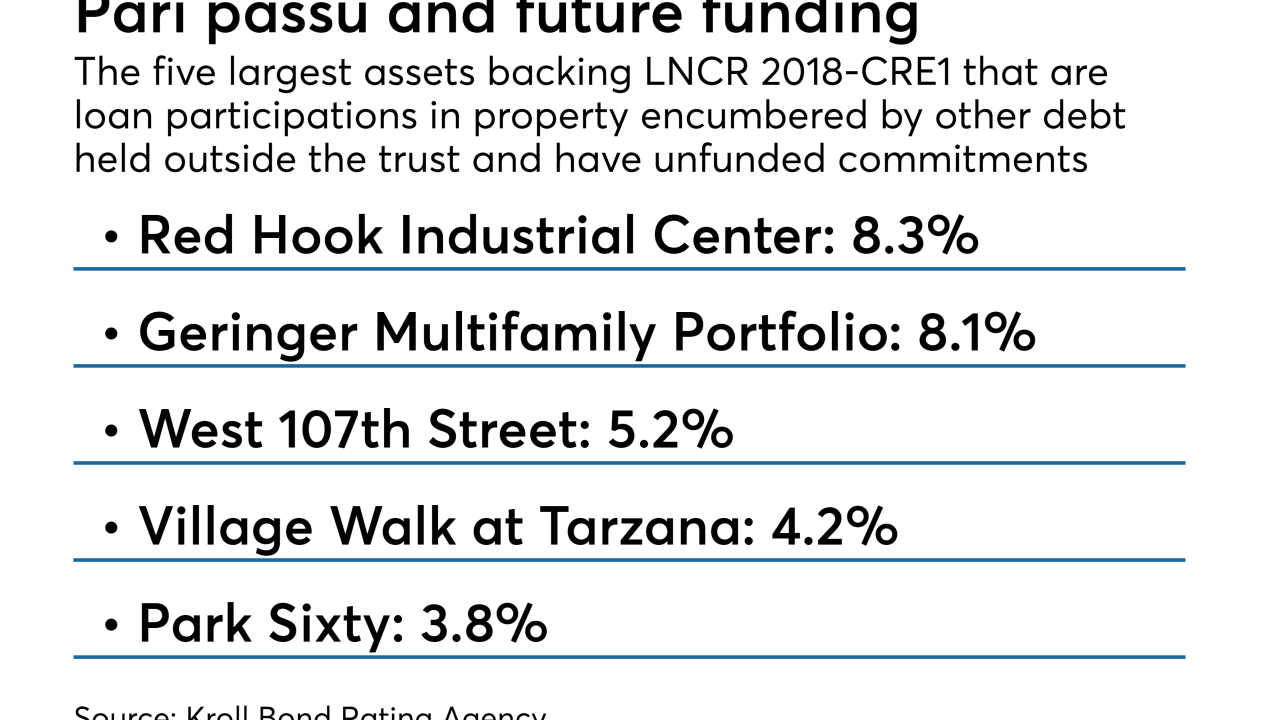

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

CBAM Asset Management's $1B CBAM 2017-4 is not its largest deal among the four BSL portfolios it has issued in less than eight months; but the latest transaction is still almost double the average peer CLO deal size of $511 million since the third quarter.

November 17 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

Freddie Mac has priced its first credit-risk transfer securities backed in part by tax-exempt loans used to finance affordable multifamily rental properties.

June 15