A Greenwich, Conn.-based commercial real estate lender jointly owned by a pair of sovereign wealth funds is returning to the securitization market with the largest CRE CLO since the financial crisis, according to Kroll Bond Rating Agency.

LoanCore Capital Markets, through its affiliate LoanCore Capital Credit Advisor, will market bonds totaling $805 million backed by $1.1 billion in balances on a mix of 27 whole mortgage loans and participations used to finance the rehabilitation and repurposing of business properties.

That makes it the largest deal since the financial crisis, according to Kroll, though a pair of $1 billion deals from two other large players, Blackstone and TGP, come close.

Like Blackstone, LoanCore is pushing the risk envelope a bit in terms of the types of collateral and structure of its deal. Most post-crisis deals have been backed entirely by whole loans giving the trusts controlling interests in properties, as opposed to loan participations.

All but one of the loans was originated through LoanCore (formerly Jefferies LoanCore) and held in its real estate investment trust formed in 2016, according to a presale report from Kroll. The loans were used for refinancing, acquiring or recapitalizing commercial properties undergoing or targeted for improvements, such as a United Parcel Service warehouse facility in Brooklyn slated for demolition to pave the way for a new warehouse campus.

The deal is LoanCore's second CRE CLO ever, but the first in nearly five years for the firm, which was founded as a joint venture between Jefferies Group and the Government of Singapore Investment Group (GIC). The company was renamed after Jefferies sold its 48.5% stake in the lender to Canada Pension Plan Investment Board (CPPIB), which now splits the 96% ownership stakes with the Singapore government fund.

The notes being issued through the LNCR 2018-CRE1 trust include a $473.8 million Class A tranche benefiting from 55% subordination and Class A-S notes totaling $142.1 million with 41.5% subordination. Each of the tranches have preliminary triple-A ratings from KBRA.

Other rated notes being issued include $64.5 million in Class B notes (AA-); $63.2 million in Class C (A-); and a Class D tranche (BBB) totaling $61.9 million. An LCC affiliate will retain the Class E (BBB-) notes totaling $30.2 million; $38.3 million in Class F (BB-) notes; $47.4 million in Class G bonds (B-); and an unrated tranche of preferred shares totaling $131.6 million.

All the issued bonds are floating rate, indexed to one-month Libor.

Among the largest loans in the pool is the trust’s $87.4 million participation in a 385,710-square-foot Brooklyn warehouse complex (Red Hook Industrial Center) that UPS plans to level for a new distribution complex; an $85.3 million portion of a multistate portfolio of garden-style apartments being upgraded with $6.8 million in improvements; and a $71 million whole loan for a six-story Manhattan office building (428 Broadway) owned by the developer Jacob Chetrit, who is renovating the SoHo-neighborhood property to add retail space and upgrade the electrical and HVAC systems.

Another unusual feature in the transaction is a two-year revolving period in which additional properties may be added, so long as the new loans do not cause the pool’s aggregate loan balance to exceed the current $1.1 billion.

There are also property-type and geographic concentration caps, such as a 40% limit on office buildings and a similar ceiling for New York, California or Florida properties.

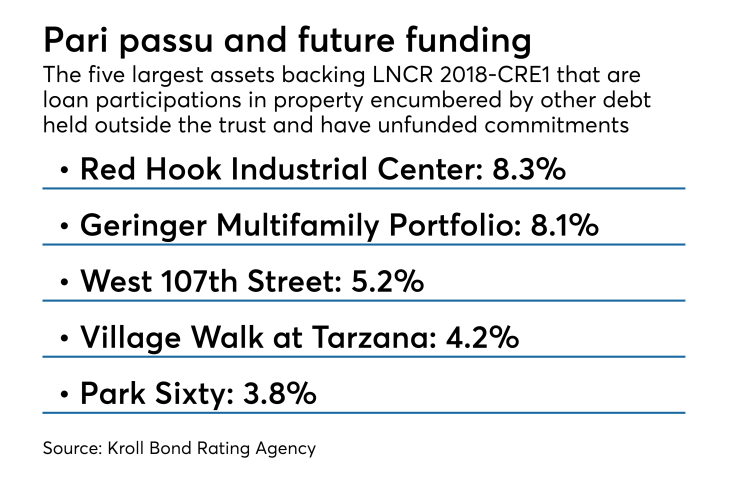

The initial assets consist of 16 pari passu participations (61.5% of the pool), 10 whole loans (33.9%) and a senior participation (4.5%). Four of the properties have associated mezzanine debt held outside the trust, and one asset in the pool is permitted to incur additional debt: an office tower in Sherman Oaks, Calif., is permitted to take on $2.6 million of future obligations beyond its $43 million trust loan balance for property-assessed clean energy (PACE) upgrades.

Kroll puts the loan-to-value ratio for the properties at 132.1%, based mostly on as-is appraisals.

LoanCore's previous deal was through its DivCore affiliate, which sponsored an initial 13-loan deal in 2013 (DIVCORE CLO 2013-1) sized at $404 million. DivCore added 13 more loans totaling $497 million during the two-year reinvestment period; the deal has since been paid down.

Last fall, Moody's Investors Service placed LoanCore's B1 corporate rating under review for downgrade following the CPPIB sale, citing the simultaneous reduction in equity stakes by LoanCore's management.

Kroll does not rate LoanCore.