-

The $52 billion in year-to-date volume in resets of collateralized loan obligations is nearly outpacing new-paper issuance of $53.5 billion, reports LPC.

June 11 -

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

May 8 -

It's the busiest start to the year, post-financial crisis, for collateralized loan obligations, according to Thomson Reuters, and nearly 60% higher than the pace set in the first two months of 2017.

March 7 -

The $12.9 billion in collateralized loan obligations issued last month brings the 11-month total to $108 billion, just shy of the 2014 record of $124 billion.

December 8 -

Just $7.6 billion of deals were refinanced or reset in September, bringing the total for the third quarter to $27.2 billion, far short of the pace of the first half, when approximately $138 billion was reworked.

October 9 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

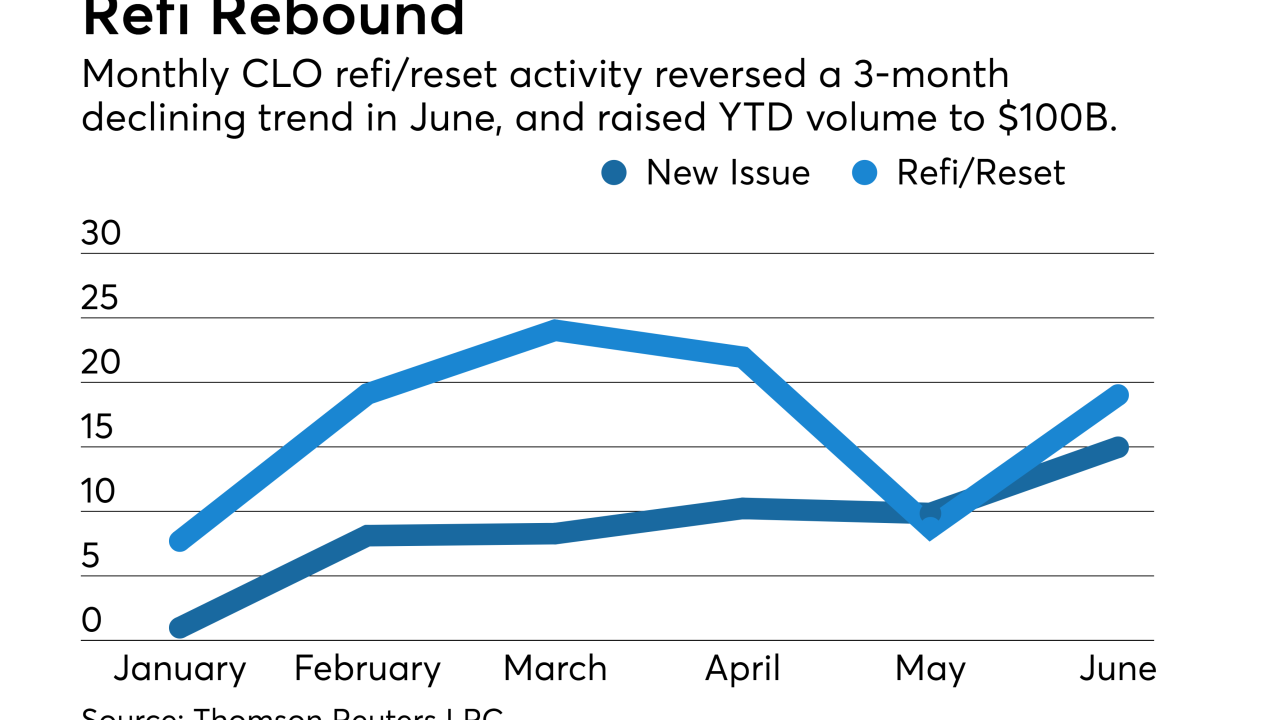

That was an increase of more than $5 billion, or 30%, from May's total, according to Thomson Reuters LPC, though it fell short of refinancing/reset activity, which rebounded to more than $19 billion.

July 10