New issuance of collateralized loan obligations jumped to $14,97 billion in June, the largest monthly output of the year, according to Thomson Reuters LPC.

That was up by more than one-third from the $9.8 billion issued in May. The volume brought the half-year, new-deal issuance total to $52 billion, more than double the volume at the same point last year.

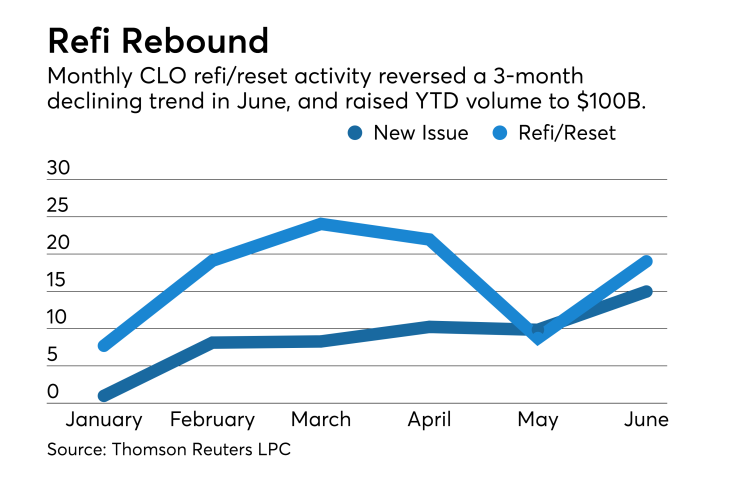

Refinancing ($11 billion through 24 deals) and reset ($7.9 billion, 18 deals) activity also remained brisk in June, surpassing the total for June new issuance after being eclipsed in May and reversing a three-month decline in activity. The six-month CLO refi/reset volume has now surpassed $100 billion.

The wave of CLO deals is being fed by a record pipeline of leveraged loans (of which CLOs are the biggest buyers). LPC reported a record $732 billion in syndicated loans were issued to speculative-grade rated companies in the first half of 2017, breaking the previous record of $660 billion in the first half of 2013. Only $381 billion in deal volume had been issued at this point last year.

Over 71% of the issuance in leveraged loans involved refinancing activity for companies taking advantage of lower rates they are able to command in the senior-loan market due to investor demand. New-money loans totaled $215 billion, a level 7% higher than the first six months of 2016.

Some signs have already emerged that levels of demand may be waning. The total loan volume in June of $105.61 billion was the lowest since January, and last month loan returns were flat at 0.04%, according to LPC.

Additionally, the average spread on a corporate loan of 345 basis points was flat compared to May; and average bid prices ticked down to 97.64 cents on the dollar. The number of loans trading above par declined to 58% from 63% a month ago – but that is a level still well ahead of June 2016 when only 8% of loans were trading above 100 in the secondary market, according to LPC.

The slight decline in loan prices has not yet impacted US CLO portfolios, which saw the average discount margin on AAA paper tighten to 125 basis points from 128 in May. That matches April’s spread, which had been at the market’s

The average bid for U.S. CLO portfolios dip to 98.03 from 98.42 in May.

In Europe, LPC reported that four new CLO deals were issued totaling €1.6 billion, bringing total-year volume through June to €8 billion through 21 deals. That tops the levels from a year ago, when Europe CLO managers issued €7 billion in primary issuance. Refinance/reset activity in Europe was €3 billion in June, bringing the first-half total volume to €14 billion.

CLO Roundup

The market saw light pricing activity last week, according to LPC, with three of four deals totaling $1.78 billion closing last week involving resets.

Benefit Street Partners CLO III, sized at $467.7 million, lowered its AAA spread to 125 basis points from its original margin of 135 basis points. The deal represents the fourth refinancing/reset that manager Benefit Street Partners has arranged among its 10 managed CLOs since last fall.

Crescent Capital Group also reset the senior notes in its 2014-vintage $462.6 million Atlas Senior Loan Fund V to 126 basis points from 155; it also tightened the margins on its AA paper (185 from 220 basis points), A (260 from 300) and agreed to wider margins on the subordinate BBB (400 from 345) and BB (698 from 470) tranches.

Carlson Capital reset Cathedral Lake II, a $372.15 million 2015-vintage portfolio, to 131 basis points from 188 on its AAA notes. The deal closed just one week after resetting the $368 million Cathedral Lake III.

Apollo Credit Management was able to refinance its $475 million ALM VI deal from 2015 to 105 basis points from 143.