With risk premiums on collateralized loan obligation at or near their tightest levels since the financial crisis, there maybe nowhere to go but out, according to Wells Fargo Securities.

In research published Friday, analysts at Wells Fargo said there is more risk to the downside, particularly as new issuance is picking up.

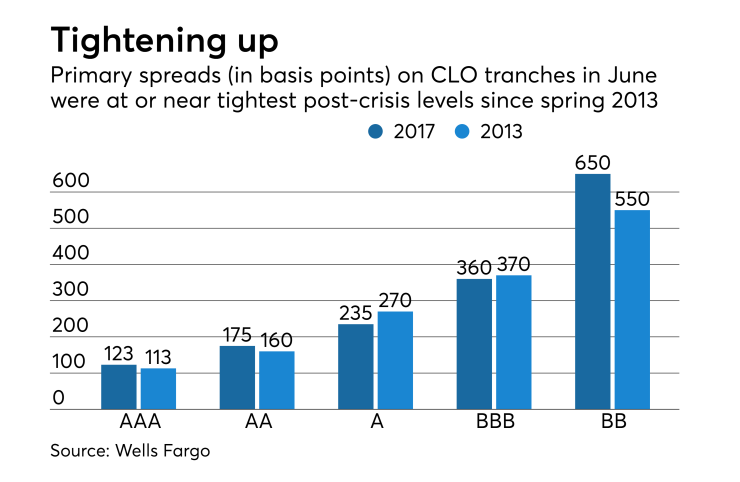

CLO spreads have been tightening for the past six months. Spreads on tranches rated double-A through triple-B in March of this year, reaching levels not seen since the second quarter of 2013. However, spreads on tranches rated triple-A and double-B are still outside the tightest post-crisis levels reached in that period.

Wells did not forecast any particular spread levels for any of the senior or mezzanine tranches in CLOs in its report. It instead considered which macroeconomic and fixed-income/CLO market trends would lend themselves to either tightening or widening spreads, and leaned toward the latter.

“Across leveraged credit, we see investors with cash to spend, but also note an unwillingness to step in when yield opportunities are presented,” stated the report, which includes senior analyst and lead author David Preston. “Therefore, while our base case is for range-bound spreads, we see a move wider as more likely than sustained tightening.”

The Salmagundi report cited a Wells’ Economics Group note on the tepid first-quarter growth in U.S. GDP as well as “steadily downgraded” forecasts for second-quarter growth. In addition, “doubts are beginning to surface” on the pace at which the Federal Reserve will “normalize” rates.

A lower supply of CLO paper would help sustain a tightened spread environment, the newsletter noted, but new issuance totaling $49 billion in deals is double the pace from 2016. Total market volume is $160 billion when including the robust refinancing and reset activity this year. Issuance is expected to continue ramping up at levels more than twice last year’s pace, as forecasts by both Wells and JPMorgan have risen in recent weeks.

“The case for wider CLO spreads centers on investor indigestion due to heavy issuance, along with slower LIBOR growth — or CLOs following [high yield] spreads wider in a credit sell-off,” the report added.

CLO deal roundup

Nearly $5 billion in new-issue primary, refinanced or reset deals priced in the market last week, according to Thomson Reuters.

The two new-issue CLOs were from KKR and Alcentra NY LLC.

Alcentra’s Shacketon 2017-XI, a $506.2 million portfolio, came in at 127 basis points for its AAA rated tranche and included several issuer-friendly covenants: a five-year reinvestment period, a nine-year weighted average life, as well as a higher-than-average concentration limit (10%) of second-lien, senior unsecured and “first-lien/last out” loans. In addition, Alcentra will use the discount purchase price, rather than the loan balance, in calculating the volume of lower C-rated loans it adds to the portfolio (the portfolio had identified 61% of its assets as of the June 23, according to a Moody’s Investors Service presale report).

The $713 million KKR CLO 18 priced its AAA notes at 127 basis points over Libor, a slightly narrow spread than its KKR CLO 17 offering in February.

Among the refis/resets pricing this week are a trio of 2015-vintage deals, all exiting their non-call periods but now subjecting managers to their risk-retention requirements under the new terms.

The estimated $550 million Palmer Square CLO 2015-2 was reset to 127 basis points from its original AAA price of 150 basis points in a revision that extends the terms as well as adding nearly $150 million in new collateral from an older CLO being redeemed by manager Palmer Square Management. A presale report from S&P Global Ratings noted that the replacement notes are being added at a lower overall cost of debt than the original notes.

3i Debt Management’s $480 million Jamestown CLO VI portfolio squeezed its margin to 115 basis points from 160 basis points in a refinancing, while Carlson Capital had a slight gain for its $368 million Cathedral Lake III, to 132 from 137 basis points over Libor.

Other resets priced last week were Highbridge Loan Management 3-2014 ($517.55 million portfolio, maintaining its AAA margin of 118 basis points); the $500 million Octagon Investment Partners XV to 121 from 129 basis points; and THL Credit Wind River 2013-1, a $467.2 million portfolio managed by THL Credit Senior Loan Strategies LLC originally issued in April 2013. THL actually absorbed a higher AAA-paper margin of 125 basis points from 115 basis points, but tightened for the unrated B and C notes as well as boosting the cov-lite concentration cap to 60% from 50%.

Napier Park refinanced its AAA margin substantially on its $521 million Regatta IV Funding 2014-vintage portfolio to 102 from 141 basis points over Libor. Black Diamond Capital Management’s new price for its $351.6 million Black Diamond CLO 2013-1 is 105 basis points, from its original margin of 145.