Wells Fargo now expects issuance of collateralized loan obligations to reach $85 billion this year; that's some $15 billion more than it was calling for in December 2016.

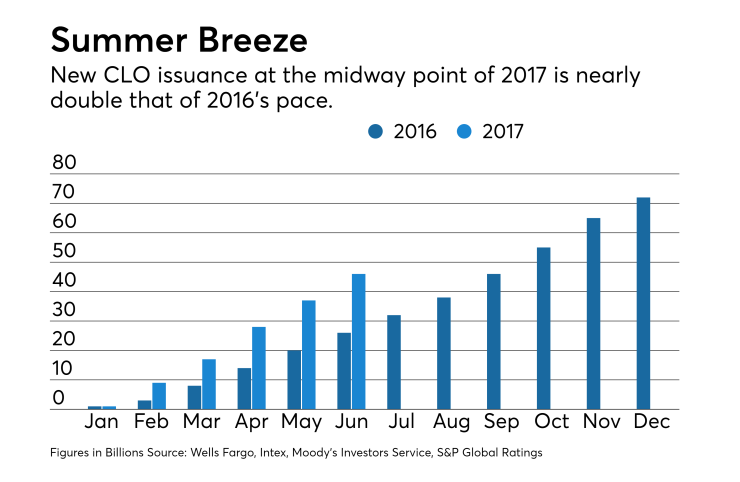

The upward revision, announced last week, comes as nearly $28 billion of deals have been printed so far in the second quarter. Total volume of new deals stood at $46 billion as of June 19, more than double the pace of 2016 but trailing that of 2014 and 2015 at the year's mid-point.

Four new deals were completed last week, according to Thomson Reuters LPC. TCI Capital Management priced its $461.2 million TCI-CENT CLO 2017-1 on Monday through arranger Deutsche Bank; the transaction included a triple-A discount margin spread of 127 basis points.

And on Friday, three deals priced: Crescent Capital Group's $413.7 million Atlas VIII CLO, with a AAA spread of 130 basis points; Barings CLO 2017-1, sized at $512.4 million with a spread of 118 basis points; and Carlyle Investment Management completed its third CLO of the year with the $613 million Carlyle US CLO 2017-3. The AAA price was 118 basis points above Libor.

But refinancings still dominate the market overall, having topped $90.1 billion as of June 22, according to JPMorgan Chase. LPC reports that six re-worked deals were priced last week, including resets by American Money Management Corp. (for its 2013-vintage $413.3 million AMMC CLO XIII) and Golub Capital (the $611.3 million Golub Capital Partners CLO 16, originally issued in August 2016). Each maintained existing senior-tranche spreads of 126 basis points (AMMC) and 170 basis points (Golub).

Among deals getting new rates were the $324 million Silver Spring CLO (managed by Silvermine Capital Management), which was reduced to a AAA spread of 125 basis points from 145; Apollo Credit Management’s ALM XVI, a $959.8 million portfolio that tightened its AAA paper to 105 basis points from 146; NXT Capital CLO 2014-1, a $271 million transaction reduced to 140 basis points from 175; and Apex Credit Partners’ $433.95 million JFIN CLO 2014-2, now priced at 117 basis points on the AAA discount margin vs. the original 150 basis points.

Wells’ revision puts its forecast in line with that of JPMorgan, which stands at $85 billion to $94 billion, up from a range of $50 billion $60 billion originally. Even with the forecast change, JPMorgan left its year-end forecast for spreads on new-issue triple-A rated tranches unchanged at approximately 110 basis points, however.

In additional to simple demand, JPMorgan cited its new forecast based on high levels of capital already used for risk-retention stakes. The bank’s analysts estimate $2.3 billion of risk-retention has been deployed thus far either by managers or third parties. “It is difficult to estimate the amount of risk retention financing that has been raised, but our point is that it is likely much higher than this [approximate] $2 billion deployed, and suggests more headroom for CLO manager issuance,” the bank stated in a mid-year report on the market.

Another factor in the expected second-half CLO surge is the sharp rise in issuance of CLOs backed by loans to small and medium-sized companies. Eleven of the 82 CLO deals in 2017 have been middle-market deals totaling nearly $7 billion; the record post-crisis year for middle-market issuance was $7.6 billion in 2016, according to Wells Fargo.