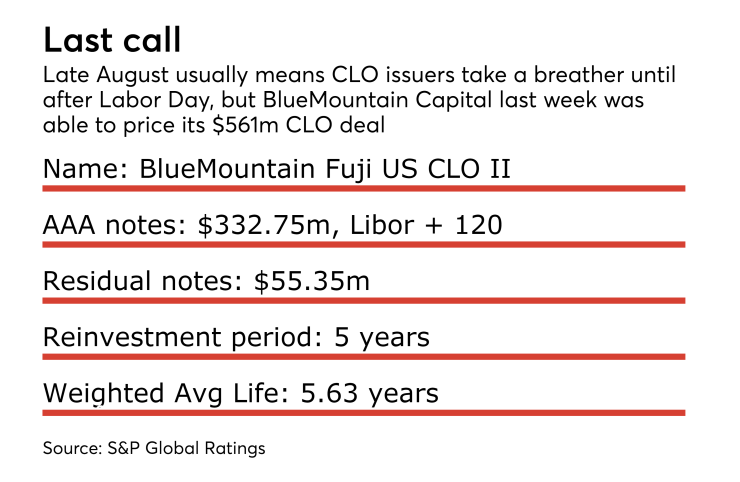

In one of the final U.S. CLO deals to price before the start of the market’s annual August lull, BlueMountain Capital Management has closed on a $561.4 million portfolio, according to Thomson Reuters LPC.

BlueMountain Fuji CLO II is the second collateralized loan obligation of the year managed by BlueMountain Capital. It is also the second deal to be issued through the alternative asset manager’s BlueMountain Fuji affiliate created two years ago to house and invest in risk-retention and equity stakes in U.S. and European CLOs.

BlueMountain Fuji CLO II includes a $332.8 million AAA tranche (as rated by S&P Global Ratings) that will carry a coupon of Libor plus 120 basis points, according to presale reports. That is in line with the BlueMountain CLO 2017-1 transaction that was completed in May with an AAA coupon margin of 124 basis points.

BlueMountain’s deal represents the 32nd U.S. CLO to price in August, with a total volume of $15.9 billion. That included $10.1 billion in new-issue CLOs, according to JPMorgan’s High Yield and Leveraged Loan Morning Intelligence newsletter update. That makes it the third-busiest month of the year, and only the third time since last November new CLO issuance topped $10 billion.

BlueMountain’s deal follows the pricing last week of Regatta Loan Management’s $511.6 million Regatta Funding 2017-1 through Bank of America Merrill Lynch; Brigade Capital Management’s Battalion CLO XI (sized at $652.8 million) via Morgan Stanley; CIFC Funding 2017-IV ($814.4 million) and Wellfleet Credit Partner’s second CLO of 2017 sized at $557 million (dubbed Wellfleet CLO 2017-2).

A few deals launched this month have expected closing dates for September, including Oaktree Capital Management’s

Apex Partners, which will take an eligible horizontal risk-retention stake in that deal, is matching the $450 million note size of its first deal of the year in February, but is taking on a shorter reinvestment (4.2 years) and non-call (2) periods than it structured for Apex Credit CLO 2017. The AAA coupon spread of 127 basis points is tightened as well from the 147 basis points over Libor for the senior tranche of the first transaction.

Year-to-date issuance of new U.S. deals has reached $70.9 billion; refinancing is at $117.5 billion.

Bain Capital Credit this week also closed on its Bain Capital Euro CLO 2017-1, a €363 million portfolio priced through Citigroup. Moody’s Investors Service and S&P have rated the transaction, which has a €206 million AAA tranche and €37 million in residual notes that will be maintained for risk-retention purposes.

That brings the total of August European CLO pricings to €2.1 billion through six deals, which include €800 million in new primary transactions.