Nassau Re, a fast-growing reinsurance group founded two years ago with seed funds from Golden Gate Capital, is marketing its debut collateralized loan obligation.

Naussau 2017-1 will be backed by $438 million of loans acquired by a majority-owned affiliate of Nassau’s investment advisory arm, Nassau Corporate Credit LLC. A majority owned affiliate will oversee the CLO under a shared-services agreement with NCC.

The deal is the third rated debut securitization by a CLO manager this year, according to Thompson Reuters LPC, and the second involving broadly syndicated loans. Overall, seven new managers have entered the field in 2017, according to Wells Fargo structured finance analyst David Preston.

The portfolio is considered by S&P Global Ratings to be more diverse and better-leveraged than comparable collateralized loan obligations the firm has rated this year.

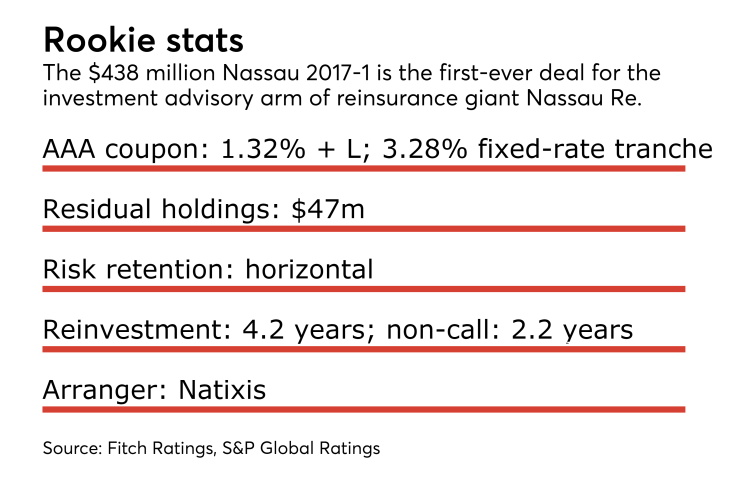

Both S&P and Fitch Ratings have assigned preliminary ratings to the debut deal, including the AAA tranche that is split between a $231.3 million Class A-1-T floating-rate tranche (expected to pay Libor plus 132 basis points) and a $30 million fixed-rate tranche paying 3.28% through the Class A-1-F series.

The senior notes benefit from 38.5% credit enhancement.

A Class A-2 tranche, rated AA, carries a coupon of 180 basis points over the Libor benchmark, while three remaining deferrable subordinate classes are priced between 2.7% and 6.2% over Libor.

(Fitch did not rate any classes beneath the Class A-1 tranches.)

A subordinate equity tranche sized at $47 million will include a horizontal risk-retention slice that is dual compatible with U.S. and European regulations, and will be held by NCC CLO Manager, a wholly owned subsidiary of Nassau Re’s investment advisory affiliate Nassau Corporate Credit LLC of Darien, Conn.

To qualify for Euro retention compliance, Nassau will operate as an originator through the purchase of the some of the collateral assets before selling off to the issuer for securitization.

The CLO, which comes with a 4.2-year reinvestment period and 2.2-year noncall period, is being managed by NCC CLO Manager, a wholly-owned subsidiary of NCC. The deal’s weighted average life is eight years.

Presale reports notes that the portfolio was built with stronger-than-average characteristics. S&P states the deal’s total leverage (the proportion of equity to debt) is 8.32%, compared to three-month average of 9.59% for recently issued CLOs rated by the firm; and comes with a wider weighted average spread of 3.79 and excess spread of 2.02%, both signs of more reliable cash-flow.

The weighted average ratings factor of 2585, which calculates the balance of the ratings of the underlying loan issuers, is below that of the 2789 level reported in CLO issues in the third quarter. The portfolio includes 185 loans from 153 high-yield and high-leveraged corporate borrowers.

Fitch says only 1.2% of the pool are loans rated in the triple-C range, out of the maximum 7.5% permissible bucket of problem CCC-rated loans.

The transaction, which was placed by Natixis, did have a higher scenario default rate, as measured by S&P.

Nassau Re has grown its assets under management to $17 billion under Golden Gate, which seeded the firm in 2015 with a $750 million equity line of credit. The company has made two major acquisitions for the insurance business of both The Phoenix Cos. and Universal American.

It joins the ranks of other first-time CLO managers in 2017: middle-market lender Midcap Financial Services Capital Management and the recently formed CBAM CLO Management, backed by private equity firm Eldridge Industries.

The $1.25 billion CBAM 2017-1, which closed in June, was the second-largest CLO transaction of the year, as well, according to Thomson Reuters LPC.

The seven new managers this year is ahead of the pace of eight first-time issuers that appeared in the CLO market in 2016.