Delinquency rates on private-label credit cards — such as the cards that Citigroup issues on behalf of Sears and other retailers — have

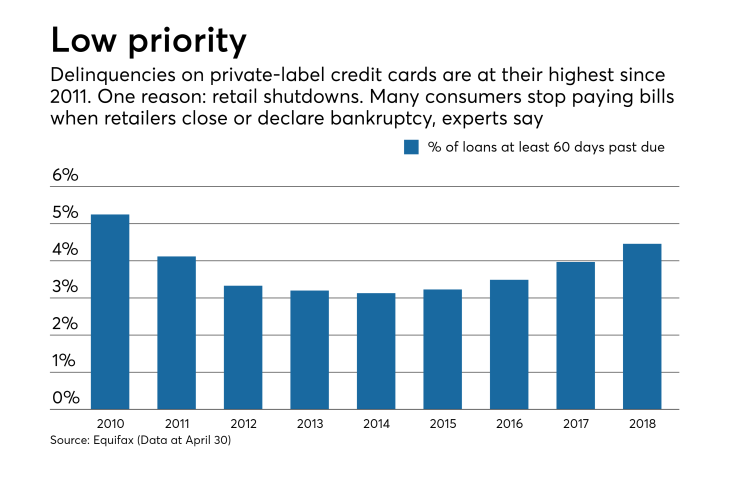

The portion of private-label credit cards with accounts at least 60 days late climbed to 4.46% in April, up from 3.97% in April 2017. When compared with the same months last year, delinquencies have increased by at least 49 basis points in every month so far in 2018.

Several factors have combined to drive past-due rates higher, including weaker underwriting on the part of card issuers,

Amy Crews Cutts, the chief economist at Equifax, said that many consumers apparently think that when a retailer closes stores or goes out of business, they don’t have to pay that store’s credit card bill.

“Consumers think they’re getting a free pass” when a retailer goes bankrupt, she said.

It’s a pitfall that retailers and banks have known about for some time. Once a store closes, consumers are less likely to pay off their existing debts because they’ve lost a physical connection to the retailer, according to a 2017

Sears, for example,

Private-label delinquency rates have also spiked at bankrupt retailers, including Toys R Us and HHGregg, Cutts said.

Still, the spike in delinquency rates can’t be attributed solely to the struggles of prominent retailers. Many card issuers have made the mistake in recent years of not only offering cards to more subprime consumers, but also boosting credit lines.

“They gave consumers too much room, which allowed them to get into trouble,” Cutts said.

The surge in delinquencies has not soured Citi on its private-label relationships, however. On Monday, the company said that it was extending its relationship with Sears and that the deal includes enhancements to its card rewards program.

Citi executives have recently said that default rates in its private-label card business have been manageable.

“Yes, we see higher losses coming out of the lower FICO score accounts, but I don’t see a marked deterioration as yet where there’s significantly more stress than you would otherwise think about,” Chief Financial Officer John Gerspach said during an April 20 conference call.

Citi issues both private-label and cobranded credit cards for Sears. Private-label cards can only be used at a specific store and Citi issues that type of card for Sears and Home Depot, among others. Cobranded cards can be used anywhere and Citi issues that type of card for Sears, Costco, American Airlines and others.

In its news release announcing the extension of the Sears partnership, Citi noted that many Sears cardholders use their cards to make purchases elsewhere.

“More than 70% of [dollars spent] on our Citi-Sears general purpose cards occurs at merchants beyond Sears,” Craig Vallorano, the head of Citi Retail Services, said in the news release.

Other banks that issue private-label cards have tightened their underwriting to deal with elevated loss levels. Synchrony Financial, one of the largest issuers of private-label cards, has slowed its pace of lending to subprime borrowers in recent quarters and has seen