While the rate of mortgages going into coronavirus-related forbearance decreased the

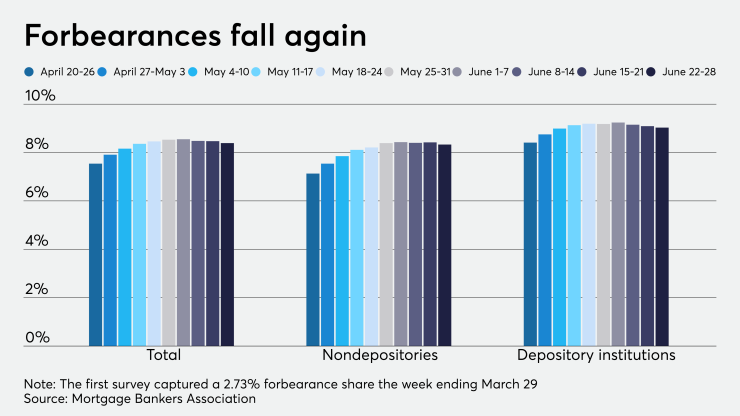

Approximately 8.39% of all outstanding loans or almost 4.2 million mortgages sat in forbearance plans the final full week of June, compared to 8.47% and about 4.2 million in the MBA’s report

"We learned last week that

"The improvement in the forbearance data was broad-based, with declines for both GSE and Ginnie Mae loans. The decrease in new forbearance requests indicates that further declines are likely in the weeks ahead. Looking at the mix of loans that are exiting forbearance, we are seeing a higher share exiting into deferral options and modifications, and somewhat fewer simply opting out of a forbearance plan."

The share of loans in forbearance at independent mortgage bank servicers dropped to 8.33% from 8.42% over that period. Depositories fell to 9.03% from 9.09%.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

The share of conforming mortgages — those purchased by Fannie Mae and Freddie Mac — in forbearance decreased to 6.17% from 6.26%. Private-label securities and portfolio loans — products which were not addressed by the coronavirus relief act — saw their share of forbearance actually rise to 10.08% from 10.07%.

Forbearance requests as a percentage of servicing portfolio volume edged down to 0.12% on June 28 from 0.15% on June 21. Call center volume as a percentage of portfolio volume decreased to 6.8% from 7.8%.

The MBA's sample for this week's survey includes a total of 51 servicers including 28 independent mortgage bankers and 21 depositories. The sample also included two subservicers. By unit count, the respondents represented nearly 76%, or 38.2 million, of outstanding first-lien mortgages.