Lenders that specialize in auto lending are expressing confidence that the boom they have been riding for much of the last decade still has some life remaining.

During earnings calls in recent days, executives at Ally Financial and Santander Consumer USA struck a mostly optimistic tone regarding 2019. They betrayed little concern about the chance of a recession that could make it harder for many Americans to meet their obligations.

“Everything we see across our portfolios reinforces that the consumer remains healthy,” said Ally CEO Jeffrey Brown. “Employment conditions are strong across the country. Wage growth is accelerating. Tax reform and falling gas prices have been incrementally beneficial. All of this leads to a strong consumer balance sheet. We'll continue to monitor trends, but our data remains favorable.”

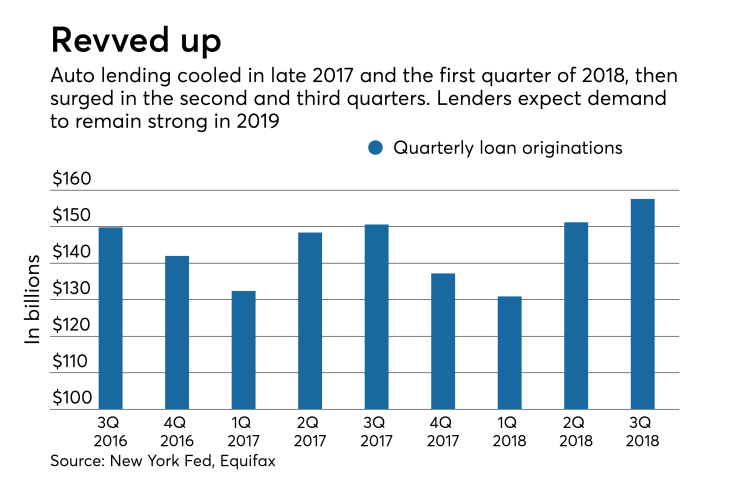

U.S. auto loan originations hit an all-time high of $157.6 billion in the third quarter of last year, according to the Federal Reserve Bank of New York and Equifax. Strong loan growth over the last half-decade has been fueled by low interest rates and a belief — which emerged from relatively strong performance of auto loans following the financial crisis — that consumers need a car to get to work even in tough times.

The perception that auto loans are a solid bet has enabled lenders to take bigger risks — notably by offering consumer loans of 72 months or more — which can result in outsize losses when borrowers stop paying. Another worry for lenders is that used-car prices will decline, which will result in smaller recoveries when borrowers default.

Santander Consumer is forecasting a modest 1% decline in used-car prices in 2019, as more vehicles enter the market. But CEO Scott Powell did not sound overly concerned Wednesday about the possibility of a price decline.

“Just keep in mind that that outlook last year was for used-car prices to be down 4%, 5%, 6%, something like that, and we actually ended up 3%,” he said. “So I always take those things with a little bit — with a lot of salt, actually. And based on our view of the strength of the consumer and the demand for the used cars, we're pretty optimistic.”

Still, Santander Consumer increased its provision for credit losses to $691 million at the end of the fourth quarter, up 15% from a year earlier.

Executives at the Dallas company voiced concern about the possibility of another government shutdown, which could hurt many Americans’ ability to purchase cars and to make payments on their existing auto loans. The Congressional Budget Office said this week that the five-week shutdown in December and January cost the U.S. economy $11 billion.

The Internal Revenue Service is currently funded through Feb. 15. Another government shutdown could delay tax refunds, which would damage household balance sheets in the short run.

“That has a big impact on our delinquency rate and our loss rate,” Powell said. “We’re hopeful there that we get the issues settled.”

The pain would likely be more acute at subprime lenders like Santander Consumer, since many of their customers have small financial cushions. In the fourth quarter, 64% of the firm’s retail installment contract originations went to borrowers with credit scores of 640 or below.

At Ally, which has a smaller subprime footprint than Santander Consumer, executives did not identify any warning signs about the financial outlook for U.S. consumers. The Detroit company reduced its provision for credit losses by 11% to $266 million in the fourth quarter.

“Credit performance in our portfolio remained solid throughout 2018,” Brown said Wednesday.

Though Ally has been taking steps to diversify its business, 84% of its pretax income from continuing operations last year came from its automotive finance unit.

At banks that rely less heavily on auto lending, executives offered less effusive outlooks on the sector.

Mark Tryniski, the CEO of Community Bank System in DeWitt, N.Y., said the company’s posture toward auto lending is closely tied to the state of the U.S. economy and the employment picture. “So that one is really difficult to project,” he said during a Jan. 23 earnings call.

At Capital One Financial in McLean, Va., the auto loan charge-off rate fell by 7% year over year in the fourth quarter. But CEO Richard Fairbank cautioned, “Over the longer term, we continue to expect that the auto charge-off rate will increase gradually as the cycle plays out.”