-

This proposed Libor replacement is an imaginary, backward-looking benchmark dreamed up by the economists at the Fed with no discernible market.

September 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Property-level insurance and funds fronted by servicers appear to mitigate the potential losses from damages and repairs in the Gulf Coast from the massive storm.

August 28 -

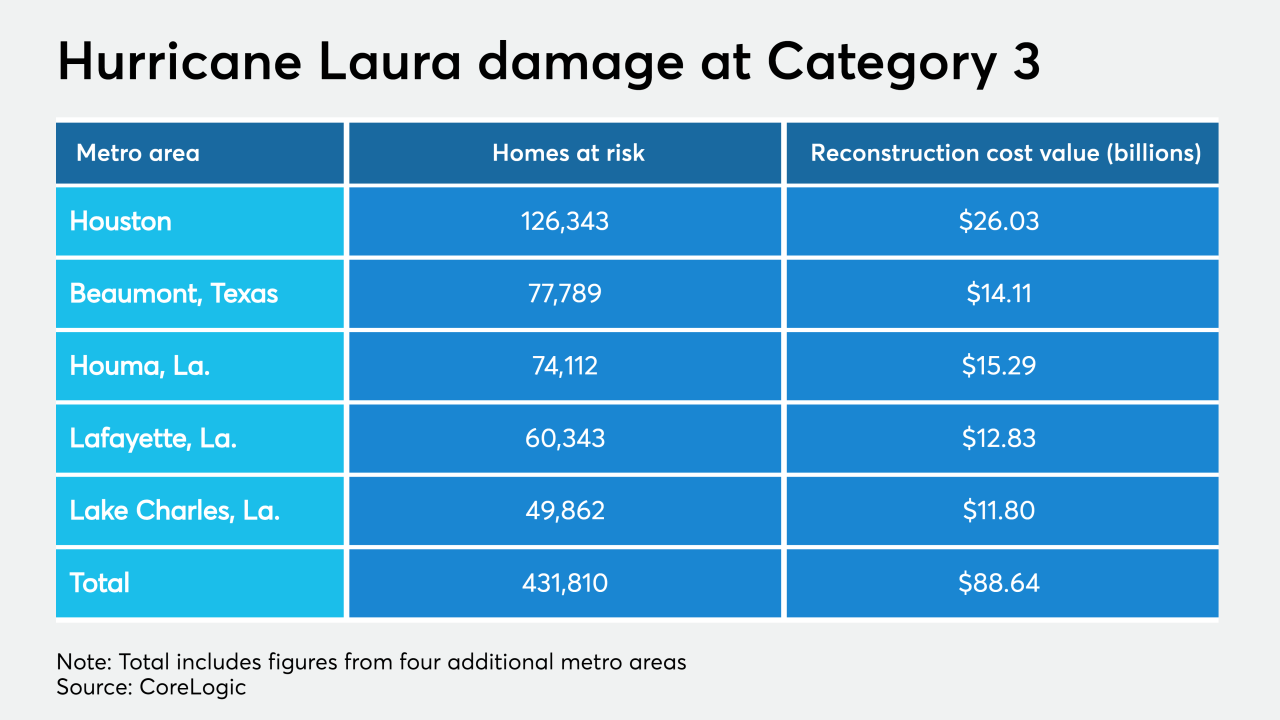

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Stack Infrastructure has raised nearly $1.4B in the ABS market since last year to construct and manage build-to-suit "hyperscale" data centers, reportedly for tech giants like Amazon, Apple, Google and Microsoft.

August 23 -

Banks and other lenders have found a way to potentially make billions of dollars from the coronavirus-fueled upheaval in the U.S. mortgage market — yet it risks burning bond investors in the process.

August 20 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

The ongoing pandemic and the resulting weak global economy will lead to tighter-than-expected underwriting of structured transactions and continue to weaken their performance, but investors are nevertheless starting to open their arms to more risk.

July 28 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

June 3 -

Fannie Mae and Freddie Mac have different timelines for the switch.

May 28 -

Progress Residential is bringing its next securitization of single-family rental properties to market, even as concerns mount on the depth of pandemic-driven tenant forbearance and delinquency trends.

May 19 -

The central bank will disclose information on a monthly basis about its Term Asset-Backed Securities Loan Facility and its Paycheck Protection Program Liquidity Facility.

May 12 -

Michael Burry, the doctor-turned-investor who famously bet against mortgage securities before the 2008 financial crisis, has taken to Twitter with a controversial message: lockdowns intended to contain the coronavirus pandemic are worse than the disease itself.

April 8 -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

Tom Barrack, who a week ago warned that commercial real estate financing was on the brink of collapse because of the coronavirus pandemic, is now calling for a moratorium on margin calls and intervention by the Federal Reserve to keep values of mortgage debt from plummeting further.

March 29 -

Two Harbors, a real estate investment trust, sold the bulk of its nonagency mortgage-backed securities portfolio to head off margin calls and refocus on its more favorable agency-MBS investments.

March 26