The government-sponsored enterprises have jointly issued a playbook detailing the steps that they, along with lenders and investors, will take in transitioning away from the London interbank offered rate.

The playbook includes a timeline that definitively states certain milestones in the transition, reinforcing

Both Fannie Mae and Freddie Mac have created dedicated web pages with lender information about the transition to the

"To protect our nation's housing finance markets, FHFA has

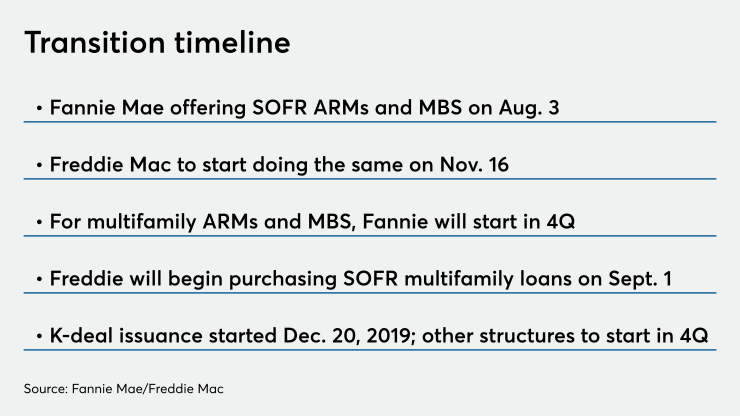

There are some differences in their respective timelines.

Fannie Mae will stop purchasing Libor adjustable-rate residential mortgages and issuing securities as of Dec. 31.

Freddie Mac will no longer accept Libor ARM applications for single-family loans on Oct. 1. It will stop issuing securities as of Dec. 1 and at the end of month stop making purchases of these loans through the cash window.

Instead, Freddie will start allowing SOFR-indexed mortgage applications to be underwritten through Loan Product Advisor on Oct. 1, and start purchasing these loans on Nov. 16.

Fannie Mae will start purchasing single-family SOFR loans on Aug. 3.

The timeline also includes dates for transitioning multifamily mortgages, credit risk transfer products and mortgage securitizations as well.

Regardless of whether current dislocations in the structured CRT market deterring issuance are cleared up, both Fannie and Freddie are stopping Libor CRT issuance at the end of the year, and Fannie won't begin doing SOFR CRT until after the start of 2021. The timeline for Freddie indicates it could produce SOFR CRTs in the fourth quarter.

The only instance where Libor use goes past Dec. 31 is for Freddie Mac multifamily issuance, where the index will be used on new variable-rate MBS through the end of the second quarter of 2021.

SOFR is the only Libor alternative addressed in the document;