-

Enpal and M&G's move comes at a complex moment for securitizations backed by energy infrastructure and home efficiency equipment.

October 21 -

The issuance marks the first time a multilateral climate fund is turning to the capital markets, as cash-strapped developed nations balk at providing the funds needed to cut greenhouse gas emissions.

January 15 -

The "greenium" spread is not economically feasible for bond issuers anymore, T. Rowe Price's Matt Lawton said.

December 9 -

The renewables firm also plans to raise as much as $500 million by February via banks or a private placement in the offshore market.

November 29 -

Sustainability-linked bonds (SLB) make up roughly $280 billion of issuance and can play an enormous part in transitioning the world economy.

March 26 -

The global shift to a low-carbon world will be "long, hard and complex," but Barclays's commitment is unwavering.

March 19 -

The company will use some of its fiber-optic network and associated customer contracts in the Dallas area to back a bond issue that will refinance some of the company's existing debt and finance a network expansion.

July 20 -

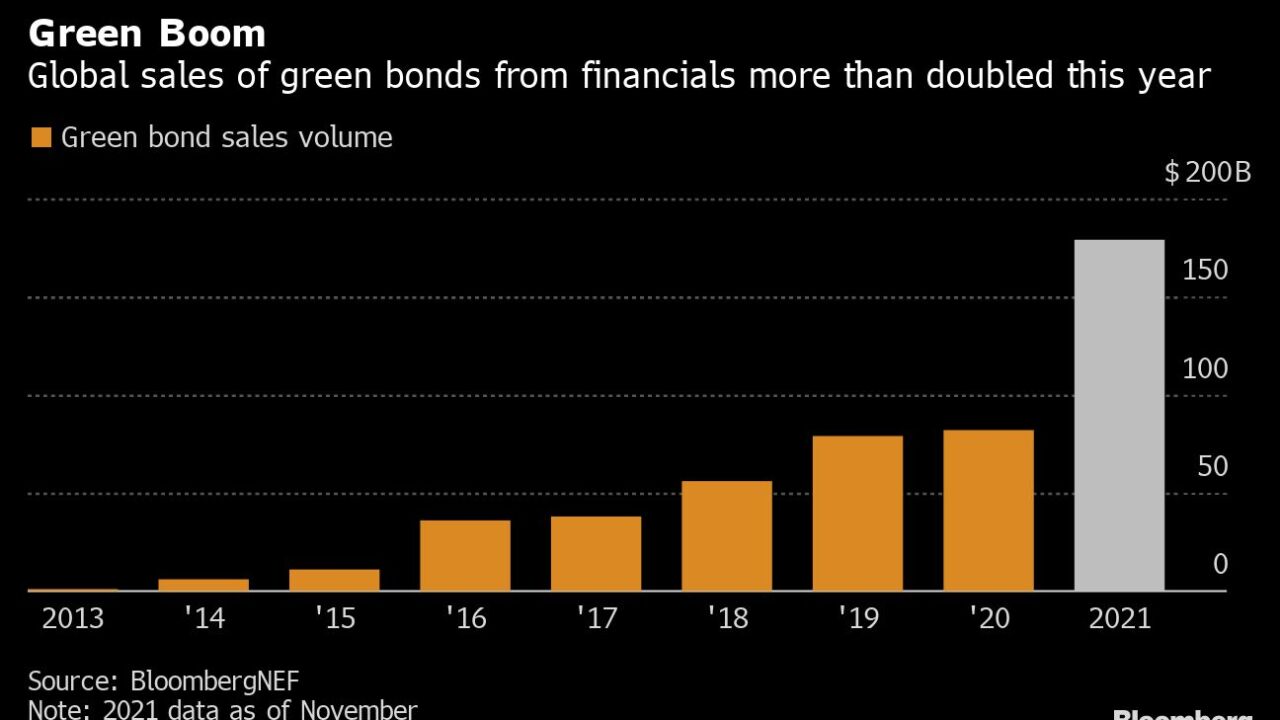

Almost $350 billion was raised from green bond sales and loan arrangements in the first half of this year, compared with less than $235 billion of oil, gas and coal-related financing.

July 5 -

GoodLeap 2023-2 has loans with fewer 25-year terms and higher FICO scores generally. Together, they'll have lower expected loss rates than those with longer terms and lower FICO scores.

May 5 -

Arrangers and analysts aren't predicting a return to the exponential growth of the past decade that turned a fringe concept into a $5.6 trillion asset class.

December 21 -

The single-family rental industry is slowly making its homes more energy-efficient. About 21% of total US energy consumption last year came from residential energy use.

October 4 -

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22 -

Citigroup Global Markets is lead underwriter on the fourth issuance through Toyota’s ABS Green Bond program. The deal references two potential pools to be securitized.

June 4 -

JPMorgan Chase and Loop Capital Markets have submitted pitches suggesting ways to structure $1 billion of bonds that Governor Gavin Newsom proposed to build vehicle charging stations

March 24 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The European Union's first social bond sale, totaling 17 billion euros, was 14 times oversubscribed, meaning the EU could have sold 200 billion euros worth of bonds. That indicates a market that’s structurally underserved.

October 22 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Recent good fortunes for lenders such as Loanpal and Sunnova reflect what will could be a solid year for solar-panel loan originations and securitizations, despite the economic impact of the coraonvirus pandemic on markets and consumer spending.

June 3 -

PACE Funding Group, based in Los Gatos, Calif., recently obtained a $55 million line of credit from SunTrust Bank and Rosemawr Management and is gearing up for its second securitization later this year.

August 21 -

The New York State Energy Research and Development Authority is marketing its fifth transaction financing local residential solar-panel installations; all of the notes carry an A rating from Kroll.

March 6