-

The single-family rental industry is slowly making its homes more energy-efficient. About 21% of total US energy consumption last year came from residential energy use.

October 4 -

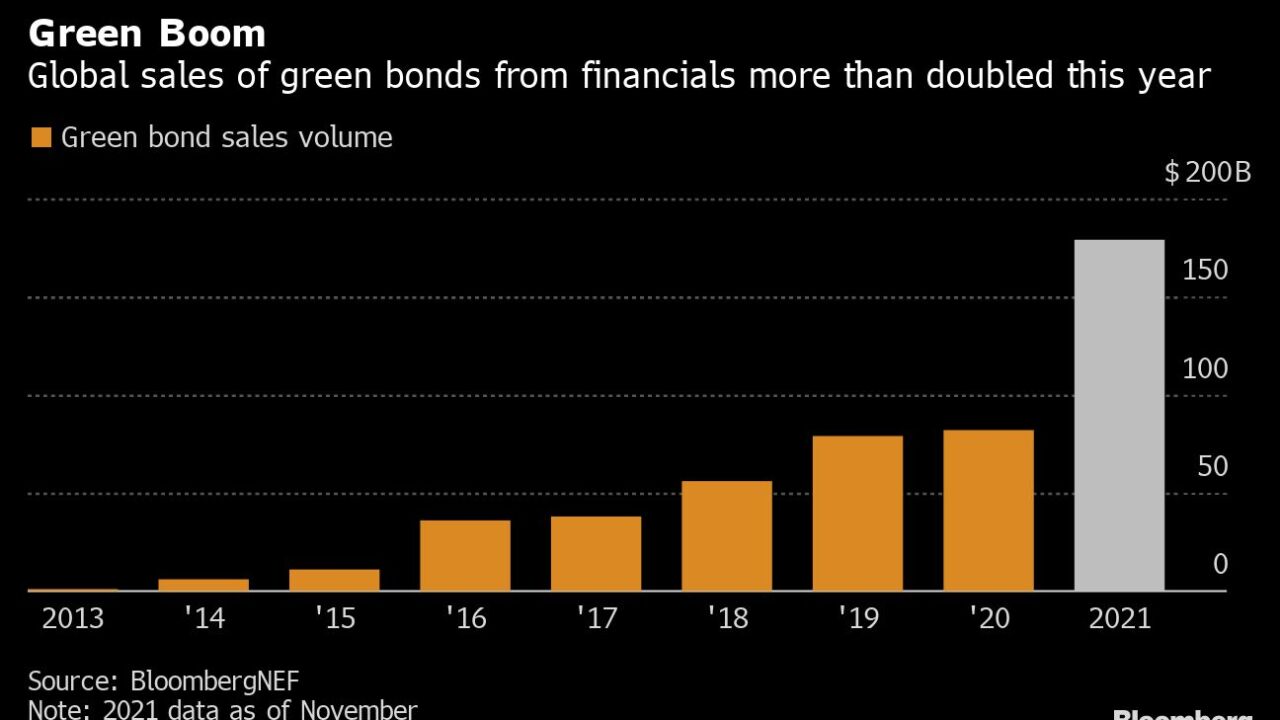

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22 -

Citigroup Global Markets is lead underwriter on the fourth issuance through Toyota’s ABS Green Bond program. The deal references two potential pools to be securitized.

June 4 -

JPMorgan Chase and Loop Capital Markets have submitted pitches suggesting ways to structure $1 billion of bonds that Governor Gavin Newsom proposed to build vehicle charging stations

March 24 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The European Union's first social bond sale, totaling 17 billion euros, was 14 times oversubscribed, meaning the EU could have sold 200 billion euros worth of bonds. That indicates a market that’s structurally underserved.

October 22 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Recent good fortunes for lenders such as Loanpal and Sunnova reflect what will could be a solid year for solar-panel loan originations and securitizations, despite the economic impact of the coraonvirus pandemic on markets and consumer spending.

June 3 -

PACE Funding Group, based in Los Gatos, Calif., recently obtained a $55 million line of credit from SunTrust Bank and Rosemawr Management and is gearing up for its second securitization later this year.

August 21 -

The New York State Energy Research and Development Authority is marketing its fifth transaction financing local residential solar-panel installations; all of the notes carry an A rating from Kroll.

March 6 -

The single-B rated company is facing a large cash requirement as it ramps up production of its Model 3; but leases backed by electric vehicles pose additional risks for investors in asset-backeds.

January 26 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

December 11 -

The new deal is smaller, at $130.1 million, and the collateral is almost entirely of PV systems financed through third-party loan agreements.

December 5 -

The $75 million deal is backed by financing for a variety of property types, including office buildings, manufacturing facilities and hospitals; it was privately placed with TIAA Investments.

September 27 -

Cisco DeVries, the chief executive of Renew Financial, said the bills will bring much-needed stability to Property Assessed Clean Energy, which uses a property assessment to finance upgrades.

September 18 -

It's the sponsor's first securitization to be rated by Morningstar; DBRS and Kroll Bond Rating Agency are still capping their ratings of Property Assessed Clean Energy bonds at double-A.

July 25 -

The director of the Hawaii Green Infrastructure Authority is trying to put its bond money to work.

June 7