(Bloomberg) --The green debt market is growing at a faster pace than the real-world projects it was created to support, thanks to some financial engineering.

While no official estimate exists for the difference between green finance and actual green business, a growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

“Financial institutions can paint a picture of themselves which makes their contribution to the climate transition more meaningful than it actually is,” said Stanisław Stefaniak, a sustainable finance researcher at the Warsaw-based think-tank Instrat.

The concern centers on the reselling of green loans, whereby the finance industry’s contribution to an underlying project gets counted as often as the original debt is refinanced. After issuing green loans, bankers can bundle them into a green bond that can then be sold on to another financial institution. Both can claim they are financing the climate transition.

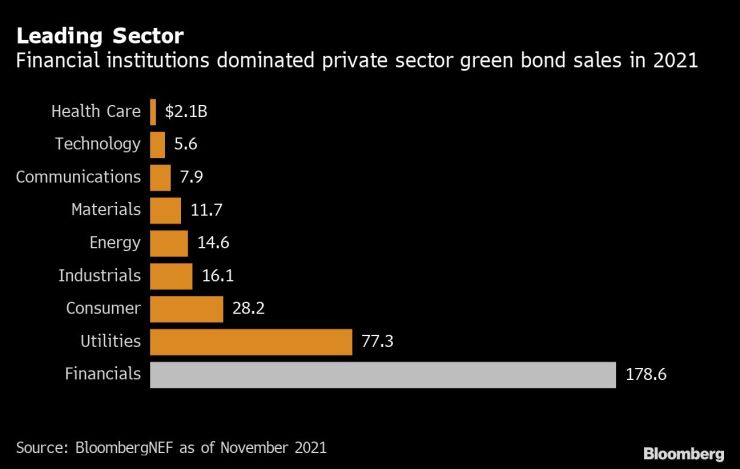

The accounting conundrum means the amount of green financial assets on banks’ and asset managers’ balance sheets outstrips real-world green capital expenditures. This year, financial institutions printed a record $180 billion in green bonds, more than any other private sector.

“It is difficult to put a number on the level of double counting that will happen due to the private nature of the loan market,” said Maia Godemer, a sustainable finance analyst at BloombergNEF. The “caveat,” however, is that we risk ending up with a “brighter picture about the actual decarbonization that is enabled by credit institutions,” she said.

The repackaging and restructuring of debt is a well-established and fully legal form of financial engineering. Though there are examples to show that such models can backfire if applied without restraint -- the subprime mortgage meltdown being a case in point -- rebundling debt can also add liquidity and bring more stakeholders into a market to help it grow.

Since banks are under pressure from regulators, particularly in Europe, to make their lending greener, this kind of refinancing serves them well. But the disconnect from actual green business may complicate efforts to track their contribution to the urgent decarbonization needed to avoid a climate catastrophe.

“If the bank has a legitimate exposure that it is able to report but then sells or repackages the loan, there is a risk that the purchaser getting the credit could be viewed as benefitting from financial engineering as opposed to representing the sustainable money going into the real economy,” said Tim Conduit, a partner at Allen & Overy. “It is a question of how the different green exposures are reported.”

Policy makers are starting to counter this potential for greenwashing in the debt market. Proposed amendments to the European Union’s green bond standard include a clause that would prevent “the creation of green bonds out of thin air” by continuous refinancing, according to Paul Tang, a lawmaker responsible for guiding the legislation through the European Parliament.

Wes Bricker, who co-leads PwC LLP’s trust solutions practice, says that if the EU’s goal is to use the green asset ratio reported by banks “to identify the volume of investment into green projects so that policy makers and society can understand if we are transitioning at a sufficiently rapid pace, we can get an inaccurate signal by inflating.”

“It depends on what we want from that number, who is using it and for what purpose,” Bricker said.

Even established asset classes such as green bonds have a questionable climate impact. They often provide money to refinance completed green projects and the label doesn’t oblige the issuer to use the freed-up capital on another green project. And this year saw the emergence of green derivatives and repos, which regulators have warned may be prone to greenwashing as they race to design a rulebook for such products.

The EU’s regulatory packages are global in scope, and affect non-EU firms if they target clients in the bloc. The idea is to steer capital away from activities that hurt the planet and into projects that protect the environment and social justice.

Frédéric Hache, who heads the Brussels-based Green Finance Observatory, says European policy makers should be guided by the vision articulated during the climate summit in Scotland last month. He proposes that any bank refinancing its green loan book via green securities not count the loans toward its green asset ratio.

“COP26 has recently highlighted the crucial importance of avoiding the double counting of carbon credits for environmental integrity and credibility purposes,” he said. “The same applies to green claims.”

(Adds quote from Allen and Overy in 9th paragraph.)

--With assistance from John Ainger.

© 2021 Bloomberg L.P.