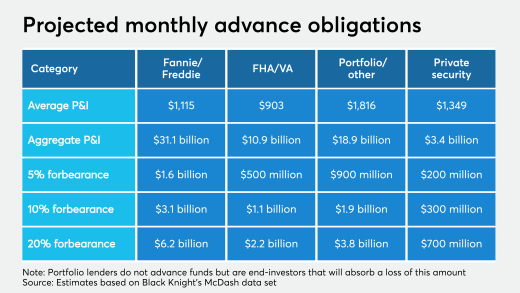

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

Lenders must balance the financial risk of extending credit without explicit backing from the Small Business Administration against the reputational risk of delaying aid for needy borrowers.

The central bank is creating a facility to provide financing to banks participating in the Small Business Administration’s Paycheck Protection Program.

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

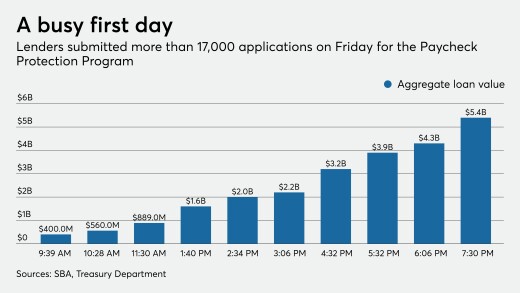

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

Nonbank financial firms spent years lobbying against tougher regulation and stricter capital requirements, arguing they didn't pose a risk to the financial system. Now, many of those companies say they are in desperate need of a bailout.

ABS participants saw markets freeze and were bracing for worse when federal aid provide a short-term respite. The question now: How much trust can anyone put in the medium-term and beyond?

-

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

April 6 -

Lenders must balance the financial risk of extending credit without explicit backing from the Small Business Administration against the reputational risk of delaying aid for needy borrowers.

April 6 -

The central bank is creating a facility to provide financing to banks participating in the Small Business Administration’s Paycheck Protection Program.

April 6 -

Ginnie Mae and the FHA provided temporary liquidity relief for mortgage servicers bracing for higher delinquencies, but the industry continues to pressure Treasury and the Fed to provide more comprehensive support.

April 6 -

Sen. Marco Rubio, R-Fla., said that $349 billion will likely not be enough meet loan demand from small businesses seeking a lifeline to help them weather the economic downturn brought on by the coronavirus outbreak.

April 5 -

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Nonbank financial firms spent years lobbying against tougher regulation and stricter capital requirements, arguing they didn't pose a risk to the financial system. Now, many of those companies say they are in desperate need of a bailout.

April 3