The coronavirus made it particularly tough for independent contractors and independent business owners to get home mortgages, but there are some signs that market may recover soon.

The company is looking to sell $1.1 billion of junk bonds secured by marquee properties including its State Street store in Chicago. The retailer is also setting up a line of credit worth about $3 billion, backed by its unsold goods

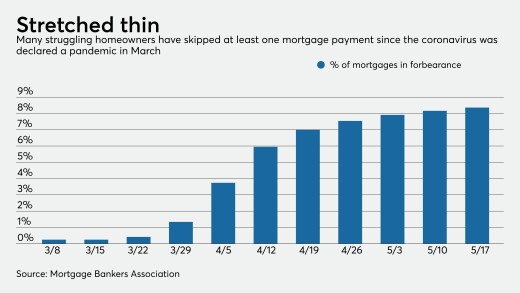

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

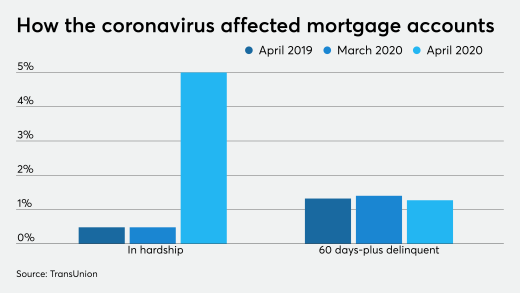

Loans with coronavirus-related forbearance have to be reported as current to the credit bureaus but there’s a ripple effect from them that has implications for credit reports and underwriting.

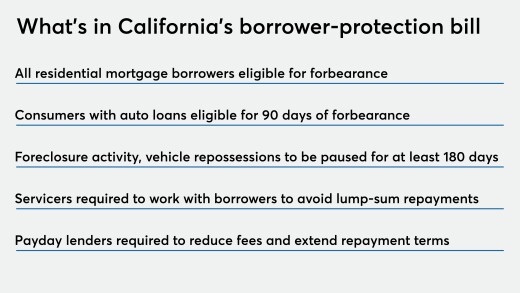

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

Progress Residential is bringing its next securitization of single-family rental properties to market, even as concerns mount on the depth of pandemic-driven tenant forbearance and delinquency trends.

-

The coronavirus made it particularly tough for independent contractors and independent business owners to get home mortgages, but there are some signs that market may recover soon.

May 27 -

The company is looking to sell $1.1 billion of junk bonds secured by marquee properties including its State Street store in Chicago. The retailer is also setting up a line of credit worth about $3 billion, backed by its unsold goods

May 27 -

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

May 26 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

Loans with coronavirus-related forbearance have to be reported as current to the credit bureaus but there’s a ripple effect from them that has implications for credit reports and underwriting.

May 22 -

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

May 21 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21