More than $1 billion in coronavirus relief went to small businesses that received multiple loans and a congressional subcommittee analyzing the Paycheck Protection Program says it has seen evidence of fraud in thousands more loans.

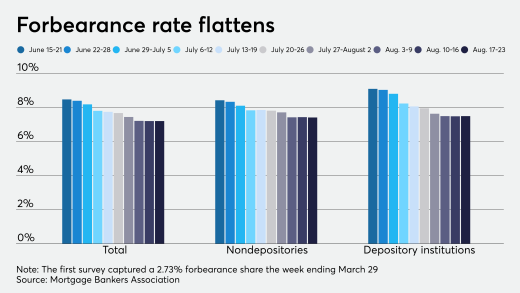

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

Although the 3.41% forbearance rate is down from two prior Navient refi deals, it remains far above what has been the low historical payment deferral and workout rate for its refinancing program for advanced-degree professionals.

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

While cutting losers to buy winners is an age-old investment proposition, the Covid-19 pandemic may create even more openings than the past crises that became bonanzas for real estate investors.

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

-

More than $1 billion in coronavirus relief went to small businesses that received multiple loans and a congressional subcommittee analyzing the Paycheck Protection Program says it has seen evidence of fraud in thousands more loans.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Although the 3.41% forbearance rate is down from two prior Navient refi deals, it remains far above what has been the low historical payment deferral and workout rate for its refinancing program for advanced-degree professionals.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

August 26 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

While cutting losers to buy winners is an age-old investment proposition, the Covid-19 pandemic may create even more openings than the past crises that became bonanzas for real estate investors.

August 24