Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

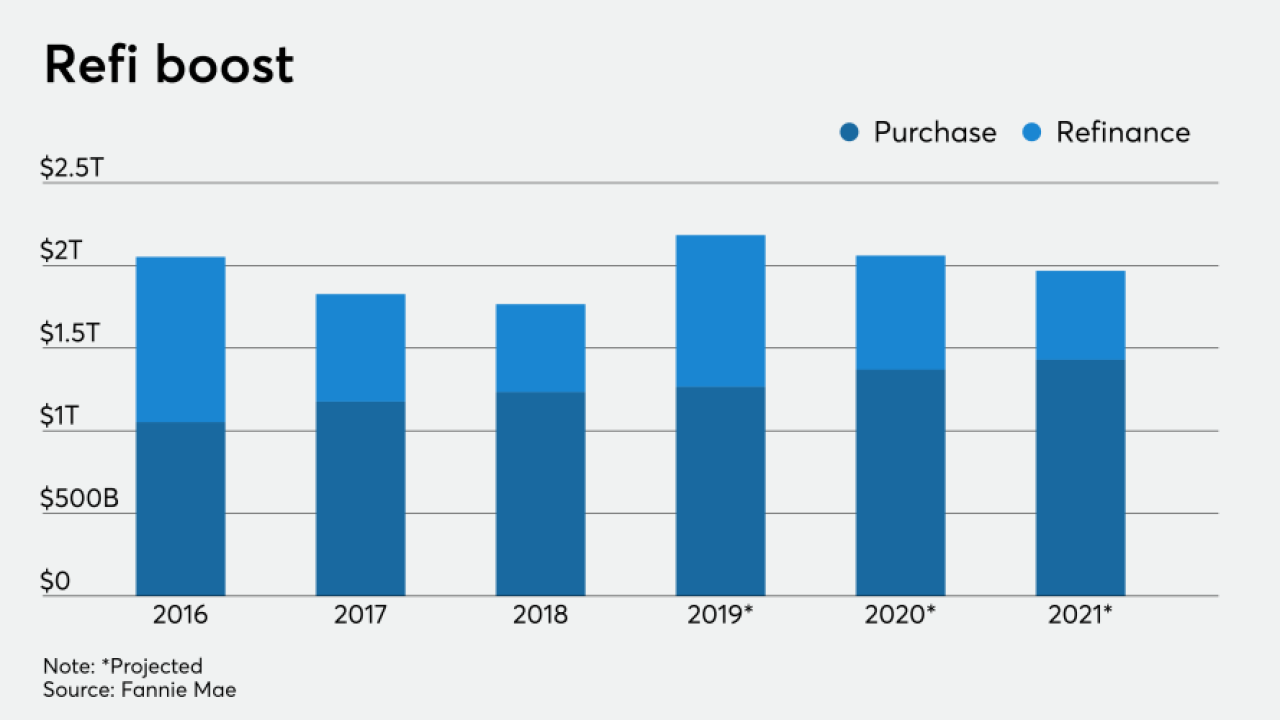

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

Getting Fannie Mae and Freddie Mac out of conservatorship has been an elusive goal. It will remain elusive, says DeMarco, in the absence of broader reform of housing finance, something that will require bipartisan support.

January 8 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 19 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

A swell of refinance demand amid a low mortgage rate environment pushed lender profit margin outlooks to the highest level since the first quarter of 2015, according to Fannie Mae.

September 11 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

Foreclosure activity fell 21% in July compared to a year ago and rose 6% from June after twelve consecutive months of declines, according to Attom Data Solutions.

August 26 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

The refinance share of mortgage applications climbed to the highest level since January 2018 as the average 30-year fixed interest rate continued tumbling, according to the Mortgage Bankers Association.

June 26 - LIBOR

Commercial and multifamily mortgage lenders need to figure out their plan for replacing the London interbank offered rate index potentially expiring at the end of 2021.

June 4 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

Commercial and multifamily mortgage debt outstanding grew 6.8% in 2018, benefiting from strong employment numbers and strained inventory, according to the Mortgage Bankers Association.

March 14 -

Despite a lower rate of increase, 2019 equity gains could pull 350,000 households from being underwater on mortgages, according to CoreLogic.

March 7 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28