Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

"The big takeaway is there's a lot of good quality reform having been done in conservatorship," Don Layton, Freddie Mac's CEO, said in an interview. "That's one item the GSEs in conservatorship have been focused on, the underlying guarantee business. That means spending money on developing new ways of managing risk and new ways of making it cheaper, faster and easier for our lender customers and, through them, the borrowers. That's what businesses do. We're focused on the nature of the conservatorship. We're not focused on downtown Washington."

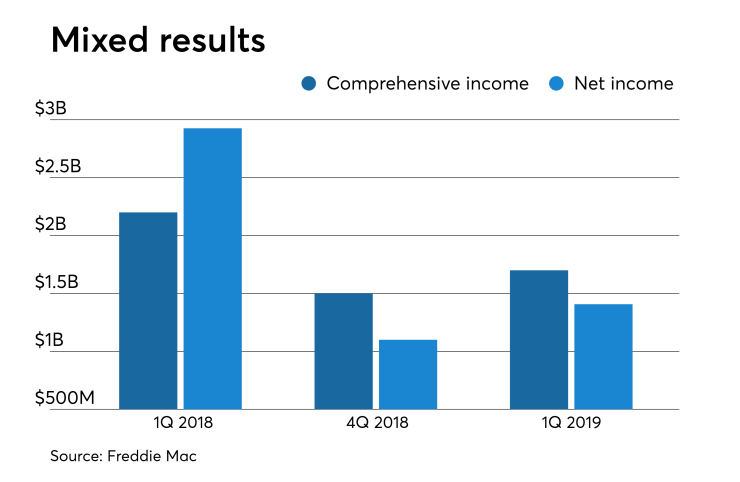

Freddie generated $1.4 billion in net profit in the opening quarter of 2019, down from $2.9 billion

"Our guarantee book of business over the prior year grew 5%, demonstrating our heightened competitiveness, and credit quality remains strong," Layton said in a press release. "We also delivered on our mission, making homes possible for nearly 450,000 families. These results demonstrate how the transformed Freddie Mac today is a well-run financial institution that produces solid earnings, serves its customers, protects taxpayers and fulfills its mission."

Layton stayed mum on updating how implementation of the

However, the government-sponsored enterprise has continued to examine what its financials might look if measured by metrics that investors could use to assess the government-sponsored enterprises if they were ever privatized.

Conservatorship capital at Freddie Mac declined by $6.1 billion, or 10%, from the prior year, due to credit risk transfer activity, home price appreciation and legacy asset dispositions, according to the GSE's earnings release. Its return on modeled capital, as calculated under the Conservatorship Capital Framework for the quarter, was 12.7%. It was 10.9% the previous quarter. Freddie Mac introduced the measure in the second quarter of last year.

After seven years as CEO, this earnings call was Layton's swan song.

"I'm not going to work full-time. I will do a portfolio of activities," Layton said, commenting on his future plans in an interview. He noted he will be a part-time writer and a fellow at a think tank focusing on housing finance.

"It's been a good seven years, I'm glad I was here," he said. "The conservatorship over those years was a major engine of reform. I'll leave it to David and others to keep carrying the flag."