Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations, according to Freddie Mac and Ten-X.

Multifamily origination volume is expected to grow to $336 billion — an annual rise of 8% after a

"A strong labor market and a persistent housing shortage have continued to fuel a robust rental market," Steve Guggenmos, multifamily research and modeling team leader at Freddie Mac, said in a press release. "As of June, multifamily completions outpaced the prior two years, but demand remains high in the majority of markets allowing them to absorb most of the new supply."

"These strong fundamentals and lower than anticipated interest rates have supported growth in multifamily originations, which are forecasted to grow to $336 billion in 2019," Guggenmos continued. "Millennials' difficulties with becoming homeowners — particularly around

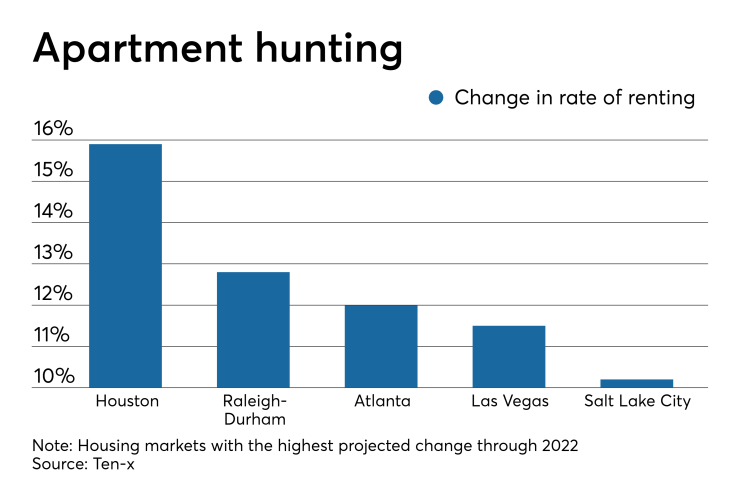

"It is unsurprising that the multifamily sector is continuing to thrive through the first half of 2019," Peter Muoio, Ten-X chief economist, said in a separate press release. "With the economy continuing to grow and the labor market very healthy, the ingredients remain in place for steady household formations and apartment demand. We continue to expect that millennials will migrate out of their family homes to rent apartments and eventually single family homes of their own."

Currently, about 32% of millennials still live at home, compared to an average of 27% in previous cycles.