A trade group for participants in the clean energy loan program argues the upcoming regulations will be too burdensome and costly for participants.

-

Lawmakers urged the Fed to retain the current weighting of the p-factor in the context of securitizations, over a level that the industry believes is far more punitive.

November 6 -

AMDR 2025-1 is the inaugural securitization for Americor, an Irvine, Calif.-based which offers debt resolution services, personal loans, debt resolution loans, mortgages and home equity lines of credit.

November 6 -

Michael Barr said he believes artificial intelligence will have a positive long-term impact on the economy, though it may cause job losses in the short term.

November 6 -

The Federal Reserve Board finalized changes to its supervisory rating framework, allowing large bank holding companies to be considered "well managed," even with one deficient rating.

November 6 -

Previously, Kim was a managing director in J.P. Morgan Chase & Co.'s strategic investments group, where she managed a diverse portfolio of fintech investments.

November 5

-

Despite record loan applications, Upstart's AI pulled back, causing a revenue miss and raising "incremental uncertainty" about its core underwriting model.

November 5 -

The issuance can be expanded to $1.2 billion, with virtually the same capital structure characteristics.

November 5 -

LADAR 2025-3's loss levels are notably lower than the rating agency's assumptions on the LADAR 2025-1 because the sponsor excluded borrowers with credit scores lower than 701 from the collateral pool.

November 4 -

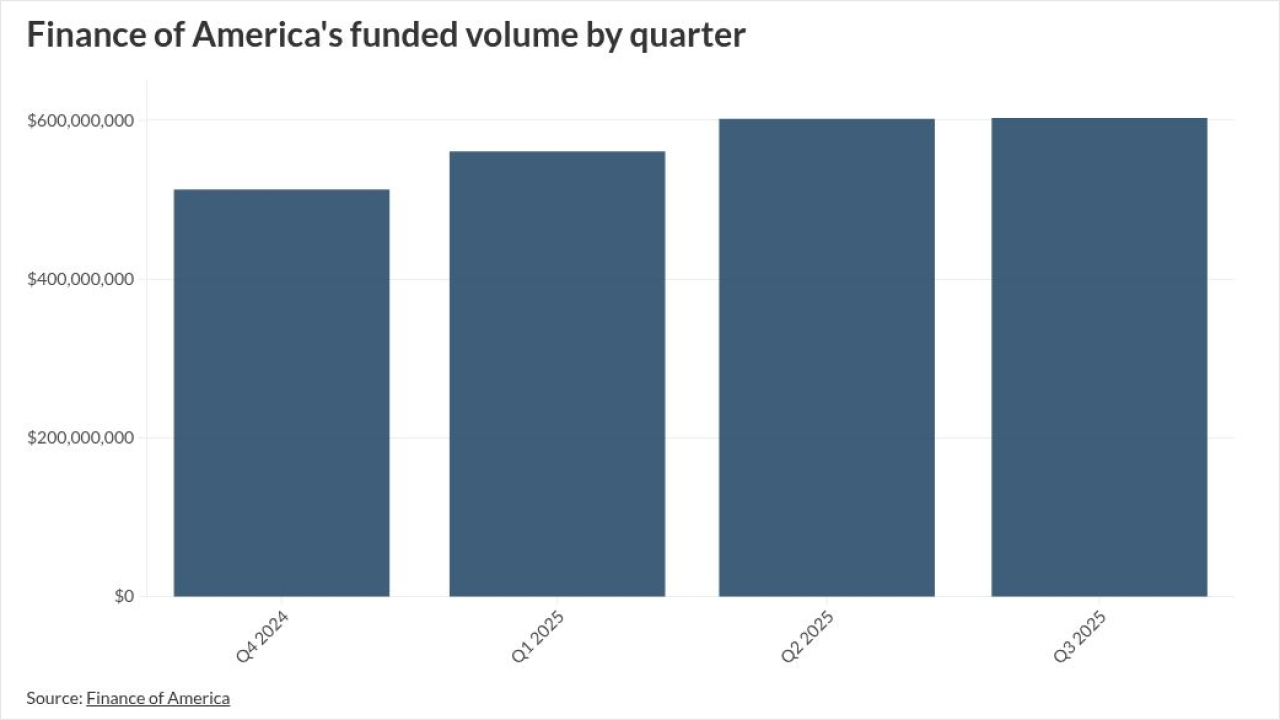

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

WFLOOR 2025-1's annualized monthly yield, which averaged 20% since 2018, has been consistently higher than most other dealer floorplan trusts that Moody's rates.

November 4 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

The buy now/pay later firm, which reports earnings Thursday, has inked deals with Worldpay to expand potential borrowers and with New York Life to obtain more capital for future lending.

November 3