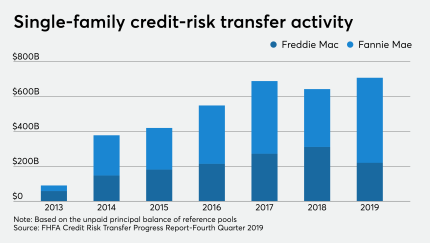

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

-

A new report on bank-held commercial real estate and C&I loans indicates troubled borrowers may be skipping payments on loans they won't be able to refinance or extend over the next year, leading to a potential wave of defaults over the next four to six quarters.

September 15 -

Electronic notes did come in handy this year given the mortgage industry's need to operate remotely, but they also increase the government-sponsored enterprises' responsibility for monitoring the risk of multiple counterparties.

September 15 -

COVID-19 and the inclusion of secondary tier loans for borrowers with lower FICOs is prompting Kroll to project credit losses nearly a third higher than the authority's 2018 solar-loan bond series.

September 15 -

The government-sponsored enterprise’s seller/servicer guide is now integrated into the online portal. Freddie also improved the readability of loan-level reporting it provides, and has further changes in the works.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15

-

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

Liberty Lending, Upstart Network and Regional Management Corp. are looking to price bonds backed by pools of unsecured consumer loans, amid market worries about the sectors' potential challenges during the COVID-19 outbreak.

September 14 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

More consumer and commercial borrowers are paying their loans, increasing the likelihood that charge-offs will be manageable for banks despite the ongoing pandemic.

September 11 -

The financial industry has praised the measured approach taken in a pending regulation on permitted communications with consumers. But two recent complaints by the bureau against debt collectors reflect a potentially aggressive enforcement stance.

September 11