The Federal Housing Administration on Thursday laid out guidelines for how previous forbearance — including forbearance granted due to coronavirus-related hardships — impacts borrowers' eligibility for new single-family mortgages.

The guidelines are similar to those

The FHA may allow borrowers who have been granted and exited forbearance previously to obtain cash-out refinances, but not until they have made at least 12 consecutive months of on-time monthly payments.

Mortgage borrowers who were previously in forbearance must make at least three months of consecutive, on-time payments before they may be eligible for a new purchase loan or a rate-and-term refi insured by the FHA.

Homeowners who have exited forbearance may be eligible for a credit qualifying streamline refinance after making at least two payments.

However, if borrowers have an FHA loan that has been modified, they may only be eligible for the streamline refi after making six payments under the terms of their modifications.

If borrowers were granted forbearance but continued to make regular payments, they may be able to get a new loan.

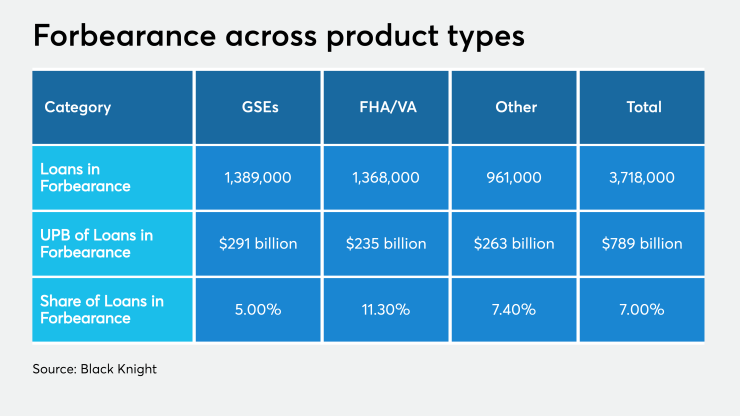

The share of government-insured loans with extended forbearance under the terms of the coronavirus rescue package passed earlier this year is relatively high at more than 11%, but overall forbearance rates have been falling, according to Black Knight.

GSE loans, in comparison, have a 5% forbearance rate, and the overall share of loans in forbearance is 7%.

Under the terms of the CARES Act, borrowers with government-related loans received the right to request and receive forbearance if they had coronavirus-related hardships for six months. They may also request a single six-month extension.

More than 2 million forbearance plans are set to expire in September. In total, more than 3.7 million borrowers are in forbearance. That number represents a more than 22% decline from when forbearance peaked at over 4.7 million in late May.