Executives at the Minneapolis bank responded to a research report that highlighted the decline in a key capital ratio after an acquisition last year. They don't plan to raise capital but aim to generate more of it from earnings in coming quarters.

-

The notes will accumulate an overcollateralization level of 11.20% of the current collateral balance and benefit from a cash reserve account equaling approximately 1.25% of the initial collateral balance.

April 21 -

Stronger than expected demand and home prices drove the latest forecast.

April 21 -

Urschel is said to have led the financing for the majority of recent franchised whole business securitizations and several dozen transactions involving cell tower, data center, fiber and other digital infrastructure assets.

April 21 -

When the deal closes, credit enhancement on the class A note will include overcollateralization, which will be 16.3% and is expected to increase to a level of 20% of the current pool balance.

April 20 -

Guidance on the A-1 notes is 38 to 40 basis points over the I-Curve, which is significantly wider than where the class A-1 notes from the 2023-1 deal closed.

April 20

-

The properties have an aggregate critical load power of 65.25 megawatts, and all of the data centers in the portfolio are turnkey, which the rating agency considers positive.

April 19 -

Executives at the Minneapolis bank responded to a research report that highlighted the decline in a key capital ratio after an acquisition last year. They don't plan to raise capital but aim to generate more of it from earnings in coming quarters.

April 19 -

Economic turbulence affected borrowers during the quarter and will likely impact their ability to refinance maturing loans, the Mortgage Bankers Association said.

April 19 -

The deal launched from the Achieve platform, bringing Freedom Consumer Credit Fund's cumulative issuances across its securitization portfolios to $4.8 billion.

April 19 -

The Tennessee bank confirmed in its earnings report that the deal, already delayed by several months amid heightened regulatory scrutiny, likely would not close by a May 27 deadline. No new target date has been set.

April 18 -

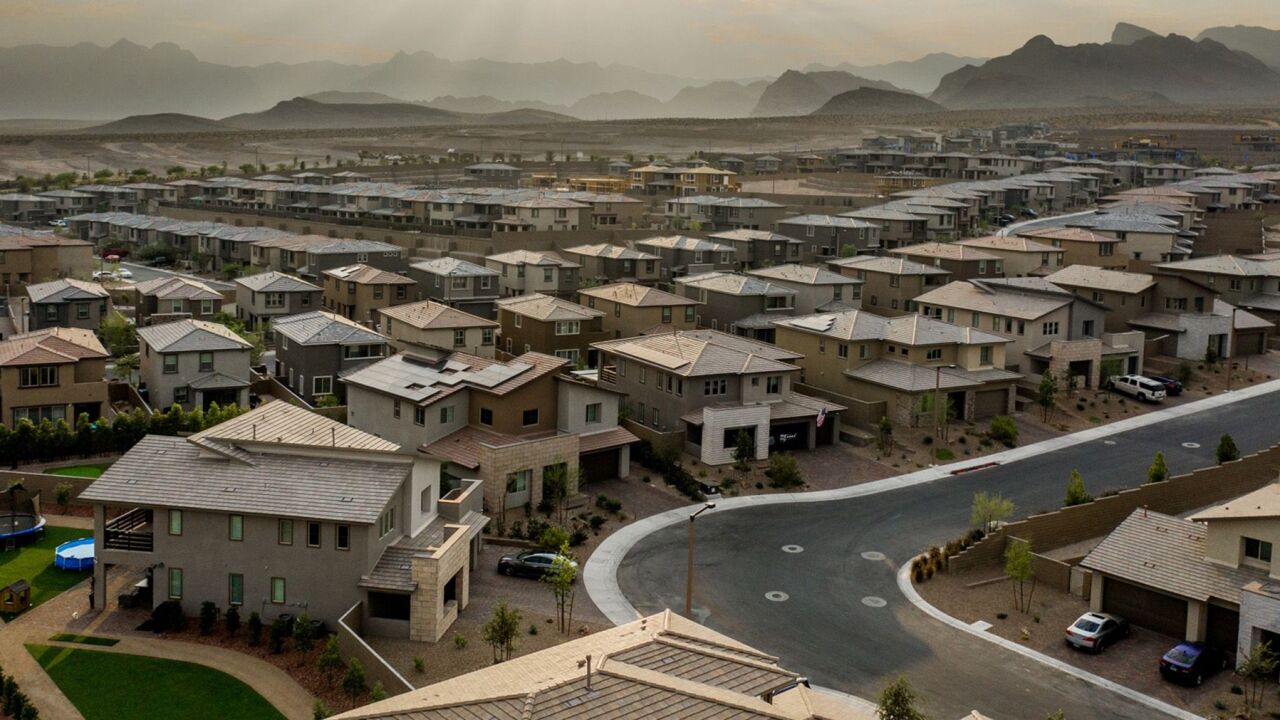

Fannie Mae researchers found housing costs decelerating for the fourth straight quarter, but limited inventory may be driving hopeful buyers to look for opportunities in the new-construction market.

April 18 -

Headcount at the nation's second-largest bank has fallen by around 1,000 since the end of last month. More job reductions are in the works after noninterest expenses rose by 6% during the first quarter.

April 18