Commercial and multifamily mortgage delinquencies rose in the first quarter compared with the prior three month period, a result of

While the sectors with the highest late payment rates remain the pandemic-affected retail and hotel industries, all other categories — particularly office and multifamily — posted gains.

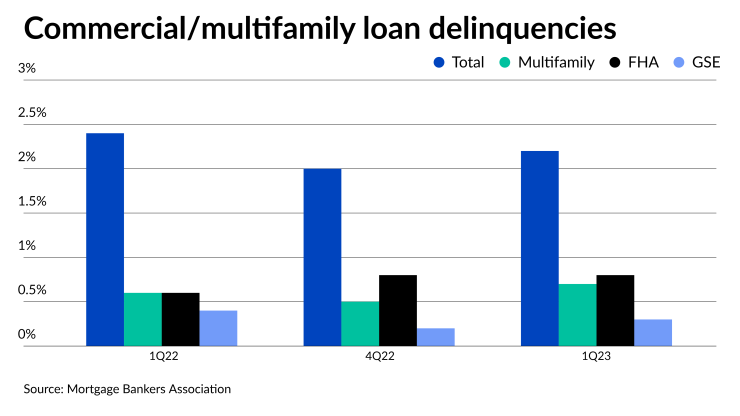

The first quarter total delinquency rate of 2.2% was up from 2% in the fourth quarter, driven by a 110 basis point rise in office property owners missing payments, to 2.7% from 1.6%. One year ago, the total delinquency rate was 2.4%.

For the period, the rate of multifamily property balances late on their loan was 0.7%, compared with 0.5% three months prior and 0.6% in the first quarter of 2022.

"

In February, the MBA predicted

However, the current rate environment, along with the uncertainty created by the failures of Silicon Valley Bank and Signature Bank, have some observers concerned that property owners might not be able to refinance because of declining property values. Comparisons are being made

Updated data from the MBA released last week put 2022 commercial and multifamily volume at $816 billion, the second best year ever, but down from $890 billion in 2021. Multifamily originations made up $437 billion of last year's total.

Delinquency rates for loans backed by Fannie Mae and Freddie Mac increased to 0.3% from 0.2% in the fourth quarter, while Federal Housing Administration-insured multifamily and health care mortgages were unchanged at 0.8%. The non-current rate in the first quarter of 2022 was 0.4% for government-sponsored enterprise loans and 0.6% for FHA.

Loans that are 90 days or more late or are now real estate owned had the highest share of total delinquencies at 1.7%, up from 1.6% in the fourth quarter.

The rate for the 60-to-90 day delinquent category also rose, to 0.2% from 0.1%, while for 30-to-60 it was unchanged at 0.3%.

This quarter's data was generated from the MBA's commercial real estate finance Loan Performance Survey for March 31. Participants reported on $2.7 trillion of mortgages, which more than half of the $4.5 billion of combined commercial and multifamily debt outstanding.