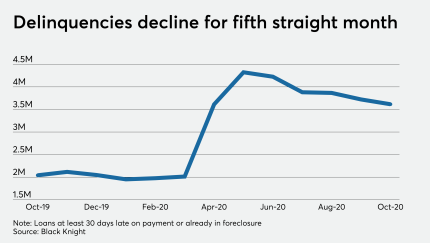

Mortgage delinquencies dropped to the lowest level since March but, particularly at the seriously delinquent level, they're still much higher than pre-coronavirus rates, according to Black Knight.

-

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

HomeEquity will sell an as-yet undetermined volume of notes to finance forthcoming originations by the bank sponsored by Birch Hill Equity Partners Management.

December 8 -

The three companies agreed to pay a total of $74 million in remediation.

December 7 -

On the same day that Mr. Cooper announced a settlement with state and federal authorities over its servicing practices, the Dallas company, U.S. Bank and PNC reached separate agreements with DOJ regarding bankrupt borrowers.

December 7 -

The single-family, duplex and multi-unit condo properties have an average age of 60 years, more than double the age of other rated SFR securitizations.

December 7

-

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

The third-quarter forbearance rate of the refinanced private student loans fell to 2.58% from the 8.36% average during the second quarter of the year – which is an approximate 70% decline.

December 4 -

Deals, trends and research in structured finance and asset-backed securities for the week of Nov. 28-Dec. 3

December 4 -

Adolfo Marzol came to the agency after a stint at HUD and a 30-year career in the mortgage industry. He will depart on Dec. 18.

December 4 -

The end date for the Paycheck Protection Program Loan Facility was moved from Dec. 31 to March 31, giving lenders more time to line up the liquidity needed to buy and sell portfolios.

December 4 -

Fannie hasn't completed any credit risk transfers to private investors since the second quarter. Some experts worry the decision — likely spurred by the company’s concerns about a recent capital regulation — could put the mortgage giant on unsteady footing.

December 3 -

The transaction involving 345 high-balance mortgages is just the third sponsored by Morgan Stanley's mortgage acquisition and trading arm since the financial crisis more than a decade ago.

December 3