Navistar Financial, a subsidiary of the truck and engine manufacturer, is marketing a new $300 million series of notes from its master trust financing the inventory of 187 dealers in its network.

-

The global pandemic and stalled trade negotiations have discouraged farmers and ranchers from taking on more debt and made banks uneasy about extending more credit.

August 4 -

Avis is sponsoring its next $500 million securitization financing its rental fleet amid the continued economic impact of the COVID-19 pandemic on the travel industry.

August 4 -

Besides reauthorizing the Paycheck Protection Program, Congress should upgrade the loan forgiveness process, offer businesses the chance to take out a second loan and ensure the pricing satisfies lenders, bankers say.

August 4 -

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

August 4

-

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

Tesla last week priced its latest auto-lease securitization at signficantly reduced spreads from its last deal—reflecting strong investor demand for TALF-backed securities and an improving outlook for the world's largest battery-electric vehicle (BEV) manufacturer.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

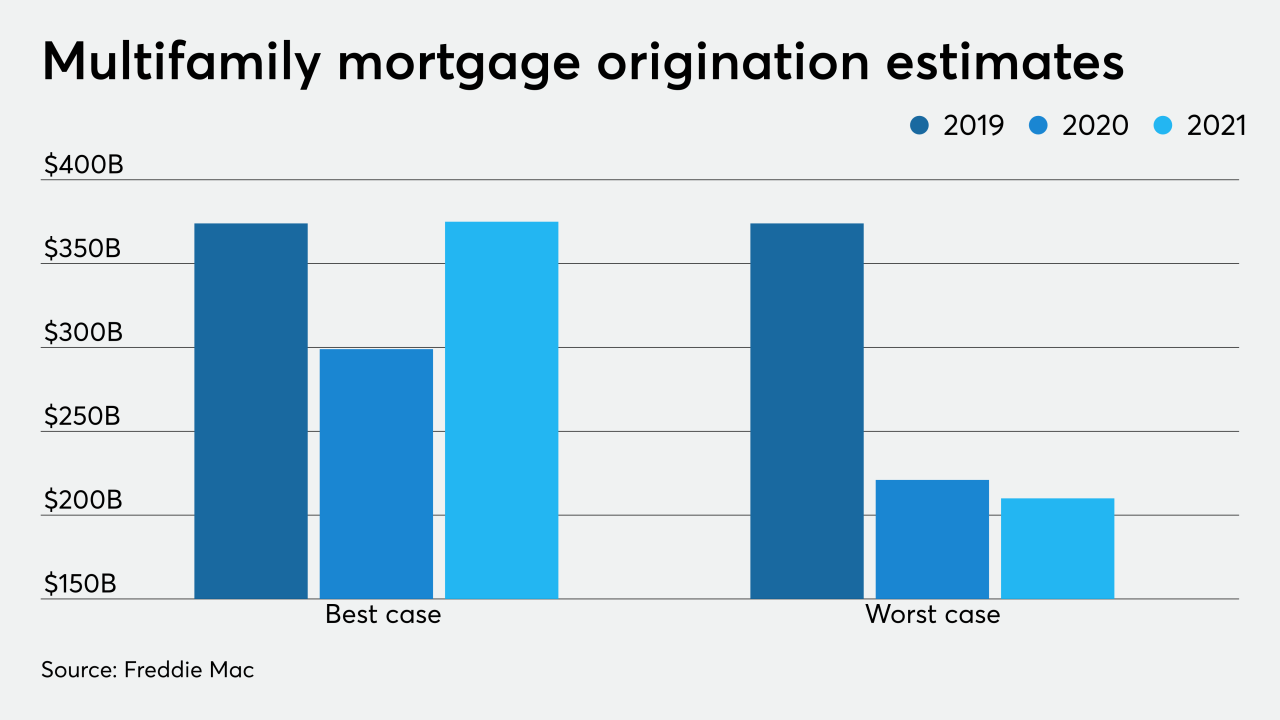

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

August 2 -

The Conference of State Bank Supervisors, banking law scholars and consumer advocacy organizations filed amicus briefs siding with the New York State Department of Financial Services in its court battle with the federal regulator.

July 31 -

In its sixth securitization of 2020, IPFS Corp. is pursuing a $400 million deal backed by a revolving pool of insurance-premium finance loans and secured by the right to receive the unearned premium amounts from the loans.

July 31