The market for mortgage servicing rights is seeing an increase in activity, after coronavirus-related developments virtually froze the market earlier this year.

Incenter Mortgage Advisors is accepting bids on a nearly $6.3 billion offering on behalf of an unnamed seller. Bids must be emailed by noon Mountain time on Tuesday.

The transaction is

The weighted average age of the GSE loans in the MSR portfolio is nearly 11 months. The package contains slightly more Fannie Mae loans than Freddie Mac loans, and the weighted average interest rate is nearly 3.78%.

All the mortgages were current as of June 30 but a little over 1% or 310 of the 27,617 loans in the portfolio had outstanding forbearance requests at that time.

The weighted average FICO score for the package is nearly 763 and the weighted average loan-to-value ratio is almost 74%.

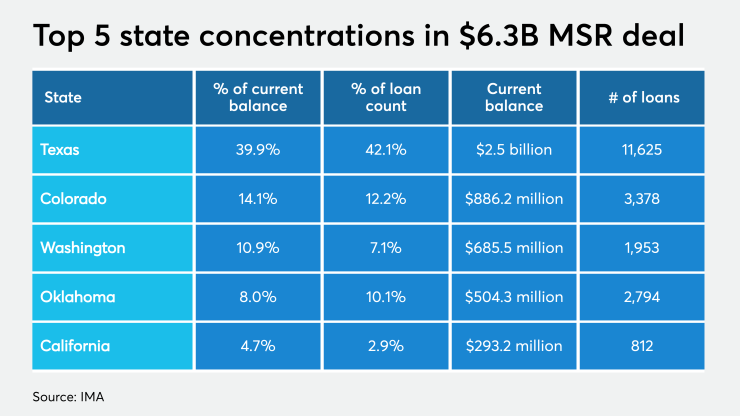

The MSRs have a nearly 40% Texas concentration, based on current loan balance, and a more than 42% concentration in the Lone Star state based on loan count.

The seller would prefer to have the MSRs trade no later than Aug. 31.

That date is the current deadline for some of the GSEs’ temporary coronavirus-related relief measures, including

Other GSE relief measures scheduled to expire on Aug. 31 include a temporary exemption from rules that typically bar mortgage companies from delivering new loans to Fannie and Freddie if borrowers request forbearance after closing. Currently, new loans can still be delivered to the GSEs in this instance if mortgage companies are willing to sell them

The measure that allows the GSEs to purchase these loans previously was scheduled to expire July 31, but the GSEs’ regulator and conservator, the Federal Housing Finance Agency,

While this measure does not directly affect the market for bulk sales of seasoned loans, it can have some bearing on the refinance options available to borrowers with older mortgages.