-

The company dropped the broker channel just months after Frank Martell became CEO; now that Anthony Hsieh is running things again, LoanDepot brought it back.

6h ago -

Other mortgage players this week have distanced themselves from the banking chaos with statements disclosing that they had no relationships with the failed companies.

March 15 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

The non-bank lender's $299.8 million prime, high-balance deal is no surprise; it follows a warehouse securitization last year. Angel Oak is also in the market with a $238.8 million deal.

March 28 -

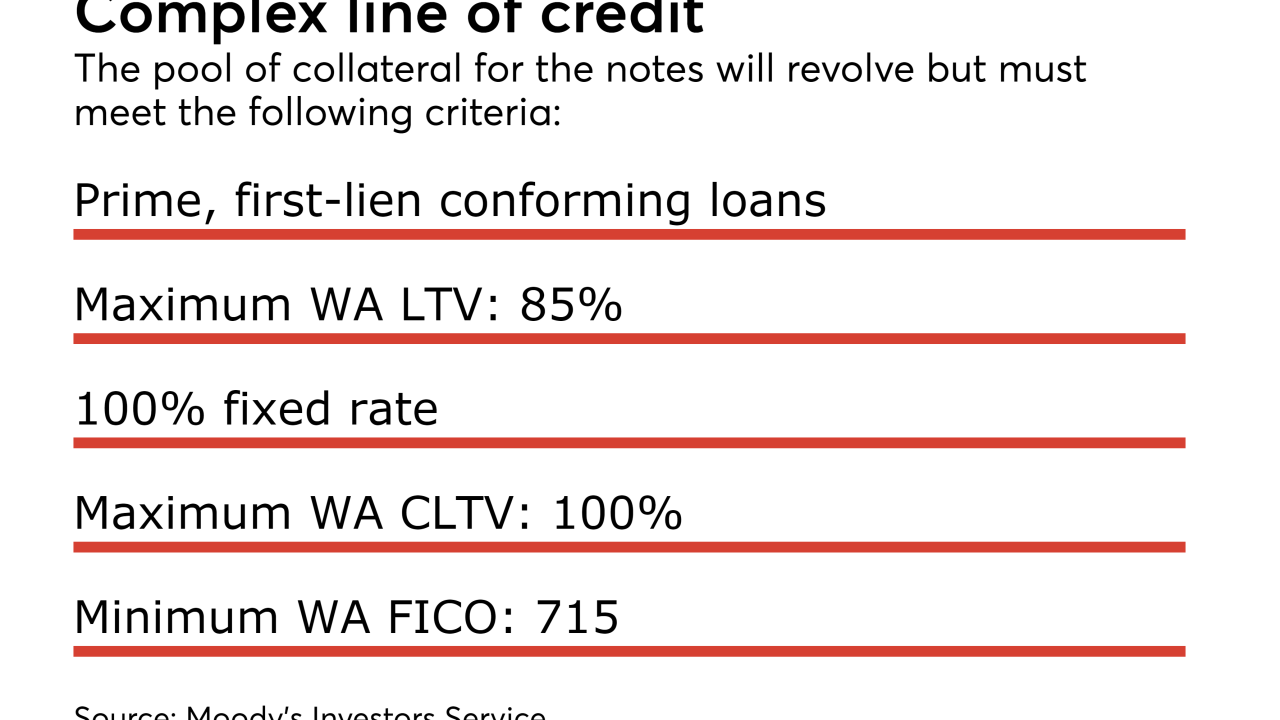

The deal is similar to several sponsored by Jefferies that used the same moniker, Station Place, but were backed by revolving pools of mortgages originated by multiple lenders.

November 30