The 20 whole loans in the transaction are secured by Bridge's weakest-rated collateral pool to date, compared to three prior Bridge REIT deals.

-

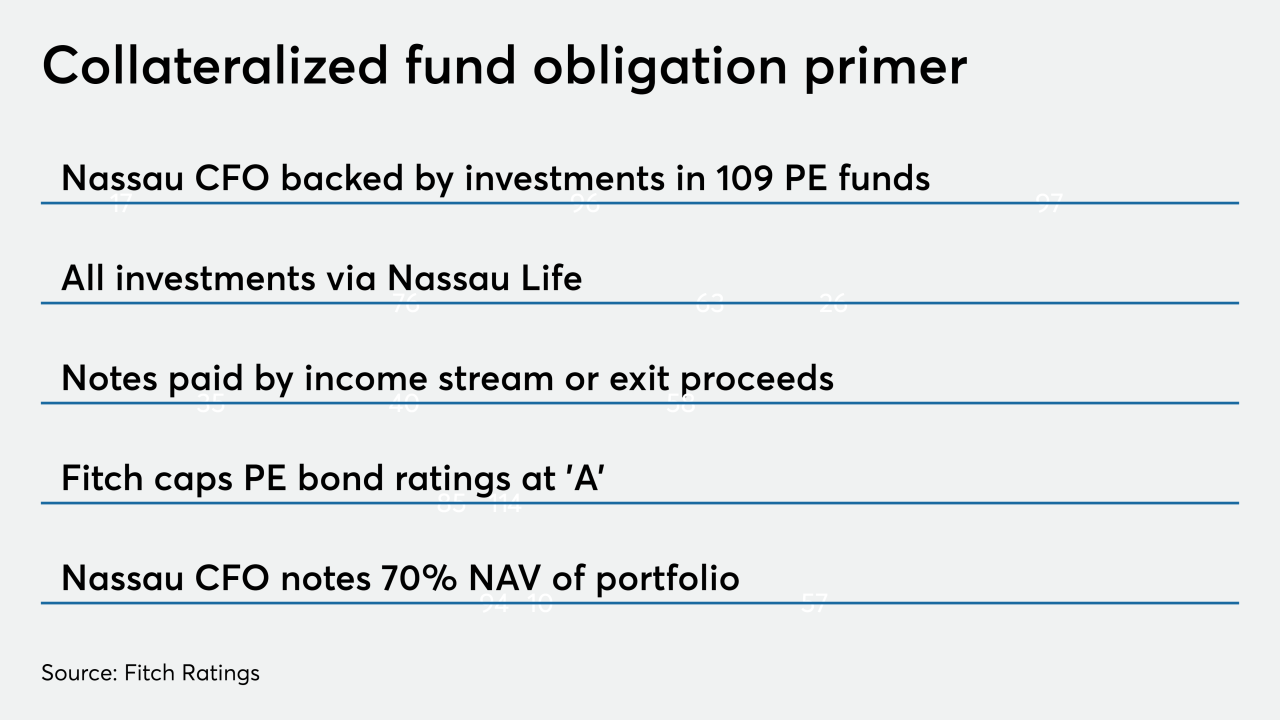

Nassau Financial Group is following the lead of a Singapore sovereign wealth fund into the fledgling asset-backed securities class of private-equity bonds.

August 12 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

The loans in the deal are for timeshares in the 52-story Elara condo and hotel tower managed by Hilton Resorts Corp.

August 11 -

Apple's new credit card isn't just another virtual card in its virtual wallet. It borrows a lot of features from the most successful brands in payments and technology.

August 8 -

Lighter seasoning compared to American Credit Acceptance's last loan portfolio issuance is the primary reason, say ratings agencies.

August 8

-

Regional Toyota captive finance lender World Omni has its highest-ever average FICO for a securitization of prime auto-lease receivables. But it also is pooling a portfolio of contracts that have a highly concentrated mix of lease maturities.

August 8 -

Fresh data from the Fed, FDIC and Bank of England shows that, directly or indirectly, banks are taking on more leveraged loans. But whether this puts their loan and securities portfolios at risk remains open for debate.

August 8 -

The potential for negative long-term mortgage rates is surfacing around the world, and with global tensions building in the U.S. market, there's a small but growing chance it could happen here, too.

August 8 -

Newly promoted partner Timothy Milton is co-portfolio manager for the Vibrant CLO platform, while veteran portfolio manager Eduardo Cabral joins as managing director.

August 7 -

The online SME lender is marketing $198.45 million in notes backed by U.S. originations. Funding Circle has previously issued ABS deals backed by small-business loans in its native UK.

August 7 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6