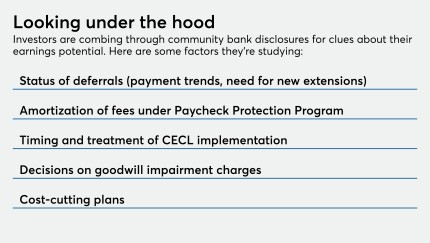

Community bank earnings are usually easy to understand, but loan deferrals and modifications as well as the complexities of the Paycheck Protection Program are skewing financial statements.

-

Citigroup’s $900 million payment blunder in a normally low-profile part of the financial market dominated by a handful of banks has experts wondering if regulators will uncover a deeper problem.

August 25 -

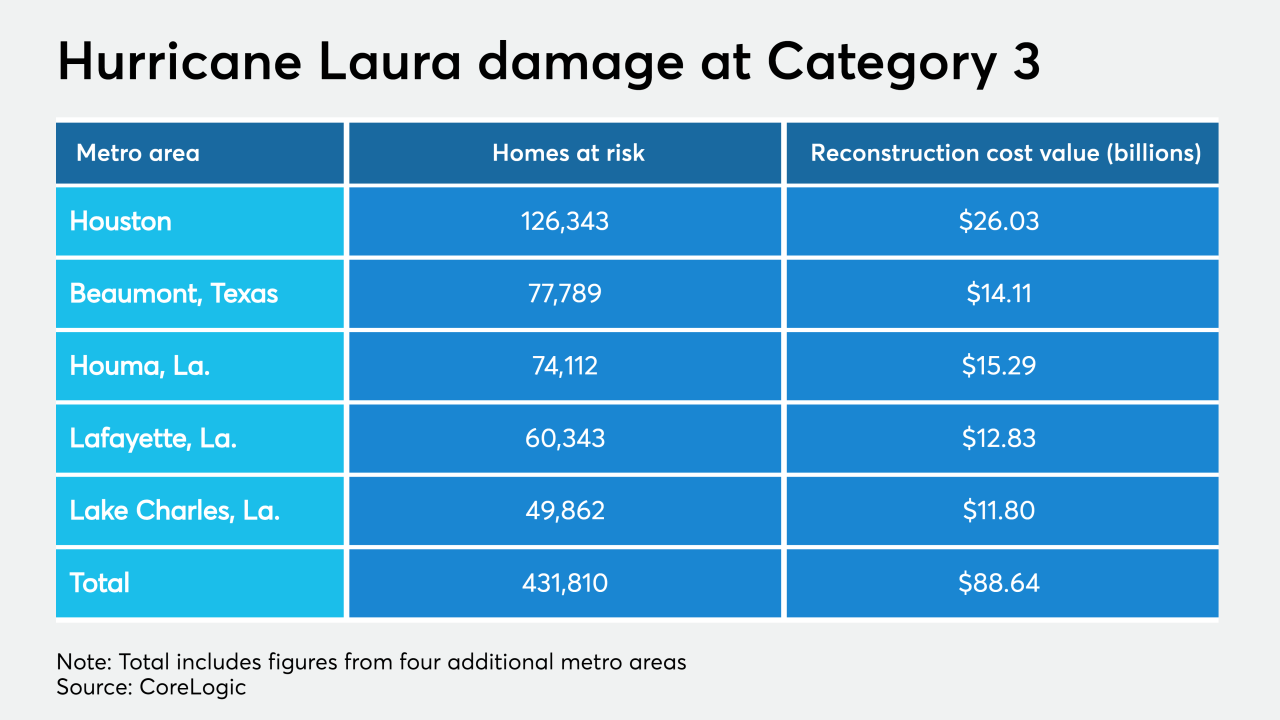

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

The $300 million transaction would be the fourth deal to price since early August, following more than a year's absence of activity in global shipping container securitizations.

August 25 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25

-

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

The transaction is the first in two years for MidCap, which provides startup and expansion financing for biosciences/healthcare and technology firms backed by VC and private equity.

August 24 -

Stack Infrastructure has raised nearly $1.4B in the ABS market since last year to construct and manage build-to-suit "hyperscale" data centers, reportedly for tech giants like Amazon, Apple, Google and Microsoft.

August 23 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

JPMorgan Chase, which has an $18.4B prime auto-loan portfolio, has not ventured into the securitization market with publicly rated auto-loan collateral since 2006, according to ratings agency reports.

August 20 -

Positive payment behaviors in conjunction with CARES Act measures kept mortgage delinquencies from rising, but the number of borrowers facing hardship grew exponentially from last year, according to TransUnion.

August 20