Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

-

Trinity’s railcar collateral qualifies as an eligible green asset, since freight transportation serves as a lower carbon-emissions alternative to big-rig trucking for land-based goods transport.

May 20 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Carvana Auto Receivables Trust 2021-N2 is the used-car retailer's ninth securitization since 2019, and the third to include a pool exclusively made of non-prime loans.

May 19 -

During a House Financial Services Committee hearing, Democrats largely praised the policy decisions of acting regulators named by the Biden administration and knocked their predecessors. But Republicans warned that moves to reverse Trump-era policies would leave financial institutions without a clear road map.

May 19 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19

-

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

The $1 billion bond, which follows similar issuances by Citigroup, JPMorgan Chase, Bank of America and Truist Financial, gives a big role to broker-dealers owned by minorities, women and disabled veterans.

May 19 -

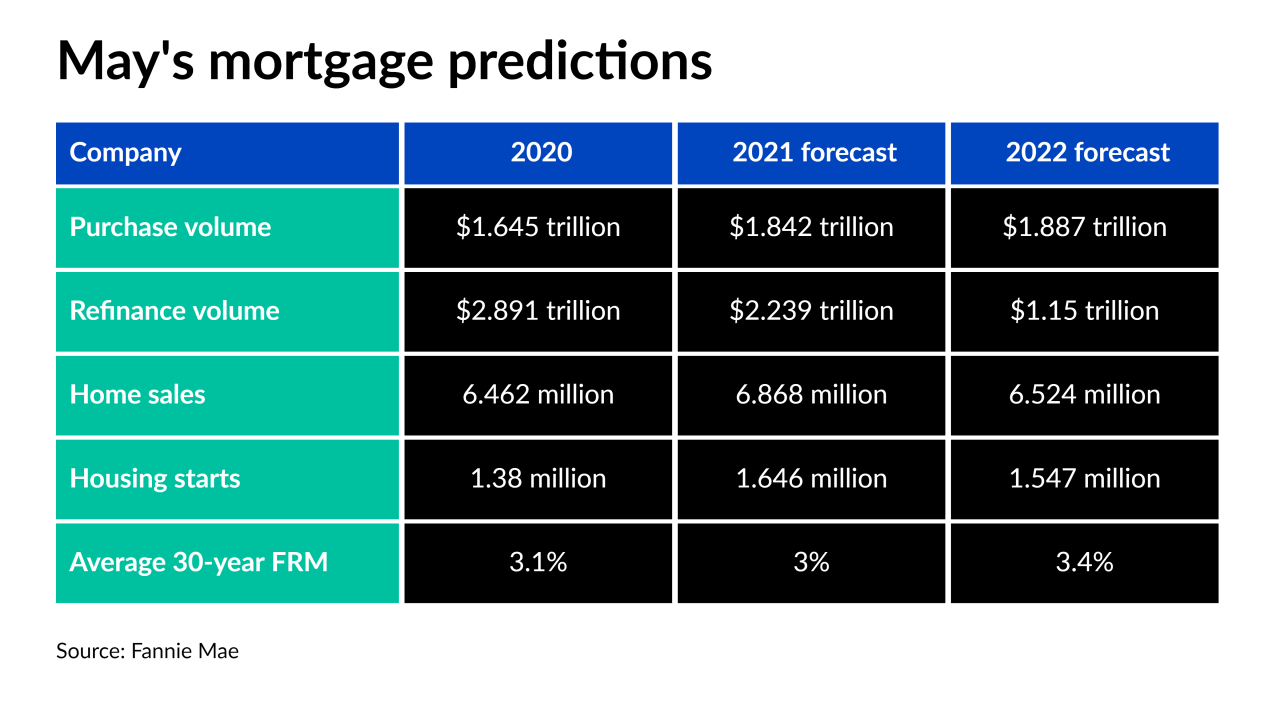

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

The loans, previously securitized in 2015, have a weighted-average interest rate of 8.57%, balances averaging $15,182 and remaining scheduled terms of 186 months.

May 18 -

The $500.2 million Morgan Stanley Residential Mortgage Loan Trust 2021-2 is supported by 547 prime-quality loans, many of them large-balance loans with outstanding obligations exceeding $1 million.

May 18 -

Taking each element of ESG - environment, social, governance - a dv01 principal says the firm is gathering the comprehensive list of authoritative sources and entities needed to build an ESG definition.

May 18