-

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26 -

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

Rising equity levels lifted borrowers across the spectrum in the second quarter, according to Attom Data Solutions.

August 6 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

Nearly 12 million renters could be served with eviction notices in the next four months. And in some cities, like New York and Houston, more than a fifth of renters say they have “no confidence” in their ability to pay next month.

July 24 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Contract signings to purchase previously owned homes surged in May by the most on record as mortgage rates fell and some states began to reopen from coronavirus lockdowns.

June 29 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

A Clever Real Estate survey found a significant share of new borrowers are not making their full payment.

June 15 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

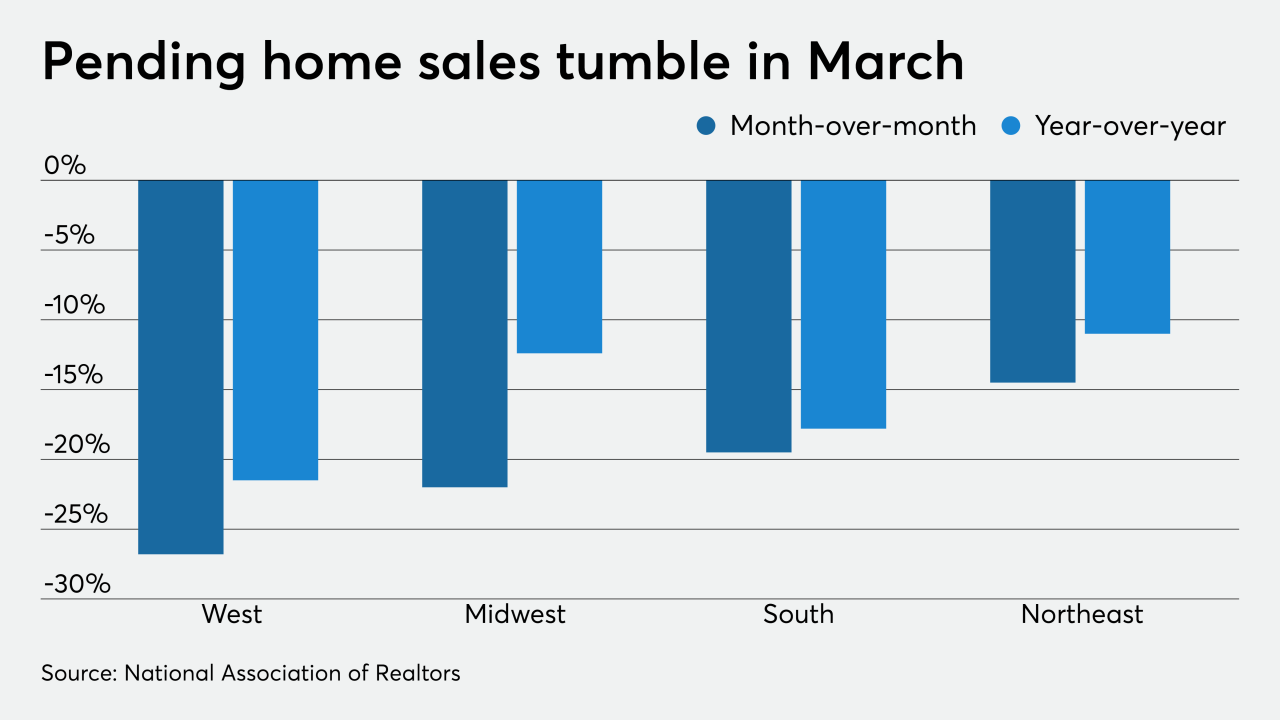

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

Increased refinancing volume led Fannie Mae to raise its 2020 estimate by $300 billion and 2021 projection by $280 billion.

March 12 -

Fannie Mae and Freddie Mac coming out of conservatorship and transitioning into public utilities would be the ideal for small mortgage lenders, according to trade-organization representative Robert Zimmer.

March 10 -

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

March 9 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

The agency is sending a strong message that it won’t rush to end an exemption for Fannie Mae and Freddie Mac while also signaling longer-term changes that will affect all lenders.

January 21